Erp quickbook

Top sales list erp quickbook

Karachi (Sindh)

Computerize accounting training manual and computerize “peachtree / quickbook / tally software “ step by step financial accounting and erp module training . call 03012224479 . registered Sindh board . we also provide online training in pakistan and worldwide...

Rs 4.000

See product

Rawalpindi (Punjab)

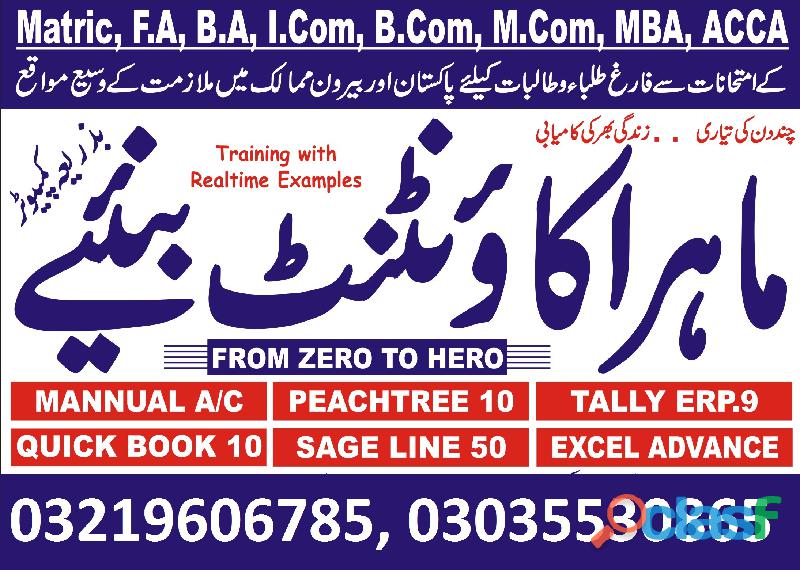

Certificate in Finance & Budgeting Quickbooks-PT,Talley ERP Course details Understanding the basics of finance and budget is helpful for everyone but upgrading these skills will help you achieve financial stability. This course can also help professionals who want to learn more knowledge and skills in budgeting to improve the financial management of their organization. This Level 2 Certificate in Finance & Budgeting lets you know more financial terms and concepts that you can implement to your business. You will be able to manage financial and budget plans through proper financial management and analysis. Course Highlights • The price is for the whole course including final exam - no hidden fees • Accredited Certificate upon successful completion at an additional cost • Efficient exam system with instant results Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Pro 2012 & 2013 COURSE CURRICULUM 1. What’s new in Quickbook Pro 2013 2. Quickbook Overview 3. The Company file 4. Setting up for Multiple users 5. Navigation in Quickbook 6. Adjusting preferences 7. The Chart of Account 8. Company lists 9. Importing data 10. Working ith the Bank Account 11. Creating items 12. The Basic of working with Inventory 13. Working with Vendors & paying bills 14. Customers, Jobs & Recording sales 15. Sales Adjustments & Statements 16. Customizing templates & forms 17. Accounts Receivable & Deposits 18. Sales tax 19. Report & The Report center 20. Managing Employees 21. Working with Credit cards 22. Loans & Liabilities 23. Reconciling Accounts 24. Online Banking 25. What’s new in Quickbook 2012 26. Finalizing your Accounting How will I be assessed? • You will have one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts for Beginner Learners why not improve your chances of gaining professional skills and better earning potential. Course Curriculum • Module 1: Program Basics– Set up your program, discover more about the user interface such as toolbar and keyboard options • Module 2: Restoring and Backing-up Data – Learn about data storage, creating back-ups and restoring them • Module 3: Basic Setting and Details – Manage financial dates, company details and program dates • Module 4: The Chart of Accounts – Create, modify and review chart of accounts • Module 5: Bank Receipts – Enter bank receipts • Module 6: Bank Payments – Oversee VAT, overheads, assets and bank payments • Module 7: Financials – Observe the financial state of your company • Module 8: Customers – Add new customers, use the new customer wizard, and manage their details • Module 9: Suppliers – Add and edit supplier records • Module 10: Working with Lists – Utilize lists to sort out records • Module 11: Batch Invoices – Create customer invoices, check bank accounts and nominals • Module 12: Service Invoices – Create service, manage line and invoice • Module 13: Processing Invoices – Process invoices and update ledgers • Module 14: Product and Services – Duplicate, add items, services and products • Module 15: Stock Control – Control your stocks through adjustments, activity and returns • Module 16: Product Invoices – Invoice management for products utilizing multiple platforms • Module 17: Product Credit Notes – Create credit notes • Module 18: Reviewing Your Accounts – Review the financial state of your company • Module 19: Aged Debtors and Statements – Analyse account balances, aged debtors, statements and customer communication history • Module 20: Customer Receipts – Allocate receipts automatically, manually or partially using discounts and payments on account • Module 21: Customer Activity – Observe customer activity • Module 22: Supplier Batch Invoices – Add new suppliers, their account balances and batch invoices • Module 23: Supplier Payments – Record and observe supplier payments, activity, print remittance and cheques • Module 24: More about the Nominal Ledger – Journal entries, nominal code activity, ledger graphs and records • Module 25: More about bank accounts – Learn about bank transfers, combined payments and petty cash transactions • Module 26: Using the Cash Register – Recording and depositing with the cash register • Module 27: Bank Reconciliation – Reconcile bank account and carry out group transactions • Module 28: Recurring Entries – Recurring entry processes including bank set up, adding journals, and deleting recurring entries • Module 29: VAT Returns – Produce, make, print, reconcile and complete VAT related transactions • Module 30: More About Reports – Follow the audit trail, period trial balance, profit and loss, and the balance sheet report • Module 31: Using Dashboards – Use the dashboards effectively Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Business Basics Course details Overview This course will be extremely useful for business owners, or those hoping to go into business accounting. Get to grips with all the financial basics of business, how to set up and maintain an effective payroll system, how to get your business out there, and how to use SEO effectively. Learners will come away from this course with a whole host of useful skills, which will help you to gain employment in the accounting and business world. Description This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Introduction 2: Business Entities 3: Beginning Your Business 4: Financial Basics Part 1-2 5: Employees Payroll 6: Getting Your Business Out There 7: Seo 8: Other Topics 9: Closing Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 it can be done at any time by extending your subscription. Course Curriculum 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgeting for your Daily Life This course aims to help individuals who are having a difficult time budgeting to successfully control their money and limit spending on unnecessary items. In this course, you will learn how to set goals, create your own budget effectively, overcome debts and overspending, and also acquire strategies that will help in making long-term budgeting effective and successful. Take back control of your finances and become a savvy spender! COURSE CURRICULUM 1. Learning how to budget 2. Realizing, where your money goes 3. Self- assessment 4. Setting up the budget 5. Creating monthly vs. Yearly budgets 6. Sticking to your budget using strategies 7. Long term budgeting The method of Assessment: At the end of the course, learners will take an online multiple choice questions assessment test. This test is marked automatically, so you will receive an instant grade and know whether you have passed the course. Certification: Successful candidates will be awarded certificate in Budgeting for your Daily Life. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Assessment This course will be assessed on the basis of one assignment. We believe doing practical assignments are the best way to assess the ability of the students and also it is the best way to make them apply what they have learnt into practice. Students can start their assignments from day one and complete the course as soon as they submit their assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Managerial and Cost Accounting This Diploma in Managerial Cost Accounting will prepare you for employment within this exciting industry, and will allow you to become highly skilled when it comes to cost accounting. The course covers a whole range of exciting topics, including: Overview of Managerial Accounting, Planning and Directing, Key Components of Cost, and Cost of Flow Concept. Become a successful Cost Accountant with this excellent course. Course Description: This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Method of Assessment: At the end of the course, learners will take an online multiple choice question assessment test. The online test is marked straight away, so you will know immediately if you have passed the course. Certification: Successful candidates will be awarded a certificate for Diploma in Managerial and Cost Accounting. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Peachtree Pro Accounting 2009 This excellent Peachtree Pro Accounting 2009 course will provide an in depth introduction to the general accounting features of Peachtree Pro Accounting, as well as step-by-step instructions on how to set up a new company, vendors, and employee payroll on Peachtree Pro Accounting. During this excellent Peachtree Pro Accounting course, you will learn how to achieve better business results, whether you’re business is new, or you’re an experience business manager. This Peachtree Pro Accounting course is taught by an expert instructor, and is packed full of insider knowledge and tips, to help your business improve. If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. • You will only need to pay £19 for assessment when you submit your assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

3 photos

Muzaffarabad (Azad Kashmir)

