Storage stocks

Top sales list storage stocks

Rawalpindi (Punjab)

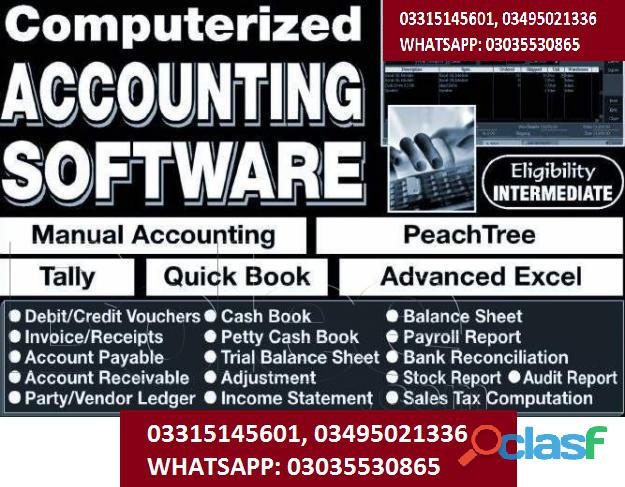

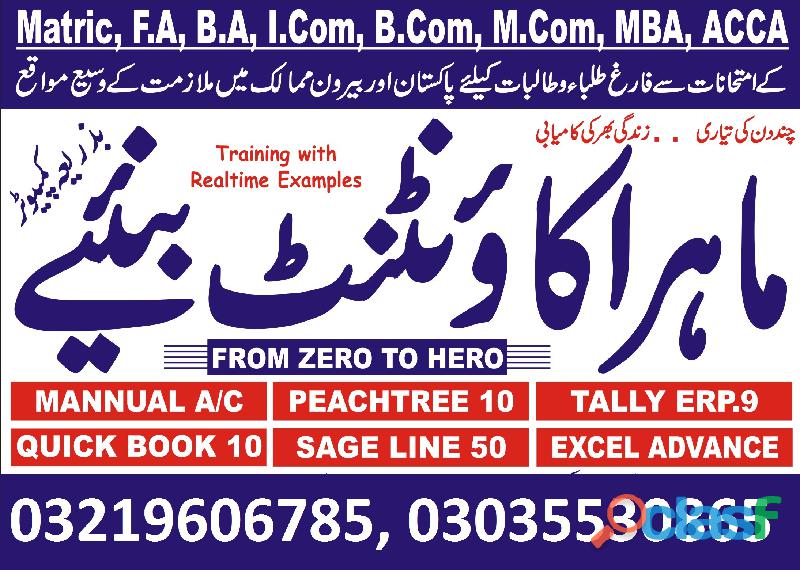

Quickbooks-PT,Talley ERP Book-Keeping Bundle Course details Overview In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Course Description Accounting and book-keeping skills are always in demand in any organisation. As well as finding employment, many learners go on to set up their own book-keeping business by offering their services to local companies. In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Sage Line 50 is essential if you want to work in an accounts office, finance department or as a book-keeper. This is because Sage Accounts is one of the most popular accounting package in the UK, particularly in Small and Medium Enterprises (SMEs) QuickBooks is the and book-keeping software for small and medium sized businesses. It is easy to use and gives you much-needed control over your business finances. QuickBooks Point of Sale provides retailers with an easy-to-use, affordable, scalable, customisable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. Each course teaches you everything you need to know so you can run an entire business within either program. It's the easiest and most affordable way to dive into each program in order to decide which one is right for you! Who Is This Course For? Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Requirements Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Trainings In this course, you will learn HOW TO USE AND INVEST IN CRYPTOCURRENCIES WITHOUT LOSING MONEY. You will also learn: 1. How to analyze investments of all asset classes to identify intrinsic value 2. How to compare the different cryptocurrencies and analyze them as investments 3. How to build wealth over time in the safest and fastest way possible 4. How the psychology of investing can make you rich or poor and how to use it to your advantage 5. The dangers of FOMO in investing 6. How to save money on taxes when making investing decisions 7. How to avoid getting in trouble with the law when investing in Cryptocurrencies 8. How to think clearly about investing and building wealth 9. How to use human emotion to your advantage when it comes to investing 10. Much more Do yourself a favor and educate yourself about how cryptocurrencies work so that you don't make the same mistake as countless others, and lose your money! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2013 Training - Bookkeeping Made Easy This QuickBooks 2013 Training for Beginners will show you how to unlock the power of Quickbooks 2013 and take direct control of your business finances. Expert author Barbara Harvie teaches you how to setup and manage the accounting for your business using QuickBooks 2013. This video based Quickbooks tutorial removes the barriers to learning by breaking down even the most complex of operations into easy to understand, bite-sized pieces, making it fast and fun for you to learn. This Quickbooks training course is designed for the absolute beginner, and no previous accounting software experience is required. You will start with the basics of using an accounting package - setting up your company file. You will quickly learn how to manage day to day operations by setting up items, services, customers and jobs right in the QuickBooks 2013 interface. You will learn how to create invoices and manage them once the customer has paid. Barbara shows you how to enter and pay bills, track your inventory, and manage all your banking tasks. In this video based tutorial, you will also learn how to create reports, customize reports, and maybe most importantly, how to back up your company file. By the time you have completed the computer based training QuickBooks tutorial course for Beginners course for Intuit QuickBooks 2013, you will have a clear understanding of how to setup and manage your company finances on a day to day basis, as well as access the financial information you need to help you be successful in your endeavour. Working files are included, allowing you to follow along with the author throughout the lessons. Take this ultimate QuickBooks tutorial right now and learn QuickBooks 2013. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sales Tax with QuickBooks Course details This, step by step course shows you exactly how to record and manage ANY sales tax related situation for people using QuickBooks for their business. You will learn how to record, collect and pay sales tax. You will learn how to find and interpret the results of sales tax reports. You will learn how to adjust sales tax and fix sales tax mistakes. You will learn both the cash and accrual method of paying sales tax. You will lean how to manage maximum sales tax situations and situations where there are multiple sales tax in 1 transactions. Sales tax is something that effects most business. If you are working with more than one company, then you need to be able to create new sales tax items and manage these special situations. Accountants will sometimes adjust only the general ledger account called "sales tax payable" and they will forget to adjust the balance owed to the specific tax agency. This course will give you the ability to do that. