Internet business fix payroll

Top sales list internet business fix payroll

Pakistan (All cities)

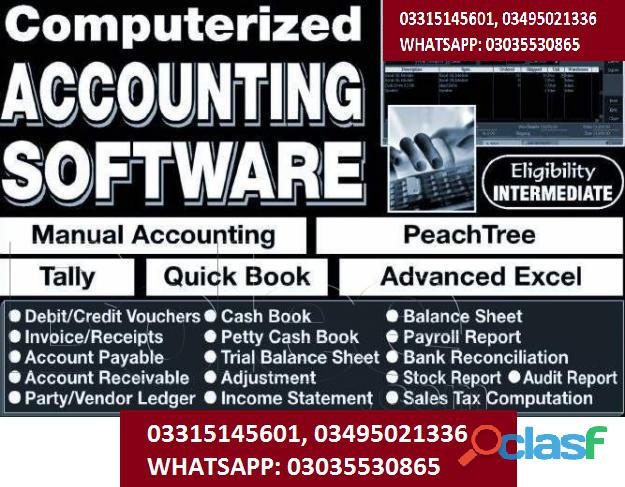

Quickbooks-PT,Talley ERP Accounting for Business If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM BOOKKEEPING AND PAYROLL MANAGEMENT • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts • Working with Ledgers • Reconciliation • Correcting Entries • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record • The Partnership & Corporations • Accounts Receivable and Bad Debts • Preparing Interim Statements • Year End – Inventory BUSINESS ACCOUNTING • Introduction to Bookkeeping • Defining a Business • Ethics and Accounting Principles • Accounting Equation & Transactions • Financial Statements • The Accounting Equation and Transactions • Transactions – Journalizing • Posting Entries and The Trial Balance • Finding Errors Using Horizontal Analysis • The Purpose of the Adjusting Process • Adjusting Entries • Vertical Analysis • Preparing a Worksheet • The Income Statement • Financial Statements- Definitions • Temporary vs. Permanent Accounts • Accounting Cycle • Financial Year • Spreadsheet Exercise How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2016 – Accounts, Payroll Management This QuickBooks Pro 2016 training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 20 guided learning hours. COURSE CURRICULUM: 01 • The Home Page • The Icon Bar • Creating a QuickBooks Company File • Setting Up Users • Using Lists 02 • The Sales Tax Process • Creating Sales Tax • Setting Up Inventory • Creating a Purchase Order • Setting Up Items 03 • Selecting a Sales Form • Creating a Sales Receipt • Using Price Levels • Creating Billing Statements • Recording Customer Payments 04 • Entering a Vendor Credit • Using Bank Accounts • Sales Tax • Graph and Report Preferences • Modifying a Report • Exporting Reports 05 • Using Graphs • Creating New Forms • Selecting Objects in the Layout Designer • Creating a job • Making Purchases for a Job • Time Tracking 06 • Payroll – The Payroll Process • Payroll – Setting Up Employee Payroll Information • Payroll – Creating Termination Paycheques • Payroll – Adjusting Payroll Liabilities 07 • Using Credit Card Charges • Assets and Liabilities • Creating Fixed Asset Accounts • Equity Accounts • Writing Letters with QuickBooks 08 • Company Management • Company File Cleanup • Using the Portable Company Files • Creating an Account’s Copy Course Duration: You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Finance For Non-Financial Professionals As a non-financial professional, you need to quickly understand and distinguish good information from poor-quality information, otherwise, your decisions may adversely affect business performance and your career prospects. This course is designed with a practical view to finance. It's suitable for professionals at all levels and entrepreneurs alike. In this course you will learn: • How to understand and use financial statements • Including; profit and loss, balance sheets and cash flow forecasts • Budgeting and forecasting techniques to improve decision-making • How to use Key Performance Indicators (KPIs) effectively • How to appraise an investment using financial techniques • The best way to develop a business plan Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP HR & Payroll Management This course has been specifically designed for those looking to learn the basics of being successful in the human resources and payroll management fields. As a bonus, we also share a few tricks for getting your foot in the door! We'll cover payroll management, hiring diversity, negotiations, working with a leadership team, payroll, benefits, insurance, payroll systems, and general management techniques. Everything you need to be a skilled, knowledgeable HR officer is in this course! Course for? For those who: • Are interested in a career in Human Resources and Payroll Management • Current HR and payroll employees who would like to improve their skills • Small business owners who are looking to make sure that they are providing a good work environment for employees • Those who would like to explore further the field of HR Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bookkeeping Diploma Level 3 The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Certification: Successful candidates will be awarded Diploma in Accounting and Bookkeeping – Level 3. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Managerial and Cost Accounting Course Description: This Campus based training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Benefits you will gain: By enrolling in this course, you’ll get: • High-quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • Includes step-by-step tutorial videos and an effective, professional support service. job roles this course is suitable for: Cost Accountant , Management Accountant , Accountant Assistant , Project Cost Accountant Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad The Complete Sage 50 Accounting Diploma Quickbooks-PT,Talley ERP The Sage 50 Intermediate Course This course builds on the concepts learned in the beginners’ course and assumes that you have a working knowledge of the basic features together with an understanding of simple transactions. You will begin by learning about accruals and prepayments, along with the calculation of assets and depreciation. You will not only learn how to undertake these more advanced transactions but also how to fix errors such as inaccurately processed assets.Stock control and monitoring are also covered in depth, enabling you to manage stock levels with confidence. You will also learn how to create an audit trail for complex transactions such as those involving discounted items and credit notes.The Sage 50 Advanced CourseThis course moves beyond everyday transactions and emphasises the processes required in chasing debt and credit control. You will learn why quotations are important, and how they can improve sales. You will gain an understanding into how businesses recover credit and payment from customers, and how to keep accurate records during the process.Audit trails are a key aspect of accurate accounting and you will gain further knowledge and insight into this process during the course. You will also gain a better understanding of budgeting, as well as how to correct common mistakes in record-keeping. Finally, you will also develop your skills in producing customised reports. The Benefits of Our Complete Sage 50 Accounting Course This course will give you a complete overview of all the main accounting tools Sage 50 offers, from the basic to the advanced. This will make you an attractive candidate for any position that entails company accounts including invoicing and debt management. You will not only be a proficient user of Sage 50 software, but you will also be able to demonstrate an in-depth understanding of how financial matters are controlled within a business. Benefits of taking the Complete Sage 50 Accounting Diploma: • Study at home and online • Study at your own pace • Access to full online support whilst completing the course • Easy-to-read modules packed with information • No entry requirements • A chance to receive an accredited qualification upon completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Pakistan (All cities)