O3235270770 Peachtree Quickbook Tally Course in Kashmir | Computerized Accounting Peachtree Quickbooks Tally Course A computerized accounting system is a system used by businesses for recording their financial information. Many systems are available and companies look for a system to match their needs.Computerized accounting refers to using computers for a range of accounting tasks. In the past, computers were used as calculators. Modern computers perform a number of additional tasks and provide analytical information.Computerized Accounting software are Peachtree, Quickbooks, Tally Erp, Sage, SAP Business One, SAP ECC 6.0 etc. Inspire Institute of Technologies Pakistan (Pvt) Ltd is affiliated with RCCI, SECP, SDA, TTB, TTPC, SDC & PSSC Government of Pakistan. Course Outlines of Computerized Accounting: Peach Tree: 1:Introduction 2:New Company Setup 3:Accounting Overview 4:General Ledger 5:Accounts Payable 6:Inventory 7:Accounts Receivable 8:Reports Quickbooks: 1:Introduction 2:New Company Setup 3:Accounting Overview 4:General Ledger 5:Accounts Payable 6:Inventory 7:Accounts Receivable 8:Reports Tally: 1:Introduction 2:New Company Setup 3:Accounting Overview 4:General Ledger 5:Accounts Payable 6:Inventory 7:Accounts Receivable 8:Reports Peachtree Quickbook Tally Computerized Accounting Course in Rawalakot Peachtree Quickbook Tally Computerized Accounting Course in Bagh Peachtree Quickbook Tally Computerized Accounting Course in Bhimber Peachtree Quickbook Tally Computerized Accounting Course in Khuiratta Peachtree Quickbook Tally Computerized Accounting Course in Kotli Peachtree Quickbook Tally Computerized Accounting Course in Mangla Peachtree Quickbook Tally Computerized Accounting Course in Mirpur Peachtree Quickbook Tally Computerized Accounting Course in Muzaffarabad Peachtree Quickbook Tally Computerized Accounting Course in Hajira Peachtree Quickbook Tally Computerized Accounting Course in Abbaspur Peachtree Quickbook Tally Computerized Accounting Course in Tararkhal Peachtree Quickbook Tally Computerized Accounting Course in Khai Gala Peachtree Quickbook Tally Computerized Accounting Course in Palandri Peachtree Quickbook Tally Computerized Accounting Course in Thorar Peachtree Quickbook Tally Computerized Accounting Course in Samahni Peachtree Quickbook Tally Computerized Accounting Course in Dheerkot Peachtree Quickbook Tally Computerized Accounting Course in Dhadyaal Peachtree Quickbook Tally Computerized Accounting Course in Peer Gali Peachtree Quickbook Tally Computerized Accounting Course in Forward Kahota Peachtree Quickbook Tally Computerized Accounting Course in Tetrinote Peachtree Quickbook Tally Computerized Accounting Course in Sudhan Gali Peachtree Quickbook Tally Computerized Accounting Course in Tain Dhalkot

See product

Karachi (Sindh)

EducationCT sindh board affiliated ..provide Computerize accounting international softwares training “Peachtree / Quickbook / Tally / Microsoft Accounting “… Best softwares for accountant and business man to manage financial accounting and ERP and easily get jobs in PK and International . . Under supervision of experience teacher With documentation and projects. Sir shahzad waiz ..03012224479

Rs 5.000

See product

Lahore (Punjab)

Our dedicated team tend to satisfy you in terms of your practical skills enhancement. Learn Tally ERP and get high paying jobs any where in the world. Call us now to plan you training.

See product

Pakistan

Peachtree Sage 50, Tally ERP, Quickbook, Advance Excel and SAP Business one, for more detail contact Commercial Phase 6, DHA Lahore

Rs 10.000

See product

Pakistan (All cities)