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Quickbooks-PT,Talley ERP Course details This course has been specifically designed for beginners / investors new to the stock market. It is one of the most comprehensive toolkit for stock market trading/ investing. How is the course structured? 1. The first three sections in the course deal with the common queries most beginners have with respect to the stock market. 2. The next three sections deal with understanding & analyzing Financial Statement of companies. 3. The rest of the sections deal with Technical Analysis. These techniques are not just applicable to stocks but also other asset classes. Why should I take this course? Do you have questions like: 1. How do I start trading in the stock market? 2. What is share or stock? 3. What is a stock exchange? 4. I have less money, Should I trade in Futures & Options? 5. How do I select a stock broker? 6. How much money should I invest in the stock market? 7. What is algorithmic trading & Should I be doing it? Great! The first 3 sections in this course answers many such questions for beginners. The next 3 sections deal with understanding & the financial statements of any company. Now you need not be intimidated with terms like Balance Sheet, Cash Flow Statement, Statement of Income. Everything is explained using a real financial statement so that you can start reading financial statements just like you read any other book! To add to it you learn how to perform Financial Ratio Analysis & Common Size Analysis of companies which would help you better understand the underlying business of a stock & its performance. This is a must have input before you invest in a stock! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bank Reconciliation Statement (College Level) Course details Welcome to Accounting Bank Reconciliation Statement Course. Business entities will be having large number of Bank transactions and these transactions will be recorded by them in their Cash Book (Bank Column). The bank balance as per Cash Book should be balanced with Bank Balance as per pass book. However, there will be certain differences due to timing difference between recording the transactions by the parties, namely the business entity and the Banker. This difference have to be identified and sorted at the earliest to avoid fraud and error. This difference can be identified by preparing a Statement known as Bank Reconciliation Statement and this course will teach you a) What is Bank Reconciliation Statement. b) What is Cash Book and Pass Book. c) Difference between Cash Book and Pass Book d) Causes for disagreement between the balance shown by Cash Book and Pass Book e) Procedure for preparing BRS f) Preparing BRS when bank balance is favourable / unfavourable. This course is structured in self paced learning style. Video lectures / screen cast are used for presenting the course content. Take this course to understand practical aspects of BRS. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Investment: Quickbooks-PT,Talley ERP Analyzing Software Companies Course details Are you looking to invest into software companies? What are the important characteristics andtrends of this industry? Dothese companies have any moat? How do they spend their cash? What are therisks? In this course, I will teach how to analyse and invest into software companies. We start off by learning about the different sub segments of the software industry. Then wemove onto quantitative financial analysis. After which, we will continue intoqualitative non financial discussion. All this will give us a holistic view of software companies before we commit investments into them. Unlike some other courses out there where you just hear instructors talking endlessly, and you only see boring text intheir presentation, this course will include animations, images, charts anddiagrams help you understand the various concepts. This is also not a motivation class whereI preach to you that you must work hard to succeed, or you must have disciplineto profit from the market. In this course, you will learn actionablemethods and frame work. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Financial Model Builder Course We go through 7 financial models: 1. Financial Model Basics - you learn the basics of financial models 2. Beyond The Basics - best practice, working capital, balance sheets and cash flows 3. Debt Equity Model - equity calculations and debt calculations incorporated into a model 4. Investment Scenario Model - a model for investments that includes multiple scenarios 5. Corporate Scenario Model - a full corporate model that incorporates multiple scenarios 6. Capital Investment Appraisal Model - a model for evaluating a capital investment 7. Pricing Model - a model for determining optimum pricing to customers. We go through many different company types: Pet Food Wholesaler, Clothing Wholesaler, Chemical Manufacturer, Investment Fund, Platinum Mine,Electricity Provider and an Office Equipment Company. If you are a • business owner • manager • finance professional or • business student and want to learn all-round financial model building skills, then this course is for you. By the end of the course, you will be able to • build accurate models • understand all essential Excel formulas and functions for financial models • create flexible models for multiple scenarios • adapt your skills to a variety of industries and requirements. In summary, this is one of the best value-for-money courses on financial models. Hope to have you as a student soon. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Computer Essentials-DIT CIT Web Development Presented with high-quality video lectures, this course will visually show you how to easily do everything with computers. This is just some of what you will learn in this course: • Learn the basic principles of hardware including circuits, coding schemes, binary, the five generations of computers, Moore's Law, IPOS, registers, cache, RAM, magnetic storage, optical storage, solid-state storage, ROM, BIOS, the motherboard, buses, and the CPU. • Learn how to operate a computer including a vast array of hands-on skills just to mention a few for example: managing files, backing up files, right clicking, taking screenshots, determining your computer's properties, upgrading your computer, changing settings on your computer. • Learn how to use word processing software including the creation of a title page, document sections, headers and footers, styles, an automatically generated table of contents, the insertion of images, references, and the insertion of an automatically generated citation of works referenced. • Learn how to use spreadsheet software including formulas, functions, relative references, absolute references, mixed references, and the creation of a graph or chart. • Learn how to use video editing software including adding credits and transitions then publishing that video to a video hosting website such as YouTube. • Learn how to use databases including table creation, the setting of a primary key, the establishment of table relationships, the setting of referential integrity, and the creation and execution of a query. • Learn how to use presentation software to more effectively give presentations. • Learn to do some simple programing including designing, coding, testing, debugging, and running a program. • Learn about the world wide web including sending email, conducting searches , having familiarity with online educational resources such as Khan Academy, and having an awareness of online "cloud computing" tools such as Google Word Processing, Google Spreadsheets, and the many other online tools offered by Google. • Learn about application software and system software including operating systems, utilities, and drivers. • Learn about networks including architecture, topology, firewalls, security, wireless networks, and securing wireless networks. • Learn about the Internet, the World Wide Web, censorship, the digital divide, net neutrality, differing legal jurisdictions, website creation, multimedia, social media, and eCommerce. • Learn about information systems, systems development, and the systems development life cycle. • Learn about program development, programming languages, and the program development life cycle. • Learn about databases including table creation, primary keys, relationships, referential integrity, queries, and structured query language. • Learn about privacy and security issues related to computers. • Learn about robots and artificial intelligence including the Turing test. • Learn about intellectual property including patents, trademarks, copyrights, and the creative commons. • Learn about ethics and ethical issues relating to the use of technology. • Learn about health ramifications of using computers including repetitive stress injury, carpal tunnel syndrome, and ergonomics. • Learn about e-Waste and other environmental concerns related to technology. Lifetime access to this course allows you to easily review material and continue learning new material. After taking this course, you will have a thorough understanding of how to use computers well. From beginners, to advanced users, this course is perfect for all ability levels. This course will add value to everyone's skillset. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Professional Bookkeeping & Accounting 2 - Bank Daybook Do you need to understand and record petty cash or banking transactions for your business? Are you considering a career in Bookkeeping or Accounting? Are you studying for Professional Accounting or Bookkeeping exams? THEN REGISTER NOW Course Overview Section 1 of this course is an introduction section. After the course introduction we will begin this course by introducing you to both the prime books of entry and cross totting as you will need a working understanding of these through out this course. You will also be presented with the case study that we will use in the activities in section 2 and 3 of this course. In section 2 we will move into Petty Cash. We will walk through each step of the petty cash process from raising petty cash vouchers, entering data to the daybook and reconciling and replenishing the petty cash. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Raise petty cash vouchers • Enter petty cash transactions to the petty cash daybook • Close the daybook and calculate the balance carried down • Reconcile the petty cash • Replenish the petty cash Section 3 of this course is about Banking Transactions. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Check remittance advice • Enter payments and receipts to the 3 column and analysis cash book • Close the cash book and calculate the balance carried down • Reconcile the bank This course contains: A case study that we will use through out this course Workbooks to download Activities to complete Quiz Certificate of Completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Certificate in Finance & Budgeting Quickbooks-PT,Talley ERP Course details Understanding the basics of finance and budget is helpful for everyone but upgrading these skills will help you achieve financial stability. This course can also help professionals who want to learn more knowledge and skills in budgeting to improve the financial management of their organization. This Level 2 Certificate in Finance & Budgeting lets you know more financial terms and concepts that you can implement to your business. You will be able to manage financial and budget plans through proper financial management and analysis. Course Highlights • The price is for the whole course including final exam - no hidden fees • Accredited Certificate upon successful completion at an additional cost • Efficient exam system with instant results Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Pro 2012 & 2013 COURSE CURRICULUM 1. What’s new in Quickbook Pro 2013 2. Quickbook Overview 3. The Company file 4. Setting up for Multiple users 5. Navigation in Quickbook 6. Adjusting preferences 7. The Chart of Account 8. Company lists 9. Importing data 10. Working ith the Bank Account 11. Creating items 12. The Basic of working with Inventory 13. Working with Vendors & paying bills 14. Customers, Jobs & Recording sales 15. Sales Adjustments & Statements 16. Customizing templates & forms 17. Accounts Receivable & Deposits 18. Sales tax 19. Report & The Report center 20. Managing Employees 21. Working with Credit cards 22. Loans & Liabilities 23. Reconciling Accounts 24. Online Banking 25. What’s new in Quickbook 2012 26. Finalizing your Accounting How will I be assessed? • You will have one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts for Beginner Learners why not improve your chances of gaining professional skills and better earning potential. Course Curriculum • Module 1: Program Basics– Set up your program, discover more about the user interface such as toolbar and keyboard options • Module 2: Restoring and Backing-up Data – Learn about data storage, creating back-ups and restoring them • Module 3: Basic Setting and Details – Manage financial dates, company details and program dates • Module 4: The Chart of Accounts – Create, modify and review chart of accounts • Module 5: Bank Receipts – Enter bank receipts • Module 6: Bank Payments – Oversee VAT, overheads, assets and bank payments • Module 7: Financials – Observe the financial state of your company • Module 8: Customers – Add new customers, use the new customer wizard, and manage their details • Module 9: Suppliers – Add and edit supplier records • Module 10: Working with Lists – Utilize lists to sort out records • Module 11: Batch Invoices – Create customer invoices, check bank accounts and nominals • Module 12: Service Invoices – Create service, manage line and invoice • Module 13: Processing Invoices – Process invoices and update ledgers • Module 14: Product and Services – Duplicate, add items, services and products • Module 15: Stock Control – Control your stocks through adjustments, activity and returns • Module 16: Product Invoices – Invoice management for products utilizing multiple platforms • Module 17: Product Credit Notes – Create credit notes • Module 18: Reviewing Your Accounts – Review the financial state of your company • Module 19: Aged Debtors and Statements – Analyse account balances, aged debtors, statements and customer communication history • Module 20: Customer Receipts – Allocate receipts automatically, manually or partially using discounts and payments on account • Module 21: Customer Activity – Observe customer activity • Module 22: Supplier Batch Invoices – Add new suppliers, their account balances and batch invoices • Module 23: Supplier Payments – Record and observe supplier payments, activity, print remittance