Bookkeeping and Payroll Diploma *New Year Offers* Quickbooks-PT,Talley ERP Description Course Curriculum 1. MODULE 01 • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts 2. MODULE 02 • Working with Ledgers • Reconciliation • Correcting Entries 3. MODULE 03 • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets 4. MODULE 04 • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash 5. MODULE 05 • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record 6. MODULE 06 • The Partnership & Corporations • Accounts Receivable and Bad Debts 7. MODULE 07 • Preparing Interim Statements • Year End – Inventory 8. MODULE HANDOUTS • Module Handouts- Bookkeeping and Payroll Management 9. ADDITIONAL STUDY MATERIALS • Additional Study Materials- Business Accounting 10. REFERENCE BOOKS • Reference Books- Business Accounting Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Administration Skills and Payroll- Quickbooks-PT,Talley ERP Course Description Course Syllabus As part of the Administration & Payroll course students will learn a range of topics including the following: • Working as an Administrative Assistant • The role of the administrator • Working practices • Meetings • Business departments • Business travel • Effective customer service • Telecommunications • Internet and office technologies • Payroll: Understanding the Basics • Payroll in the United Kingdom • Introduction to Payroll Systems • Running payroll • Starters and Leavers • Tell HMRC about a new employee • Gross Pay • Minimum wage for different types of work • Statutory Pay • Employment Allowance • The PAYE regime • PAYE Online for employers • The NIC Regime • Employees who pay less National Insurance • Statutory and Voluntary Deductions and Net Pay • Correcting payroll errors • RTI and working the Computerised Payroll System • Payroll: annual reporting and tasks • Final Assessment Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBook 2017 - Accounting, Payroll and Book Keeping Description Session 1 Section A: Course Opening • Introduction • How to Study for This Exam Section B: QuickBooks Setup • Before Setting Up a Company • Create a Company and EasyStep Interview • Remove Old Transactions • Customize the Home Page • Set Up Customer and Vendor Lists • Set Up Item Lists Section C: Navigation and Data Files • Navigate the Home Page • Navigate Menus and the Icon Bar • Navigate the Icon Bar • Back Up a Data File • Restore a Data File Section D: Program Information and Preferences • Determine the Release Number • Update QuickBooks • QuickBooks Modes • QuickBooks Versions • Password Protection • Preferences • Domain 1 and 2 Test Tips Session 2 Section A: List Management • Add Customers • Add Vendors • Add Items • General List Management • Edit List Entries • Merge List Entries Section B: Items • Items for Accounting Entries • Item Types • Products for a Specific Price • Services for a Specific Price • Unique Pricing Entries • Single Service or Product Section C: Session 2 Recap • Domain 3 and 4 Test Tips Session 3 Section A: Sales • Customer Center Lists • Navigate the Customer Center • Sales Workflow • Invoicing • Sales Receipts • Undeposited Funds • View Accounts Receivable and Checking • Customer Credits • Sales Statements • Handle Bounced Checks Section B: Purchases • Vendor Center Lists • Navigate the Vendor Center • Enter and Pay Bills • Write Checks • Use Credit Cards • Use Debit Cards • Purchase Workflow Transactions • Vendor Credits Section C: Inventory, Taxes, and Reconciliation • Inventory Workflows • Set Up and Collect Sales Taxes • Pay Sales Taxes • Bank Reconciliation Session 4 Section A: Payroll • Available Payroll Services • Starting the Payroll Setup Wizard • Employee Earnings • Employee Sick and Vacation Time • Finish the Payroll Setup Wizard • Set Up Payroll Schedules • Run Payroll • Pay Payroll Liabilities • Prepare Payroll Forms • Track Time and Invoice Customers Section B: Reports • Report Center • Customize Reports • Expand and Collapse Report Data • Report Descriptions • Process Multiple Reports • Send Reports to Excel • Memorize Reports Session 5 Section A: Basic Accounting • Financial Statements • Cash vs. Accrual Reports • Set a Closing Date • Enter a Journal Entry Section B: Customization and Shortcuts • Memorize Transactions • Set Up Multiple Users and Access • Create Custom Fields • Apply Custom Fields • Customize an Invoice Section C: Session 5 and Course Recap • Domain 9 and 10 Test Tips • Final Test Tips • Conclusion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Diploma in Bookkeeping & Payroll Management - Quickbooks-PT,Talley ERP Module 1 This module will teach you about Basic Terminology. So, the good thing about accounting is that you can start out wherever you want, at the beginning, the middle, or the end and you will still wind up at the same place, nowhere (Just kidding). You really have to start at the beginning, or you will get lost. So, let’s start there, with some basic terminology. Some of this stuff may ring a bell for those of you who took accounting previously, were hired to keep the books at the corner Mom & Pop’s shop, or, were too cheap to hire a “real Accountant” and tried to do your own books. (How did that work out for you?). Either way, when we are done here, you are bound to be familiar with a lot of these basic bookkeeping and accounting terms. Module 2 This module will teach you about Basic Terminology (II). In this unit, we will finish up with the basic accounting terms that are bound to impress at the next corporate fundraiser for the IRS. I know what you’re thinking. There is no such thing as a corporate fundraiser for the IRS because the only funds the IRS will be raised are those out of our wallets. Below are the next few terms you will need to know. Module 3 This module will teach you about Accounting Methods. Since the preceding units of this course were a piece of cake, now let’s talk about accounting methods, starting with the topics of cash and accrual. When you were a child, if your parents allowed you to go door to door selling items for your school’s fundraiser, you have used cash and accrual methods. It’s a simple concept that allows you to record the sale or purchase of an item even if you have not yet received payment. Module 4 This module will teach you about Keeping Track of Your Business. knowing how to keep track of your business will prove to be very valuable in the short run and long run. There are a number of different aspects involved in keeping track of any business the right way. Many businesses go out of business within the first year or two if things are not handled properly. Have you ever been up late at night, just craving one of those good old roast beef sandwiches from thelocal24 hour deli? You find that the craving gets so bad, you get up, leave (in your plaid jammies) and take a ride over there, with your mouth watering the whole way. You pull up, and hop out of the car(very excited), only to find that your favourite business is no longer “in business.” One could assume they did not keep very good track of their business or, they moved. Module 5 This module will teach you about Understanding the Balance Sheet. n this unit we will be discussing the accounting equation, double-entry accounting, types of assets, types of liabilities and equity. The balance sheet will help provide balance to your business. It helps keep everything organized and on point. One of the worst things in accounting is un-organization. So, don’t treat your balance sheet like your sock drawer at home or that mysterious junk drawer in your kitchen that no one wants to organize. Module 6 This module will teach you about Other Financial Statements. In this unit, we will introduce the income statement, cash flow statement, capital statement, and budget versus actual. These terms all involve money or the use of money in some form. When we are done, you will have a better understanding of how the use of these methods will help your business run more efficiently. You’ll be swapping accounting terms with that hotshot accountant friend of yours in no time. Module 7 In this module, you will learn all about Payroll Accounting Terminology. In this unit, we will be discussing many terms which involve dealing with the financial aspects of your business. We will also be discussing the accounting methods and terms used in reference to your employees, by briefly going over the following terms: gross wages, net wages, employee tax withholdings, employer tax expenses, salary deferrals, employee payroll, employee benefits, tracking accrued leave, and government payroll returns and reports. Module 8 In this module, you will learn all about What Is Payroll. If your business has employees, you’ll have to do payroll. There’s no way to avoid it, but what is payroll, A payroll is a company’s list of its employees, but the term is common. Module 9 In this module, you will learn all about Principles Of Payroll Systems. The business of employing people in the UK is regulated by government legislation designed to protect workers. Employees are entitled to receive the regular financial reward for their work. The amount is specified in their contract of employment. Module 10 In this module, you will learn all about Confidentiality And Security Of Information. As for any other financial information in business, you must be aware of the requirements of the Data Protection Act and the need for security and confidentiality of data at all times. This is particularly relevant to employee payroll records. Module 11 In this module, you will learn all about Effective Payroll Processing. Effective payroll processing isn’t just an essential business function. It also plays a key role in maintaining a high level of employee satisfaction. Employees depend on getting paid promptly and consistently with the correct amount. A payroll process that’s slow, prone to errors or overly complicated can result in a strained relationship between an employer and workers and unnecessarily tax the time of the HR team. Module 12 In this module, you will learn all about Increasing Payroll Efficiency. Payroll is a mission-critical function. Across the enterprise, no other department is under the same pressure to deliver every transaction, on-time and error-free. It’s not an option to make mistakes or hold up the pays while you finish something else. This pressure means that many payroll departments don’t have time to review their processes and procedures with an eye for efficiency gains. Enhancing the efficiency of your payroll will not only strengthen compliance, but it also has the potential to deliver significant cost and time savings. In today’s competitive business landscape most organisations are striving to do more with less. Implementing efficient processes will ease the burden and free up time for more strategic activities. Module 13 In this module, you will learn all about Risk Management in Payroll. Because it is considered to be well established and routine in nature, organisations often fail to adopt a strategic risk framework at the payroll process level. Organisations may not adequately recognise the risk associated with changes to regulations that impact payroll processing. Some organisations focus on risk relating to fraud and IT issues and often fail to consider all potential risks across the payroll lifecycle. Module 14 This module will teach you about Time Management. Timesheets, time cards, the Bundy-clock or a Time & Attendance system – no matter which system you use, whether it’s paper-based or web-enabled, time records are a core part of the payroll process. It goes without saying though, that an online, automated system will enhance productivity and efficiency. Module 15 This module will teach you about Personnel Filing. The records can be kept electronically or on paper (but back them up if they’re electronic) and should be in English. As an employer, you have flexibility over what form records take Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Chiniot (Punjab)