Bookkeeping and Payroll Diploma *New Year Offers* Quickbooks-PT,Talley ERP Description Course Curriculum 1. MODULE 01 • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts 2. MODULE 02 • Working with Ledgers • Reconciliation • Correcting Entries 3. MODULE 03 • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets 4. MODULE 04 • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash 5. MODULE 05 • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record 6. MODULE 06 • The Partnership & Corporations • Accounts Receivable and Bad Debts 7. MODULE 07 • Preparing Interim Statements • Year End – Inventory 8. MODULE HANDOUTS • Module Handouts- Bookkeeping and Payroll Management 9. ADDITIONAL STUDY MATERIALS • Additional Study Materials- Business Accounting 10. REFERENCE BOOKS • Reference Books- Business Accounting Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Administration Skills and Payroll- Quickbooks-PT,Talley ERP Course Description Course Syllabus As part of the Administration & Payroll course students will learn a range of topics including the following: • Working as an Administrative Assistant • The role of the administrator • Working practices • Meetings • Business departments • Business travel • Effective customer service • Telecommunications • Internet and office technologies • Payroll: Understanding the Basics • Payroll in the United Kingdom • Introduction to Payroll Systems • Running payroll • Starters and Leavers • Tell HMRC about a new employee • Gross Pay • Minimum wage for different types of work • Statutory Pay • Employment Allowance • The PAYE regime • PAYE Online for employers • The NIC Regime • Employees who pay less National Insurance • Statutory and Voluntary Deductions and Net Pay • Correcting payroll errors • RTI and working the Computerised Payroll System • Payroll: annual reporting and tasks • Final Assessment Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBook 2017 - Accounting, Payroll and Book Keeping Description Session 1 Section A: Course Opening • Introduction • How to Study for This Exam Section B: QuickBooks Setup • Before Setting Up a Company • Create a Company and EasyStep Interview • Remove Old Transactions • Customize the Home Page • Set Up Customer and Vendor Lists • Set Up Item Lists Section C: Navigation and Data Files • Navigate the Home Page • Navigate Menus and the Icon Bar • Navigate the Icon Bar • Back Up a Data File • Restore a Data File Section D: Program Information and Preferences • Determine the Release Number • Update QuickBooks • QuickBooks Modes • QuickBooks Versions • Password Protection • Preferences • Domain 1 and 2 Test Tips Session 2 Section A: List Management • Add Customers • Add Vendors • Add Items • General List Management • Edit List Entries • Merge List Entries Section B: Items • Items for Accounting Entries • Item Types • Products for a Specific Price • Services for a Specific Price • Unique Pricing Entries • Single Service or Product Section C: Session 2 Recap • Domain 3 and 4 Test Tips Session 3 Section A: Sales • Customer Center Lists • Navigate the Customer Center • Sales Workflow • Invoicing • Sales Receipts • Undeposited Funds • View Accounts Receivable and Checking • Customer Credits • Sales Statements • Handle Bounced Checks Section B: Purchases • Vendor Center Lists • Navigate the Vendor Center • Enter and Pay Bills • Write Checks • Use Credit Cards • Use Debit Cards • Purchase Workflow Transactions • Vendor Credits Section C: Inventory, Taxes, and Reconciliation • Inventory Workflows • Set Up and Collect Sales Taxes • Pay Sales Taxes • Bank Reconciliation Session 4 Section A: Payroll • Available Payroll Services • Starting the Payroll Setup Wizard • Employee Earnings • Employee Sick and Vacation Time • Finish the Payroll Setup Wizard • Set Up Payroll Schedules • Run Payroll • Pay Payroll Liabilities • Prepare Payroll Forms • Track Time and Invoice Customers Section B: Reports • Report Center • Customize Reports • Expand and Collapse Report Data • Report Descriptions • Process Multiple Reports • Send Reports to Excel • Memorize Reports Session 5 Section A: Basic Accounting • Financial Statements • Cash vs. Accrual Reports • Set a Closing Date • Enter a Journal Entry Section B: Customization and Shortcuts • Memorize Transactions • Set Up Multiple Users and Access • Create Custom Fields • Apply Custom Fields • Customize an Invoice Section C: Session 5 and Course Recap • Domain 9 and 10 Test Tips • Final Test Tips • Conclusion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Diploma in Bookkeeping & Payroll Management - Quickbooks-PT,Talley ERP Module 1 This module will teach you about Basic Terminology. So, the good thing about accounting is that you can start out wherever you want, at the beginning, the middle, or the end and you will still wind up at the same place, nowhere (Just kidding). You really have to start at the beginning, or you will get lost. So, let’s start there, with some basic terminology. Some of this stuff may ring a bell for those of you who took accounting previously, were hired to keep the books at the corner Mom & Pop’s shop, or, were too cheap to hire a “real Accountant” and tried to do your own books. (How did that work out for you?). Either way, when we are done here, you are bound to be familiar with a lot of these basic bookkeeping and accounting terms. Module 2 This module will teach you about Basic Terminology (II). In this unit, we will finish up with the basic accounting terms that are bound to impress at the next corporate fundraiser for the IRS. I know what you’re thinking. There is no such thing as a corporate fundraiser for the IRS because the only funds the IRS will be raised are those out of our wallets. Below are the next few terms you will need to know. Module 3 This module will teach you about Accounting Methods. Since the preceding units of this course were a piece of cake, now let’s talk about accounting methods, starting with the topics of cash and accrual. When you were a child, if your parents