and cheques • Module 24: More about the Nominal Ledger – Journal entries, nominal code activity, ledger graphs and records • Module 25: More about bank accounts – Learn about bank transfers, combined payments and petty cash transactions • Module 26: Using the Cash Register – Recording and depositing with the cash register • Module 27: Bank Reconciliation – Reconcile bank account and carry out group transactions • Module 28: Recurring Entries – Recurring entry processes including bank set up, adding journals, and deleting recurring entries • Module 29: VAT Returns – Produce, make, print, reconcile and complete VAT related transactions • Module 30: More About Reports – Follow the audit trail, period trial balance, profit and loss, and the balance sheet report • Module 31: Using Dashboards – Use the dashboards effectively Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Business Basics Course details Overview This course will be extremely useful for business owners, or those hoping to go into business accounting. Get to grips with all the financial basics of business, how to set up and maintain an effective payroll system, how to get your business out there, and how to use SEO effectively. Learners will come away from this course with a whole host of useful skills, which will help you to gain employment in the accounting and business world. Description This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Introduction 2: Business Entities 3: Beginning Your Business 4: Financial Basics Part 1-2 5: Employees Payroll 6: Getting Your Business Out There 7: Seo 8: Other Topics 9: Closing Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 it can be done at any time by extending your subscription. Course Curriculum 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgeting for your Daily Life This course aims to help individuals who are having a difficult time budgeting to successfully control their money and limit spending on unnecessary items. In this course, you will learn how to set goals, create your own budget effectively, overcome debts and overspending, and also acquire strategies that will help in making long-term budgeting effective and successful. Take back control of your finances and become a savvy spender! COURSE CURRICULUM 1. Learning how to budget 2. Realizing, where your money goes 3. Self- assessment 4. Setting up the budget 5. Creating monthly vs. Yearly budgets 6. Sticking to your budget using strategies 7. Long term budgeting The method of Assessment: At the end of the course, learners will take an online multiple choice questions assessment test. This test is marked automatically, so you will receive an instant grade and know whether you have passed the course. Certification: Successful candidates will be awarded certificate in Budgeting for your Daily Life. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Assessment This course will be assessed on the basis of one assignment. We believe doing practical assignments are the best way to assess the ability of the students and also it is the best way to make them apply what they have learnt into practice. Students can start their assignments from day one and complete the course as soon as they submit their assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Managerial and Cost Accounting This Diploma in Managerial Cost Accounting will prepare you for employment within this exciting industry, and will allow you to become highly skilled when it comes to cost accounting. The course covers a whole range of exciting topics, including: Overview of Managerial Accounting, Planning and Directing, Key Components of Cost, and Cost of Flow Concept. Become a successful Cost Accountant with this excellent course. Course Description: This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Method of Assessment: At the end of the course, learners will take an online multiple choice question assessment test. The online test is marked straight away, so you will know immediately if you have passed the course. Certification: Successful candidates will be awarded a certificate for Diploma in Managerial and Cost Accounting. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Peachtree Pro Accounting 2009 This excellent Peachtree Pro Accounting 2009 course will provide an in depth introduction to the general accounting features of Peachtree Pro Accounting, as well as step-by-step instructions on how to set up a new company, vendors, and employee payroll on Peachtree Pro Accounting. During this excellent Peachtree Pro Accounting course, you will learn how to achieve better business results, whether you’re business is new, or you’re an experience business manager. This Peachtree Pro Accounting course is taught by an expert instructor, and is packed full of insider knowledge and tips, to help your business improve. If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. • You will only need to pay £19 for assessment when you submit your assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