Peachtree Accounting Software Training Course in Rawat , 333-3300118 , Peachtree Accounting Software Training Course in Rawat , 333-3300118 , Peachtree Course Introduction Peachtree Course in rawalpindi, Peachtree Course in islamabad, Quickbook course in rawalpindi, tally course in rawalpindi ,This course is an introduction to the latest technology in computerized accounting that is currently being utilized by businesses. The basic elements of accounting will be used such as general ledger, payroll, Accounts Receivable, Accounts Payable, inventory and invoicing. Sage’s Peachtree is one of the two major competing brand names in accounting software today. One of the most striking differences between Peachtree and Quickbooks is the feature of solid – or “fixed” – asset management. What this means for the accounting software program is a comprehensive index of a small businesses’ or large company’s entire level of capital (i.e. supplies, machines, building space for offices, and account holdings). By maintaining this powerful accounting feature, businesses are then able to take stock of their worth as it relates to profitability. Peachtree features an excellent version of this feature, while Quickbooks provides a slightly less effective solid assets component. It is important to remember, however, that while this feature can be useful for certain types of organizations, many business owners may end up not using it. For example, in the Manufacturing sector, Peachtree can include work ticket technology, quantity price breaking and in-depth and customized inventory-making tools. Their specific distribution package adds flexible price management and advanced drop-shipping to the mix to meet the needs of those customers. Laserking is an example of a bespoke software solution company that adds to the Quickbooks basic functionality to provide a unique, business-specific accounting tool. In terms of most other aspects of accounting software, both Quickbooks and Peachtree ranks similarly. While Peachtree is extremely user friendly, so does Quickbooks present time tested familiarity and ease of use in its business accounting software.Course Benefits: Peachtree® accounting helps the Accountant / Accounts Personnel’s to better manage their accounting & business. Packed with all of the basic invoicing, bill paying, in-depth inventory tracking, payroll, order entry and over 100 customizable reports. Peachtree Accounting gives you the insight behind your numbers. With Peachtree today, the Business Resource Center, you get assistance snapshot of your business financials, along with other functions. And with several new web-related features, Peachtree Accounting Software can help you to establish an internet presence for your business , NEBOSH IGC Course in Peshawar, Saidu Sharif, Shangla, Sakesar, Swabi, Swat, Tangi, Tank, Thall, Tordher, Upper Dir, NEBOSH Course in Punjab, Ahmedpur East, Ahmed Nager Chatha, Ali Pur, Arifwala, Attock, Basti Malook, Bhagalchur, Bhalwal, Bahawalnagar, Bahawalpur, Bhaipheru, Bhakkar, Burewala, Chailianwala, Chakwal, Chichawatni, Chiniot, Chowk Azam Chowk Sarwar Shaheed, Daska, Darya Khan, Dera Ghazi Khan, Derawar Fort, Dhaular, Dina City, Dinga,Dipalpur, Faisalabad, Fateh Jang, Gadar, Ghakhar Mandi, Gujranwala, Gujrat,Gujar Khan,Hafizabad,Haroonabad,Hasilpur, Haveli Lakha, Jampur, Jhang, Jhelum, Kalabagh, Karor Lal Esan, Kasur, Kamalia, Kamokey, Khanewal, Khanpur, Kharian, Khushab, Kot Addu, Jahania, Jalla Araain, Jauharabad, Laar, Lahore, Lalamusa, Layyah, Lodhran, Mamoori, Mandi Bahauddin, Makhdoom Aali, Mandi Warburton, Mailsi, Mian Channu, Minawala, Mianwali, Multan, Murree, Muridke, Muzaffargarh, Narowal, Okara, Renala Khurd, Rajan Pur, Pak Pattan,Panjgur, Pattoki, Pirmahal, Qila Didar Singh, Rabwah, Raiwind, Rajan Pur,Rahim Yar Khan, Rawalpindi, Rohri,Sadiqabad, Safdar Abad – (Dhaban Singh)Sahiwal, Sangla Hill, Samberial, Sarai Alamgir, Sargodha, Shakargarh, Shafqat Shaheed Chowk, Sheikhupura Sialkot, Sohawa, Sooianwala, Sundar (city), Talagang, Tarbela, Takhtbai, Taxila, Toba Tek Singh, Vehari, Wah Cantonment, Wazirabad, Sindh, Ali Bandar, nebosh in Baden, Chachro, Dadu, Digri, Diplo, Dokri, Gadra, Ghanian, Ghauspur, Ghotki, Hala, Hyderabad,Islamkot, Jacobabad, Jamesabad, Jamshoro, Janghar, Jati (Mughalbhin), Jhudo Jungshahi, Kandiaro, Karachi, nebosh course in Kashmor, Keti Bandar, Khairpur, Khora, Klupro, Khokhropur, Korangi, NEBOSH Course in Kotri, Kot Sarae, Larkana, Lund, Mathi, Matiari, Mehar, Mirpur Batoro,Mirpur Khas, Mirpur Sakro, Mithi, Mithani, Moro, Nagar Parkar, Naushara, Naudero, Noushero Feroz, Nawabshah, Nazimabad, Naokot, Pendoo, Pokran, Qambar, Qazi Ahmad, Ranipur, Ratodero, Rohri, Saidu Sharif, Sakrand, Sanghar, Shadadkhot, Shahbandar, Shahdadpur, Shahpur Chakar, Shikarpur, Sujawal, Bazdar, Bela, Bellpat, Bagh, Burj, Chagai, Chah Sandan, Chakku, Chaman, Chhatr, Dalbandin, Dera Bugti, Dhana Sar, Diwana, Duki, Dushi, Duzab, Gajar, Gandava, Garhi Khairo, Garruck, Ghazluna, Girdan, Gulistan, Gwadar, Gwash, Hab Chauki, Hameedabad, Harnai, Hinglaj, Hoshab, Ispikan, Jhal, Jhal Jhao, Jhatpat, Jiwani, Kalandi, Kalat, Kamararod, Kanak, Kandi, Kanpur, Kapip, Kappar, Karodi, Katuri, Kharan, Khuzdar, Kikki, Kohan, Kohlu, Korak, Lahri, Lasbela, Liari, Loralai, Mach, Mand, Manguchar, Mashki Chah, Maslti, Mastung, Mekhtar, Merui, Mianez, Murgha Kibzai, Musa Khel Bazar, Nagha Kalat, Nal, Naseerabad, Nauroz Kalat, Nur Gamma, Nushki, Nuttal, Ormara, Palantuk, Panjgur, Pasni, Piharak, Pishin, Qamruddin Karez, Qila Abdullah, Qila Ladgasht, Qila Safed, Qila Saifullah, Quetta, Rakhni, Robat Thana, Rodkhan, Saindak, Sanjawi, Saruna, Shabaz Kalat, Shahpur, Sharam Jogizai, Shingar, Shorap, Sibi, Sonmiani, Spezand, Spintangi, Sui, Suntsar, Surab,Thalo, Tump, Turbat, Umarao, pirMahal, Uthal, Vitakri, Wadh, Washap, Wasjuk, Yakmach, Zhob, NEBOSH course in Federally Administered Northern Areas/FANA, Astor, Baramula, Hunza, Gilgit, Nagar, Skardu, Shangrila, Shandur, Federally Administered Tribal Areas/FATA, Bajaur, Hangu, Malakand, Miran Shah, Mohmand, Khyber, Kurram, North Waziristan,South Waziristan, NEBOSH IGC course in Wana, NWFP, Abbottabad, Ayubia,

