Plot audit accounts

Top sales list plot audit accounts

Islamabad (Islamabad Capital Territory)

House No. 608-B, Street No. 111-A, I – 8/4, Islamabad From 10 AM to 7 PM Chartered Accountant Available for Accounting, Cost Accounting Management Accounting, Audit both Annual and Internal for Students of I.Com, A/O Levels, B.Com, BBA, MBA, M.Com, ACCA, ICMA and CA. Three days free trial Classes. SATISFACTION GUARANTEE TAUQEER HUSSAIN Mobile 0303-5478158, 0312-5178701 tauqeerhussainmalik@hotmail.com

Rs 1,5

See product

Pakistan (All cities)

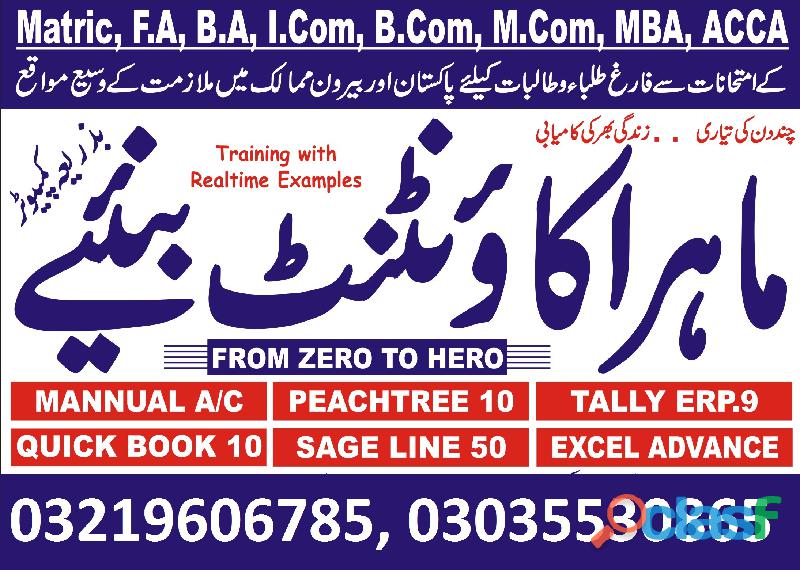

Quickbooks-PT,Talley ERP Accounting for Business If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM BOOKKEEPING AND PAYROLL MANAGEMENT • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts • Working with Ledgers • Reconciliation • Correcting Entries • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record • The Partnership & Corporations • Accounts Receivable and Bad Debts • Preparing Interim Statements • Year End – Inventory BUSINESS ACCOUNTING • Introduction to Bookkeeping • Defining a Business • Ethics and Accounting Principles • Accounting Equation & Transactions • Financial Statements • The Accounting Equation and Transactions • Transactions – Journalizing • Posting Entries and The Trial Balance • Finding Errors Using Horizontal Analysis • The Purpose of the Adjusting Process • Adjusting Entries • Vertical Analysis • Preparing a Worksheet • The Income Statement • Financial Statements- Definitions • Temporary vs. Permanent Accounts • Accounting Cycle • Financial Year • Spreadsheet Exercise How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2016 – Accounts, Payroll Management This QuickBooks Pro 2016 training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 20 guided learning hours. COURSE CURRICULUM: 01 • The Home Page • The Icon Bar • Creating a QuickBooks Company File • Setting Up Users • Using Lists 02 • The Sales Tax Process • Creating Sales Tax • Setting Up Inventory • Creating a Purchase Order • Setting Up Items 03 • Selecting a Sales Form • Creating a Sales Receipt • Using Price Levels • Creating Billing Statements • Recording Customer Payments 04 • Entering a Vendor Credit • Using Bank Accounts • Sales Tax • Graph and Report Preferences • Modifying a Report • Exporting Reports 05 • Using Graphs • Creating New Forms • Selecting Objects in the Layout Designer • Creating a job • Making Purchases for a Job • Time Tracking 06 • Payroll – The Payroll Process • Payroll – Setting Up Employee Payroll Information • Payroll – Creating Termination Paycheques • Payroll – Adjusting Payroll Liabilities 07 • Using Credit Card Charges • Assets and Liabilities • Creating Fixed Asset Accounts • Equity Accounts • Writing Letters with QuickBooks 08 • Company Management • Company File Cleanup • Using the Portable Company Files • Creating an Account’s Copy Course Duration: You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Finance For Non-Financial Professionals As a non-financial professional, you need to quickly understand and distinguish good information from poor-quality information, otherwise, your decisions may adversely affect business performance and your career prospects. This course is designed with a practical view to finance. It's suitable for professionals at all levels and entrepreneurs alike. In this course you will learn: • How to understand and use financial statements • Including; profit and loss, balance sheets and cash flow forecasts • Budgeting and forecasting techniques to improve decision-making • How to use Key Performance Indicators (KPIs) effectively • How to appraise an investment using financial techniques • The best way to develop a business plan Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP HR & Payroll Management This course has been specifically designed for those looking to learn the basics of being successful in the human resources and payroll management fields. As a bonus, we also share a few tricks for getting your foot in the door! We'll cover payroll management, hiring diversity, negotiations, working with a leadership team, payroll, benefits, insurance, payroll systems, and general management techniques. Everything you need to be a skilled, knowledgeable HR officer is in this course! Course for? For those who: • Are interested in a career in Human Resources and Payroll Management • Current HR and payroll employees who would like to improve their skills • Small business owners who are looking to make sure that they are providing a good work environment for employees • Those who would like to explore further the field of HR Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bookkeeping Diploma Level 3 The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Certification: Successful candidates will be awarded Diploma in Accounting and Bookkeeping – Level 3. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Managerial and Cost Accounting Course Description: This Campus based training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Benefits you will gain: By enrolling in this course, you’ll get: • High-quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • Includes step-by-step tutorial videos and an effective, professional support service. job roles this course is suitable for: Cost Accountant , Management Accountant , Accountant Assistant , Project Cost Accountant Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad The Complete Sage 50 Accounting Diploma Quickbooks-PT,Talley ERP The Sage 50 Intermediate Course This course builds on the concepts learned in the beginners’ course and assumes that you have a working knowledge of the basic features together with an understanding of simple transactions. You will begin by learning about accruals and prepayments, along with the calculation of assets and depreciation. You will not only learn how to undertake these more advanced transactions but also how to fix errors such as inaccurately processed assets.Stock control and monitoring are also covered in depth, enabling you to manage stock levels with confidence. You will also learn how to create an audit trail for complex transactions such as those involving discounted items and credit notes.The Sage 50 Advanced CourseThis course moves beyond everyday transactions and emphasises the processes required in chasing debt and credit control. You will learn why quotations are important, and how they can improve sales. You will gain an understanding into how businesses recover credit and payment from customers, and how to keep accurate records during the process.Audit trails are a key aspect of accurate accounting and you will gain further knowledge and insight into this process during the course. You will also gain a better understanding of budgeting, as well as how to correct common mistakes in record-keeping. Finally, you will also develop your skills in producing customised reports. The Benefits of Our Complete Sage 50 Accounting Course This course will give you a complete overview of all the main accounting tools Sage 50 offers, from the basic to the advanced. This will make you an attractive candidate for any position that entails company accounts including invoicing and debt management. You will not only be a proficient user of Sage 50 software, but you will also be able to demonstrate an in-depth understanding of how financial matters are controlled within a business. Benefits of taking the Complete Sage 50 Accounting Diploma: • Study at home and online • Study at your own pace • Access to full online support whilst completing the course • Easy-to-read modules packed with information • No entry requirements • A chance to receive an accredited qualification upon completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Certificate in Finance & Budgeting Quickbooks-PT,Talley ERP Course details Understanding the basics of finance and budget is helpful for everyone but upgrading these skills will help you achieve financial stability. This course can also help professionals who want to learn more knowledge and skills in budgeting to improve the financial management of their organization. This Level 2 Certificate in Finance & Budgeting lets you know more financial terms and concepts that you can implement to your business. You will be able to manage financial and budget plans through proper financial management and analysis. Course Highlights • The price is for the whole course including final exam - no hidden fees • Accredited Certificate upon successful completion at an additional cost • Efficient exam system with instant results Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Pro 2012 & 2013 COURSE CURRICULUM 1. What’s new in Quickbook Pro 2013 2. Quickbook Overview 3. The Company file 4. Setting up for Multiple users 5. Navigation in Quickbook 6. Adjusting preferences 7. The Chart of Account 8. Company lists 9. Importing data 10. Working ith the Bank Account 11. Creating items 12. The Basic of working with Inventory 13. Working with Vendors & paying bills 14. Customers, Jobs & Recording sales 15. Sales Adjustments & Statements 16. Customizing templates & forms 17. Accounts Receivable & Deposits 18. Sales tax 19. Report & The Report center 20. Managing Employees 21. Working with Credit cards 22. Loans & Liabilities 23. Reconciling Accounts 24. Online Banking 25. What’s new in Quickbook 2012 26. Finalizing your Accounting How will I be assessed? • You will have one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts for Beginner Learners why not improve your chances of gaining professional skills and better earning potential. Course Curriculum • Module 1: Program Basics– Set up your program, discover more about the user interface such as toolbar and keyboard options • Module 2: Restoring and Backing-up Data – Learn about data storage, creating back-ups and restoring them • Module 3: Basic Setting and Details – Manage financial dates, company details and program dates • Module 4: The Chart of Accounts – Create, modify and review chart of accounts • Module 5: Bank Receipts – Enter bank receipts • Module 6: Bank Payments – Oversee VAT, overheads, assets and bank payments • Module 7: Financials – Observe the financial state of your company • Module 8: Customers – Add new customers, use the new customer wizard, and manage their details • Module 9: Suppliers – Add and edit supplier records • Module 10: Working with Lists – Utilize lists to sort out records • Module 11: Batch Invoices – Create customer invoices, check bank accounts and nominals • Module 12: Service Invoices – Create service, manage line and invoice • Module 13: Processing Invoices – Process invoices and update ledgers • Module 14: Product and Services – Duplicate, add items, services and products • Module 15: Stock Control – Control your stocks through adjustments, activity and returns • Module 16: Product Invoices – Invoice management for products utilizing multiple platforms • Module 17: Product Credit Notes – Create credit notes • Module 18: Reviewing Your Accounts – Review the financial state of your