3 photos

Faisalabad (Punjab)

Chef and Cooking Professional Course in Faisalabad Sialkot,Chef and Cooking Professional Course in Rawalpindi Chakwal Dubai,international college of technical education in rawalpindi islamabad pakistan,best chef and cooking course in rawalpindi islamabad punjab pakistan icte,Introductory courses will teach basic cooking skills and techniques. Preparation of stocks, vegetables and meats may be introduced, along with the fundamental concepts of table service and kitchen sanitation. Coursework may also introduce recipe creation and menu design, which require a demonstration of proficiency in cooking and service on a large scale.Culinary arts, in which culinary means "related to cooking", are the cuisine arts of food preparation, cooking, and presentation of food, usually in the form of meals. People working in this field – especially in establishments such as restaurants – are commonly called "chefs" or "cooks", although, at its most general, the terms "culinary artist" and "culinarian" are also used. Table manners ("the table arts") are sometimes referred to as a culinary art.Expert chefs are required to have knowledge of food science, nutrition and diet and are responsible for preparing meals that are as pleasing to the eye as they are to the palate. After restaurants, their primary places of work include delicatessens and relatively large institutions such as hotels and hospitals.Baking and pastry courses begin by covering the principles of baking science, including ingredients, measurement and scaling. Purchasing, cost control and production management may also be introduced during this course. Students learn how to make breads, cakes, pies, tarts and puff pastries, while advanced coursework covers classical patisserie and artisan baking techniques. Students may have the opportunity to prepare showpieces.Our chef college courses focus on developing your hands-on practical skills, and you’ll have the opportunity to put them to the test both on campus and out in the industry. As well as training in our industry-standard kitchens and restaurants, you’ll gain additional real-world experience on placements, working anywhere from hotels and restaurants to cafes and food manufacturers.Become a professional chef by completing these industry standard qualifications. You'll gain a high standard of cookery skills from processes, such as roasting and frying to commodities, whilst also learning other workplace essentials like menu design.The Diploma in Professional Cookery is for anyone who works or wants to work as a chef in the catering and hospitality sector. It is ideal for learners coming straight from school who wish to seek a career in this industry. It is also ideal for those chefs in industry who would like to continue or refresh their knowledge by undertaking topics within the qualification. Maintain hygiene in food preparation, cooking and storage. Prepare fruit & vegetables for hot and cold dishes. Handle and maintain knives. Clean and store crockery and cutlery. Prepare and cook basic meat, poultry, game or offal dishes. Prepare and cook basic sauces and soups. Handle and store food. Clean food production areas, equipment and utensils. Learn about the importance of food safety and hygiene in the kitchen. Practice HACCP principles in their everyday life. Learn the importance of mise en place in the kitchen area. Learn basic important food preparation techniques. Learn advanced food preparation techniques and recipes. Learn how to manage their work area and their own personal development. Understand the importance of teamwork in the restaurant environment. Learn how to successfully integrate into their work environment. Learn how to induct and coach new employees. Learn the ins and outs of the hospitality industry.

Rs 45.000

See product

4 photos