allowed you to go door to door selling items for your school’s fundraiser, you have used cash and accrual methods. It’s a simple concept that allows you to record the sale or purchase of an item even if you have not yet received payment. Module 4 This module will teach you about Keeping Track of Your Business. knowing how to keep track of your business will prove to be very valuable in the short run and long run. There are a number of different aspects involved in keeping track of any business the right way. Many businesses go out of business within the first year or two if things are not handled properly. Have you ever been up late at night, just craving one of those good old roast beef sandwiches from thelocal24 hour deli? You find that the craving gets so bad, you get up, leave (in your plaid jammies) and take a ride over there, with your mouth watering the whole way. You pull up, and hop out of the car(very excited), only to find that your favourite business is no longer “in business.” One could assume they did not keep very good track of their business or, they moved. Module 5 This module will teach you about Understanding the Balance Sheet. n this unit we will be discussing the accounting equation, double-entry accounting, types of assets, types of liabilities and equity. The balance sheet will help provide balance to your business. It helps keep everything organized and on point. One of the worst things in accounting is un-organization. So, don’t treat your balance sheet like your sock drawer at home or that mysterious junk drawer in your kitchen that no one wants to organize. Module 6 This module will teach you about Other Financial Statements. In this unit, we will introduce the income statement, cash flow statement, capital statement, and budget versus actual. These terms all involve money or the use of money in some form. When we are done, you will have a better understanding of how the use of these methods will help your business run more efficiently. You’ll be swapping accounting terms with that hotshot accountant friend of yours in no time. Module 7 In this module, you will learn all about Payroll Accounting Terminology. In this unit, we will be discussing many terms which involve dealing with the financial aspects of your business. We will also be discussing the accounting methods and terms used in reference to your employees, by briefly going over the following terms: gross wages, net wages, employee tax withholdings, employer tax expenses, salary deferrals, employee payroll, employee benefits, tracking accrued leave, and government payroll returns and reports. Module 8 In this module, you will learn all about What Is Payroll. If your business has employees, you’ll have to do payroll. There’s no way to avoid it, but what is payroll, A payroll is a company’s list of its employees, but the term is common. Module 9 In this module, you will learn all about Principles Of Payroll Systems. The business of employing people in the UK is regulated by government legislation designed to protect workers. Employees are entitled to receive the regular financial reward for their work. The amount is specified in their contract of employment. Module 10 In this module, you will learn all about Confidentiality And Security Of Information. As for any other financial information in business, you must be aware of the requirements of the Data Protection Act and the need for security and confidentiality of data at all times. This is particularly relevant to employee payroll records. Module 11 In this module, you will learn all about Effective Payroll Processing. Effective payroll processing isn’t just an essential business function. It also plays a key role in maintaining a high level of employee satisfaction. Employees depend on getting paid promptly and consistently with the correct amount. A payroll process that’s slow, prone to errors or overly complicated can result in a strained relationship between an employer and workers and unnecessarily tax the time of the HR team. Module 12 In this module, you will learn all about Increasing Payroll Efficiency. Payroll is a mission-critical function. Across the enterprise, no other department is under the same pressure to deliver every transaction, on-time and error-free. It’s not an option to make mistakes or hold up the pays while you finish something else. This pressure means that many payroll departments don’t have time to review their processes and procedures with an eye for efficiency gains. Enhancing the efficiency of your payroll will not only strengthen compliance, but it also has the potential to deliver significant cost and time savings. In today’s competitive business landscape most organisations are striving to do more with less. Implementing efficient processes will ease the burden and free up time for more strategic activities. Module 13 In this module, you will learn all about Risk Management in Payroll. Because it is considered to be well established and routine in nature, organisations often fail to adopt a strategic risk framework at the payroll process level. Organisations may not adequately recognise the risk associated with changes to regulations that impact payroll processing. Some organisations focus on risk relating to fraud and IT issues and often fail to consider all potential risks across the payroll lifecycle. Module 14 This module will teach you about Time Management. Timesheets, time cards, the Bundy-clock or a Time & Attendance system – no matter which system you use, whether it’s paper-based or web-enabled, time records are a core part of the payroll process. It goes without saying though, that an online, automated system will enhance productivity and efficiency. Module 15 This module will teach you about Personnel Filing. The records can be kept electronically or on paper (but back them up if they’re electronic) and should be in English. As an employer, you have flexibility over what form records take Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product