Rs 6.000

See product

Jhelum (Punjab)

Mobile Repairing Course in Chakwal Jhelum, Mobile Repairing Course in Rawalpindi Attock Gujar Khan, International College Of Technical Education Offer Mobile Repairing Course in Rawalpindi Attock Gujar Khan 03115193625, Professional Mobile Repairing Course in Rawalpindi Attock Gujar Khan 0335417649, Best Mobile Repairing Course in Rawalpindi Attock Gujar Khan 03115193625, Practical Work Mobile Repairing Course in Rawalpindi Attock Gujar Khan, Admission open for admission and queries call 03115193625,03354176949. INTERNATIONAL COLLEGE OF TECHNICAL EDUCATION Pakistan No.1 IT Training, Technical, Management and Safety Officer Institute, For More Information Visit Our Website http://www.icollegete.com/ https://courses.com.pk/ Certification acceptable in Government job and Worldwide UK USA KSA UAE Canada Dubai Muscat Oman Bahrain Kuwait Qatar Saudia Japan China,In mobile repairing course you will get training for mobile hardware and mobile software solution. We give practical on all types of smart phone and basic phone to our students. In our Mobile repairing centre, you will get 100% solution for all types of mobile faults. For mobile software related faults students take training on different types of boxes which is used for software related issue. For more details about mobile repairing course call us.Multitech Mobile Repairing Course in Rawalpindi is presenting different short time skill development courses for students at a very chip or an affordable fee. The curriculum provides practical understanding and also offers know-how of theoretical concepts required within the area of mobile repairing. Our courses make students dexterous in fixing all type of technical problems of a Mobile.ICTE institute of technical and professional education award this certificate course with the knowledge and skills that can enable you to perform major and minor mobile phone repairs effectively & efficiently. The Mobile Phone Repairing Course has been designed to provide you professional knowledge and skills for repairing, installing and upgrading or downgrading mobile hardware of all the leading mobile phone manufacturers. You can perform all kinds of mobile phone hardware fixing work.A mobile phone is a portable telephone that can make and receive calls over a radio frequency link while the user is moving within a telephone service area. The radio frequency link establishes a connection to the switching systems of a mobile phone operator, which provides access to the public switched telephone network (PSTN). Most modern mobile telephone services use a cellular network architecture, and, therefore, mobile telephones are often also called cellular telephones or cell phones. In addition to telephony, 2000s-era mobile phones support a variety of other services, such as text messaging, MMS, email, Internet access, short-range wireless communications (infrared, Bluetooth), business applications, gaming, and digital photography. Mobile phones which offer these and more general computing capabilities are referred to as smartphones.A factory reset, also known as master reset, is a software restore of an electronic device to its original system state by erasing all of the information stored on the device in an attempt to restore the device’s software to its original manufacturer settings. Doing so will effectively erase all of the data, settings, and applications that were previously on the device. This is often done to fix a software issue that the device is facing, but it could also be done to restore the device to its original settings.[1] Such electronic devices include handheld computers such as PDAs and mobile phones. Since a factory reset entails deleting all information stored in the device, it is essentially the same concept as reformatting a hard drive. Pre-Installed applications and data on the card's storage card (such as a MicroSD card) will not be erased. A factory reset should be performed with caution, as it effectively destroys all data stored in the unit. Factory resets can often fix many chronic performance issues such as freezing and will not remove the device's operating system Introduction of ( Volt, current, Watt, Ohms) How to remove and fix mobile speaker and ringer How to repair and tracing battery connector supply Mobile not charging and charging/discharging problem solution Soldering and disordering of mobile components Mobile phone fingerprint related problem solution Mobile Repairing Course Content: Basics of mobile communication and electronics Study of Digital Electronics Assembling & disassembling of different types of mobile phones Use of various tools & instruments used in mobile phone repairing Details of various components used in mobile phones Study of basic parts of mobile phones (mic, speaker, vibrator, LCD, antenna, etc) Testing of various parts with multimeter Use of surge machine (DC Supply) Introduction and study of Printed Circuit Board (Motherboard) Soldering & desoldering components using soldering iron Fault finding & troubleshooting Steps for repairing hardware and software problems Circuit tracing, jumpering techniques and solutions Troubleshooting through schematic diagramsTroubleshooting through schematic diagrams Repairing procedure for fixing other new hardware faults Advanced troubleshooting techniques Admission open for admission and queries call 03115193625,03354176949. INTERNATIONAL COLLEGE OF TECHNICAL EDUCATION Pakistan No.1 IT Training, Technical, Management and Safety Officer Institute, For More Information Visit Our Website http://www.icollegete.com/ https://courses.com.pk/ Certification acceptable in Government job and Worldwide UK USA KSA UAE Canada Dubai Muscat Oman Bahrain Kuwait Qatar Saudia Japan China https://iitpakistan.com.pk/technical-courses/mobile-repairing-course-diploma-pakistan-44.html http://www.icollegete.com/course/mobile-repairing-course-in-rawalpindi/