company • Module 19: Aged Debtors and Statements – Analyse account balances, aged debtors, statements and customer communication history • Module 20: Customer Receipts – Allocate receipts automatically, manually or partially using discounts and payments on account • Module 21: Customer Activity – Observe customer activity • Module 22: Supplier Batch Invoices – Add new suppliers, their account balances and batch invoices • Module 23: Supplier Payments – Record and observe supplier payments, activity, print remittance and cheques • Module 24: More about the Nominal Ledger – Journal entries, nominal code activity, ledger graphs and records • Module 25: More about bank accounts – Learn about bank transfers, combined payments and petty cash transactions • Module 26: Using the Cash Register – Recording and depositing with the cash register • Module 27: Bank Reconciliation – Reconcile bank account and carry out group transactions • Module 28: Recurring Entries – Recurring entry processes including bank set up, adding journals, and deleting recurring entries • Module 29: VAT Returns – Produce, make, print, reconcile and complete VAT related transactions • Module 30: More About Reports – Follow the audit trail, period trial balance, profit and loss, and the balance sheet report • Module 31: Using Dashboards – Use the dashboards effectively Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Business Basics Course details Overview This course will be extremely useful for business owners, or those hoping to go into business accounting. Get to grips with all the financial basics of business, how to set up and maintain an effective payroll system, how to get your business out there, and how to use SEO effectively. Learners will come away from this course with a whole host of useful skills, which will help you to gain employment in the accounting and business world. Description This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Introduction 2: Business Entities 3: Beginning Your Business 4: Financial Basics Part 1-2 5: Employees Payroll 6: Getting Your Business Out There 7: Seo 8: Other Topics 9: Closing Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 it can be done at any time by extending your subscription. Course Curriculum 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgeting for your Daily Life This course aims to help individuals who are having a difficult time budgeting to successfully control their money and limit spending on unnecessary items. In this course, you will learn how to set goals, create your own budget effectively, overcome debts and overspending, and also acquire strategies that will help in making long-term budgeting effective and successful. Take back control of your finances and become a savvy spender! COURSE CURRICULUM 1. Learning how to budget 2. Realizing, where your money goes 3. Self- assessment 4. Setting up the budget 5. Creating monthly vs. Yearly budgets 6. Sticking to your budget using strategies 7. Long term budgeting The method of Assessment: At the end of the course, learners will take an online multiple choice questions assessment test. This test is marked automatically, so you will receive an instant grade and know whether you have passed the course. Certification: Successful candidates will be awarded certificate in Budgeting for your Daily Life. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Assessment This course will be assessed on the basis of one assignment. We believe doing practical assignments are the best way to assess the ability of the students and also it is the best way to make them apply what they have learnt into practice. Students can start their assignments from day one and complete the course as soon as they submit their assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Managerial and Cost Accounting This Diploma in Managerial Cost Accounting will prepare you for employment within this exciting industry, and will allow you to become highly skilled when it comes to cost accounting. The course covers a whole range of exciting topics, including: Overview of Managerial Accounting, Planning and Directing, Key Components of Cost, and Cost of Flow Concept. Become a successful Cost Accountant with this excellent course. Course Description: This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Method of Assessment: At the end of the course, learners will take an online multiple choice question assessment test. The online test is marked straight away, so you will know immediately if you have passed the course. Certification: Successful candidates will be awarded a certificate for Diploma in Managerial and Cost Accounting. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Peachtree Pro Accounting 2009 This excellent Peachtree Pro Accounting 2009 course will provide an in depth introduction to the general accounting features of Peachtree Pro Accounting, as well as step-by-step instructions on how to set up a new company, vendors, and employee payroll on Peachtree Pro Accounting. During this excellent Peachtree Pro Accounting course, you will learn how to achieve better business results, whether you’re business is new, or you’re an experience business manager. This Peachtree Pro Accounting course is taught by an expert instructor, and is packed full of insider knowledge and tips, to help your business improve. If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. • You will only need to pay £19 for assessment when you submit your assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