Rs 18.000

See product

4 photos

Rawalpindi (Punjab)

Quickbooks-PT,Talley ERP Book-Keeping Bundle Course details Overview In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Course Description Accounting and book-keeping skills are always in demand in any organisation. As well as finding employment, many learners go on to set up their own book-keeping business by offering their services to local companies. In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Sage Line 50 is essential if you want to work in an accounts office, finance department or as a book-keeper. This is because Sage Accounts is one of the most popular accounting package in the UK, particularly in Small and Medium Enterprises (SMEs) QuickBooks is the and book-keeping software for small and medium sized businesses. It is easy to use and gives you much-needed control over your business finances. QuickBooks Point of Sale provides retailers with an easy-to-use, affordable, scalable, customisable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. Each course teaches you everything you need to know so you can run an entire business within either program. It's the easiest and most affordable way to dive into each program in order to decide which one is right for you! Who Is This Course For? Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Requirements Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Trainings In this course, you will learn HOW TO USE AND INVEST IN CRYPTOCURRENCIES WITHOUT LOSING MONEY. You will also learn: 1. How to analyze investments of all asset classes to identify intrinsic value 2. How to compare the different cryptocurrencies and analyze them as investments 3. How to build wealth over time in the safest and fastest way possible 4. How the psychology of investing can make you rich or poor and how to use it to your advantage 5. The dangers of FOMO in investing 6. How to save money on taxes when making investing decisions 7. How to avoid getting in trouble with the law when investing in Cryptocurrencies 8. How to think clearly about investing and building wealth 9. How to use human emotion to your advantage when it comes to investing 10. Much more Do yourself a favor and educate yourself about how cryptocurrencies work so that you don't make the same mistake as countless others, and lose your money! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2013 Training - Bookkeeping Made Easy This QuickBooks 2013 Training for Beginners will show you how to unlock the power of Quickbooks 2013 and take direct control of your business finances. Expert author Barbara Harvie teaches you how to setup and manage the accounting for your business using QuickBooks 2013. This video based Quickbooks tutorial removes the barriers to learning by breaking down even the most complex of operations into easy to understand, bite-sized pieces, making it fast and fun for you to learn. This Quickbooks training course is designed for the absolute beginner, and no previous accounting software experience is required. You will start with the basics of using an accounting package - setting up your company file. You will quickly learn how to manage day to day operations by setting up items, services, customers and jobs right in the QuickBooks 2013 interface. You will learn how to create invoices and manage them once the customer has paid. Barbara shows you how to enter and pay bills, track your inventory, and manage all your banking tasks. In this video based tutorial, you will also learn how to create reports, customize reports, and maybe most importantly, how to back up your company file. By the time you have completed the computer based training QuickBooks tutorial course for Beginners course for Intuit QuickBooks 2013, you will have a clear understanding of how to setup and manage your company finances on a day to day basis, as well as access the financial information you need to help you be successful in your endeavour. Working files are included, allowing you to follow along with the author throughout the lessons. Take this ultimate QuickBooks tutorial right now and learn QuickBooks 2013. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sales Tax with QuickBooks Course details This, step by step course shows you exactly how to record and manage ANY sales tax related situation for people using QuickBooks for their business. You will learn how to record, collect and pay sales tax. You will learn how to find and interpret the results of sales tax reports. You will learn how to adjust sales tax and fix sales tax mistakes. You will learn both the cash and accrual method of paying sales tax. You will lean how to manage maximum sales tax situations and situations where there are multiple sales tax in 1 transactions. Sales tax is something that effects most business. If you are working with more than one company, then you need to be able to create new sales tax items and manage these special situations. Accountants will sometimes adjust only the general ledger account called "sales tax payable" and they will forget to adjust the balance owed to the specific tax agency. This course will give you the ability to do that. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Quickbooks-PT,Talley ERP Course details This course has been specifically designed for beginners / investors new to the stock market. It is one of the most comprehensive toolkit for stock market trading/ investing. How is the course structured? 1. The first three sections in the course deal with the common queries most beginners have with respect to the stock market. 2. The next three sections deal with understanding & analyzing Financial Statement of companies. 3. The rest of the sections deal with Technical Analysis. These techniques are not just applicable to stocks but also other asset classes. Why should I take this course? Do you have questions like: 1. How do I start trading in the stock market? 2. What is share or stock? 3. What is a stock exchange? 4. I have less money, Should I trade in Futures & Options? 5. How do I select a stock broker? 6. How much money should I invest in the stock market? 7. What is algorithmic trading & Should I be doing it? Great! The first 3 sections in this course answers many such questions for beginners. The next 3 sections deal with understanding & the financial statements of any company. Now you need not be intimidated with terms like Balance Sheet, Cash Flow Statement, Statement of Income. Everything is explained using a real financial statement so that you can start reading financial statements just like you read any other book! To add to it you learn how to perform Financial Ratio Analysis & Common Size Analysis of companies which would help you better understand the underlying business of a stock & its performance. This is a must have input before you invest in a stock! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bank Reconciliation Statement (College Level) Course details Welcome to Accounting Bank Reconciliation Statement Course. Business entities will be having large number of Bank transactions and these transactions will be recorded by them in their Cash Book (Bank Column). The bank balance as per Cash Book should be balanced with Bank Balance as per pass book. However, there will be certain differences due to timing difference between recording the transactions by the parties, namely the business entity and the Banker. This difference have to be identified and sorted at the earliest to avoid fraud and error. This difference can be identified by preparing a Statement known as Bank Reconciliation Statement and this course will teach you a) What is Bank Reconciliation Statement. b) What is Cash Book and Pass Book. c) Difference between Cash Book and Pass Book d) Causes for disagreement between the balance shown by Cash Book and Pass Book e) Procedure for preparing BRS f) Preparing BRS when bank balance is favourable / unfavourable. This course is structured in self paced learning style. Video lectures / screen cast are used for presenting the course content. Take this course to understand practical aspects of BRS. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Investment: Quickbooks-PT,Talley ERP Analyzing Software Companies Course details Are you looking to invest into software companies? What are the important characteristics andtrends of this industry? Dothese companies have any moat? How do they spend their cash? What are therisks? In this course, I will teach how to analyse and invest into software companies. We start off by learning about the different sub segments of the software industry. Then wemove onto quantitative financial analysis. After which, we will continue intoqualitative non financial discussion. All this will give us a holistic view of software companies before we commit investments into them. Unlike some other courses out there where you just hear instructors talking endlessly, and you only see boring text intheir presentation, this course will include animations, images, charts anddiagrams help you understand the various concepts. This is also not a motivation class whereI preach to you that you must work hard to succeed, or you must have disciplineto profit from the market. In this course, you will learn actionablemethods and frame work. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Financial Model Builder Course We go through 7 financial models: 1. Financial Model Basics - you learn the basics of financial models 2. Beyond The Basics - best practice, working capital, balance sheets and cash flows 3. Debt Equity Model - equity calculations and debt calculations incorporated into a model 4. Investment Scenario Model - a model for investments that includes multiple scenarios 5. Corporate Scenario Model - a full corporate model that incorporates multiple scenarios 6. Capital Investment Appraisal Model - a model for evaluating a capital investment 7. Pricing Model - a model for determining optimum pricing to customers. We go through many different company types: Pet Food Wholesaler, Clothing Wholesaler, Chemical Manufacturer, Investment Fund, Platinum Mine,Electricity Provider and an Office Equipment Company. If you are a • business owner • manager • finance professional or • business student and want to learn all-round financial model building skills, then this course is for you. By the end of the course, you will be able to • build accurate models • understand all essential Excel formulas and functions for financial models • create flexible models for multiple scenarios • adapt your skills to a variety of industries and requirements. In summary, this is one of the best value-for-money courses on financial models. Hope to have you as a student soon. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Computer Essentials-DIT CIT Web Development Presented with high-quality video lectures, this course will visually show you how to easily do everything with computers. This is just some of what you will learn in this course: • Learn the basic principles of hardware including circuits, coding schemes, binary, the five generations of computers, Moore's Law, IPOS, registers, cache, RAM, magnetic storage, optical storage, solid-state storage, ROM, BIOS, the motherboard, buses, and the CPU. • Learn how to operate a computer including a vast array of hands-on skills just to mention a few for example: managing files, backing up files, right clicking, taking screenshots, determining your computer's properties, upgrading your computer, changing settings on your computer. • Learn how to use word processing software including the creation of a title page, document sections, headers and footers, styles, an automatically generated table of contents, the insertion of images, references, and the insertion of an automatically generated citation of works referenced. • Learn how to use spreadsheet software including formulas, functions, relative references, absolute references, mixed references, and the creation of a graph or chart. • Learn how to use video editing software including adding credits and transitions then publishing that video to a video hosting website such as YouTube. • Learn how to use databases including table creation, the setting of a primary key, the establishment of table relationships, the setting of referential integrity, and the creation and execution of a query. • Learn how to use presentation software to more effectively give presentations. • Learn to do some simple programing including designing, coding, testing, debugging, and running a program. • Learn about the world wide web including sending email, conducting searches , having familiarity with online educational resources such as Khan Academy, and having an awareness of online "cloud computing" tools such as Google Word Processing, Google Spreadsheets, and the many other online tools offered by Google. • Learn about application software and system software including operating systems, utilities, and drivers. • Learn about networks including architecture, topology, firewalls, security, wireless networks, and securing wireless networks. • Learn about the Internet, the World Wide Web, censorship, the digital divide, net neutrality, differing legal jurisdictions, website creation, multimedia, social media, and eCommerce. • Learn about information systems, systems development, and the systems development life cycle. • Learn about program development, programming languages, and the program development life cycle. • Learn about databases including table creation, primary keys, relationships, referential integrity, queries, and structured query language. • Learn about privacy and security issues related to computers. • Learn about robots and artificial intelligence including the Turing test. • Learn about intellectual property including patents, trademarks, copyrights, and the creative commons. • Learn about ethics and ethical issues relating to the use of technology. • Learn about health ramifications of using computers including repetitive stress injury, carpal tunnel syndrome, and ergonomics. • Learn about e-Waste and other environmental concerns related to technology. Lifetime access to this course allows you to easily review material and continue learning new material. After taking this course, you will have a thorough understanding of how to use computers well. From beginners, to advanced users, this course is perfect for all ability levels. This course will add value to everyone's skillset. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Professional Bookkeeping & Accounting 2 - Bank Daybook Do you need to understand and record petty cash or banking transactions for your business? Are you considering a career in Bookkeeping or Accounting? Are you studying for Professional Accounting or Bookkeeping exams? THEN REGISTER NOW Course Overview Section 1 of this course is an introduction section. After the course introduction we will begin this course by introducing you to both the prime books of entry and cross totting as you will need a working understanding of these through out this course. You will also be presented with the case study that we will use in the activities in section 2 and 3 of this course. In section 2 we will move into Petty Cash. We will walk through each step of the petty cash process from raising petty cash vouchers, entering data to the daybook and reconciling and replenishing the petty cash. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Raise petty cash vouchers • Enter petty cash transactions to the petty cash daybook • Close the daybook and calculate the balance carried down • Reconcile the petty cash • Replenish the petty cash Section 3 of this course is about Banking Transactions. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Check remittance advice • Enter payments and receipts to the 3 column and analysis cash book • Close the cash book and calculate the balance carried down • Reconcile the bank This course contains: A case study that we will use through out this course Workbooks to download Activities to complete Quiz Certificate of Completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Quickbooks-PT,Talley ERP Diploma Who should consider learning the Features of Sage 50 Accounting? • Sage 50 Accounting Software is a fast, efficient and powerful accounting and invoicing solution that is ideally suited for small businesses. It is particularly recommended (but not restricted) for businesses that employ roughly 5 to 99 employees. • The software incorporates different versions for different levels of financial activity and is considered one of the most user-friendly accounting applications for SMEs (small and medium-sized enterprises). • Sage 50 is an intensive software package and in order to maximise the benefit, one would need to cover all aspects of the course in detail. It incorporates strong reporting features coupled with flexible tools for management, accounting as well as taxation. • By choosing to study a comprehensive course on Sage 50, candidates can expect to accurately manage company invoicing, produce financial and sales reports as well as process VAT records. • In-depth study and knowledge of different tools and features of the Sage 50 accounting software can help candidates add value to their team. • Similarly, Sage 50 software is also ideal for those who own their own businesses and wish to become self-sufficient in managing their own accounting and invoicing and so on. Expertise in Sage 50 accounting software helps reduce reliance on external accountants. • In addition, Sage 50 accounting software is recommended for those who wish to make a seamless transition from manual payroll processing to a computerised system. By opting to educate and update one’s skills in Sage 50, candidates can prove their ability to potential employers. The Sage 50 online course is suitable for individuals, business entrepreneurs and aspiring students who wish to learn the basics of computerised accounting and invoicing. • A detailed working knowledge of Sage 50 can help aspirants gain confidence and help them provide a high standard of accounting services to companies. • Candidates from all backgrounds and fields are free to learn the Sage 50 accounting course; it does not require any prerequisite academic qualifications. The only prerequisite condition is a basic working knowledge of numeracy, literacy and IT skills. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Tax Accounting Certificate Finally, there are a number of international standards when it comes to taxation and accounting reporting and the course provides an overview of how the existing tax standards came into being and which international and British organisations enforce these regulations. Keeping up with the recent news, it also outlines the possible impact that the upcoming exit from the European Union may have on taxation What you will learn: • What tax is and how the taxation system in the United Kingdom operates • What taxes apply to individuals residing in the United Kingdom • What benefits and allowances exist to support people in underprivileged positions • How to calculate National Insurance contributions based on individual earnings • What the different National Insurance classes are and who they apply to • How to calculate Income Tax and demystify tax codes • What income can be tax free and the various tax reliefs for individuals • How to calculate Corporation Tax that companies get charged on their sales • The mechanics of VAT and the VAT schemes are used to reclaim VAT on purchases • What charges apply to international imports and exports in the EU and outside the EU • How to import and export goods and services and prevent double taxation • What double entry accounting is and how debit and credit operations affect accounts • How to do your own company accounting, preparing and submitting Annual Returns Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Diploma in Accounting with Intuit QuickBooks Furthermore, you can check the validity of your qualification and verify your certification on our website at any time. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM Module 1 • Getting the Facts Straight • The Accounting Cycle • The Key Reports • A Review of Financial Terms • Understanding Debits and Credits • Your Financial Analysis Toolbox • Identifying High and Low Risk Companies • The Basics of Budgeting • Working Smarter Module 2 • Opening QuickBooks Pro 2008 • Accounting Basics, Part One • Accounting Basics, Part Two • Getting Started with QuickBooks • Getting Help in QuickBooks • Lists, Forms, and Registers • Using the Chart of Accounts • Using the Journal • Adding Items and Services • Adding Vendors • Adding Customers • Adding Employees • Sales Receipts • Customer Payments • Finance Charges • Setting up Invoices • Finishing Invoices • Tracking Invoices • Issuing Credit Memos Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Technical Analyst Diploma Course details Overview A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Hence technical analysis focuses on identifiable price trends and conditions. If you believe in this approach or want to combine it with the fundamental analysis, then this course is for you. Become a professional technical analyst. Description In this course you will learn: • Defining technical analysis • Indicators • Managing the trade • 10 Secrets of the top technical traders • Considering a trading system etc. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Accounting for Small Business it can be done at any time by extending your subscription. COURSE CURRICULUM MODULES • Introduction to Accounting • Financial Statements • Assets and Liabilities • Accounting Transactions • Inventory and Cost Methods • Stakeholders and Equity • Managerial Accounting • Cost Accounting • Costs and Expenses • Budgetary Control • Analysis and Decision Making • Module Book- Accounting for Small Business • BookKeeping Training Manual ADDITIONAL STUDY MATERIALS • Additional Study Materials- Accounting for Small Business RECOMMENDED BOOKS • Recommended Books – Accounting & Finance How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgets and Money Management Skills Diploma Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Course Overview • Finance Jeopardy • The Fundamentals of Finance • The Basics of Budgeting • Parts of a Budget • The Budgeting Process • Budgeting Tips and Tricks • Monitoring and Managing Budgets • Crunching the Numbers • Getting Your Budget Approved • Comparing Investment Opportunities • ISO 36501:2008 • Directing the Peerless Data Corporation Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market & Forex Trading Beginner Quickbooks-PT,Talley ERP This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you're an individual looking to excel within this field then Level 2 Certificate in Stock Market & Forex Trading is for you. We've taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept - from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success. All our courses offer 3 months access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full CPD accredited qualification. And, there are no hidden fees or exam charges. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Basics of Stock Market & Forex Trading Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Retail Banking Diploma This course is designed to provide you with all the knowledge and skills you need to be effective when it comes to retail banking. This is still a relatively new sector of the banking industry, so learning how it works and how to incorporate into your current bank can help you achieve success moving forward. Some of the things you can expect to learn include: • Get an introduction into retail banking, understand what this type of banking is and why it is becoming so important to banks now and moving forward. • Learn about the various financial systems and how they link to retail banking. • Identify the different types of banking and banking channels. • Understand the different retail banking products and how these differ from traditional banking products. What sets this apart from banking that has been used for years? • Get an understanding on retail mortgages and loans and why this is important in today's market place. • Learn about various banking services and how these relate to retail banking. • Identify the different banking payment systems to improve customer experience and meet their unique banking and financial needs. • This module will teach you about various banking operations which will be beneficial to you in the retail banking sector. • Learn about Islamic banking, what it is and how it can benefit you. • Get valuable insight into customer service and the importance thereof. Customer service can make the difference on whether the client opens an account with your bank or one of your competitors. • Understand money laundering, what it is, how it is carried out and what to watch for to reduce the risk of this happening on your watch. Benefits There are so many great benefits to completing the retail banking course online. Some of the benefits you can expect to take advantage of include: • Study online from anywhere at any time. • Use any device to study - computer, laptop, tablet or phone. • Comprehensive course broken down into manageable modules, making it easier to study. • Study at your own pace whether you choose to study full time or part time, complete the course in a matter of days or weeks, the choice is up to you and the time you have to dedicate to your studies. • Enjoy the convenience of online support during your studies. • Gain a lifetime access to all modules to revisit as and when needed. • On successful completion instantly download and print your industry recognised certificate. • All certificates are verifiable using their unique code. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Business and Accounting Basics Diploma What you will learn • An introduction into the importance of accounting • A look at four ways to structure your business • How to deal with relevant government bodies, registering and filing • The benefits of a business bank account • How to set up a business bank account • Evaluating funding sources for your business • Dealing with money from customers • How to keep track of business costs and tax relief • The essentials of recordkeeping and bookkeeping • How to deal with taxes • Employing staff • Taking money out of your business • How to read the profits, cash and ratios in your accounts • Using forecasting methods to plan for the future • How to know if you need an accountant • Ethical practices of an accountant Business Basics Diploma Have you always dreamed of starting your own business? Do you need the skills and knowledge to start your own business and achieve success? Have you finished school and are thinking of entering the business world and want to boost your career from the start? Then this Business Course from New Skills Academy may be what you are looking for.The business diploma course is made up of sixteen modules. These modules are brimming with valuable information that you can use straight away in your working day. Overall the sixteen modules take around ten hours to complete, each module taking you between fifteen to thirty minutes.Learn about branding, setting goals and financial, learn everything you need to know to start or grow your own business. You will gain a lifetime access to the course modules, so you can refer back to them at any time.Enjoy the convenience of online learning, where you can study at your own pace using any device from anywhere, as long as you have internet access. What you will learn • Starting your own business, where to begin, generating ideas and personal qualifies you are going to need. • Understanding the importance of a business plan and how to start your own. • Researching into your business market and how to identify your target audience. • What is branding, how to use branding and how it will effect your business moving forward. • How to set goals and tackle issues. • Understanding financing and options available. Identify how much money you will need to start up your business along with what you need to give in return. • Understanding cash flow, accounts and bookkeeping. Learn how to budget, how to keep track of invoices and payments. • Get a firm understanding of marketing and social media and how you can use these to boost your business moving forward. Learn how to market your business on a tight budget and what considerations to factor into your marketing decisions. • How to source and manage staff. What you need to do to keep them motivated. Also learn the importance of training. • Learn the legal issues which could affect your business moving forward. • Get the low-down on tax and what taxes you will be accountable for. Also get some tips and advice to make tax an easy and stress free process within your company. • Identify with your insurance needs. Get a good understanding of business insurance and what costs you may incur if you don't have the right insurance in place at all times. • Learn how technology can help you grow your business. Identify what technology you need, how not to overpay for essential technology and things you should be aware of at all times. • Identify what business ethics is and how it relates to your business. You will also learn how to operate effectively and how business ethics identifies how you are perceived. • Know why you need a website, what to include and how to market it effectively. • Know when it's time to grow your business, know the pitfalls and how to deal with the future. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