3 photos

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen.Auditor Diploma Course Content: Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen. Auditor Diploma Course Content: Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen. Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

Rs 30.000

See product

Jhelum (Punjab)

QuickBooks 2010: New Features Course details New Features in QuickBooks 2010 will introduce you to the significant changes in this latest version of the software. In this course you’ll learn about a variety of time-saving task and data entry features, learn how to easily customize professional, elegant forms, be introduced to the completely revised Report Centre, as well as discover a variety of connected services available at your fingertips. Course outline: This course consists of the following: 1. Saving time in Quickbooks 2010 2. Optimizing data entry 3. Improving form functionality 4. The Redesigned report center 5. The new Document Management System 6. Capitalizing on connected services Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Business Accounting Diploma We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at any time. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Professional Bookkeeper Introduction • Introduction to Accounting and Business • The Accounting Equation • Analyzing Transactions • Entering Information - Posting Entries • Adjusting Process • Adjusting Entries • Adjustment Summary • Preparing a Worksheet • Financial Statements • Completing the Accounting Cycle • The Accounting Cycle Illustrated • Fiscal Year • Spreadsheet Exercise Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Advance Accounting & Bookkeeping Diploma training course is comprehensive and is designed to cover the following key topics are listed under the curriculum. This course has been designed for 40 guided learning hours. COURSE CURRICULUM UNIT 01. ADVANCED ACCOUNTING • Type of Business Ownership • Accounting Concepts • Accounting Journals and Ledgers • Formulas & Equations • Financial Statements • Analysing of Financial Statements • Inventory Management • Accounting for Depreciation • Accounting for Compensation, Taxes & Liabilities • Closing and Adjusting Entries • Corporate Accounts UNIT 02. FINANCIAL ACCOUNTING • Introduction to Accounting • What are Financial Statements in Accounting • The Accounting Cycles • Preparing Financial Statements • Control in Accounting • Inventory Management in Accounting • Accounts Receivable • Operating Cycle in Accounting • Asset Management Section 02 • Liabilities in Accounting • Equity in Accounting- Section 2 • Cash Flow Statement Patterns • Analysing Financial Statements in Accounting UNIT 03. BOOKKEEPING TRAINING MANUAL • Bookkeeping Training Manual UNIT 04. ADDITIONAL STUDY MATERIALS • Additional Study Materials- Advance Accounting Certification: Successful candidates will be awarded certificate for “Diploma in Advance Accounting & Bookkeeping”. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 offers quality online, professional qualifications to individuals worldwide, catered to the way in which those looking to progress within their careers and business are wanting to learn. And, because the training is online – at times and locations that best suit your lifestyle. The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Payroll Management Level 3 Payroll Management Training Diploma Level 3 has been given SPTTC Punjab Board accreditation and is one of the best-selling courses available to students worldwide. This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you’re an individual looking to excel within this field then Payroll Management Training Diploma Level 3 is for you. We’ve taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept – from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success. All our courses offer 3 months access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full SPTTC accredited qualification. And, there are no hidden fees or exam charges. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Diploma in Payroll Management Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Pakistan

Softax - Workshop “ADVANCE TAXATION” Federal & Provincial SALES TAX LAWS. Learn how to handle critical issues relevant to identification & input adjustment of taxable goods & services, withholding, e-filing etc. at Regent Plaza, Karachi on 28-01-2016. Contact Mr. Mujtaba Qayyum at 0333-3358711 or 021-32640313 Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Pakistan

Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product