Rs 20.000

See product

4 photos

Rawalpindi (Punjab)

Mobile phone repairing training course in rawalpindi punjab 03354176949 Mobile phone repairing course in rawalpindi punjab 03115193625, International college of technical education offers Mobile phone repairing Course in Rawalpindi punjab pakistan admission open for admission and information call 03115193625, 03354176949 New session Mobile phone repairing professional course. A mobile phone is a portable telephone that can make and receive calls over a radio frequency link while the user is moving within a telephone service area. The radio frequency link establishes a connection to the switching systems of a mobile phone operator, which provides access to the public switched telephone network (PSTN). Most modern mobile telephone services use a cellular network architecture, and, therefore, mobile telephones are often also called cellular telephones or cell phones. In addition to telephony, 2000s-era mobile phones support a variety of other services, such as text messaging, MMS, email, Internet access, short-range wireless communications (infrared, Bluetooth), business applications, gaming, and digital photography. Mobile phones which offer these and more general computing capabilities are referred to as smartphones. A factory reset, also known as master reset, is a software restore of an electronic device to its original system state by erasing all of the information stored on the device in an attempt to restore the device’s software to its original manufacturer settings. Doing so will effectively erase all of the data, settings, and applications that were previously on the device. This is often done to fix a software issue that the device is facing, but it could also be done to restore the device to its original settings.[1] Such electronic devices include handheld computers such as PDAs and mobile phones. Since a factory reset entails deleting all information stored in the device, it is essentially the same concept as reformatting a hard drive. Pre-Installed applications and data on the card's storage card (such as a MicroSD card) will not be erased. A factory reset should be performed with caution, as it effectively destroys all data stored in the unit. Factory resets can often fix many chronic performance issues such as freezing and will not remove the device's operating system A mobile virtual private network (mobile VPN or mVPN) is a VPN which is capable of persisting sessions across changes in physical connectivity, point of network attachment, and IP address. The "mobile" in the name refers to the fact that the VPN can change points of network attachment, not necessarily that the mVPN client is a mobile phone or that it is running on a wireless network. Mobile Repairing Course Content: Basics of mobile communication and electronics Study of Digital Electronics Assembling & disassembling of different types of mobile phones Use of various tools & instruments used in mobile phone repairing Details of various components used in mobile phones Study of basic parts of mobile phones (mic, speaker, vibrator, LCD, antenna, etc) Testing of various parts with multimeter Use of surge machine (DC Supply) Introduction and study of Printed Circuit Board (Motherboard) Soldering & desoldering components using soldering iron Fault finding & troubleshooting Steps for repairing hardware and software problems Circuit tracing, jumpering techniques and solutions Troubleshooting through schematic diagrams Troubleshooting through schematic diagrams Repairing procedure for fixing other new hardware faults Advanced troubleshooting techniques. Mobile phone repairing professional course in rawalpindi punjab 03115193625, for more information visit our website www.icollegete.com, www.courses.com.pk

See product

4 photos