Book review

Top sales list book review

Rawalpindi (Punjab)

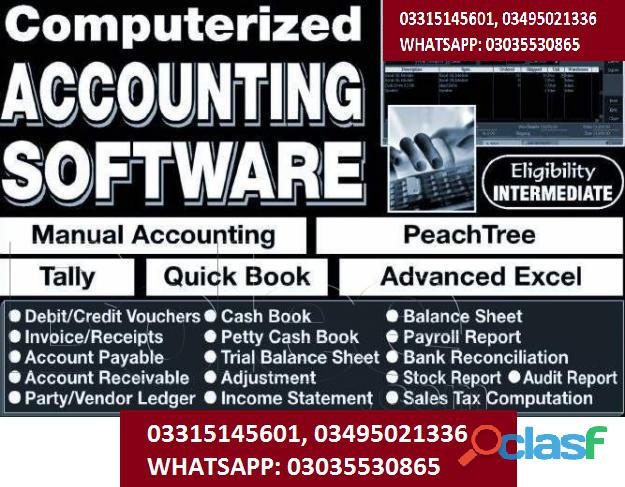

Peachtree Pro Accounting 2009 If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Stock Management Basics Course details Stock signifies an ownership in a corporate setting. If you have stocks in a corporation then you have the right to claim a part of their assets and earnings. Learning how to manage your stocks is important to ensure you are not on the losing end. You are taught in this Stock Management Basics Online Course different ways to manage stocks and when you should buy or sell one. This course will also strengthen your ability to analyze the stock market. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Stock Management Basics Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Mastering Financial Accounting This online training course is comprehensive and designed to cover the topics listed under the curriculum. COURSE CURRICULUM 1. INTRODUCTION: WHAT IS ACCOUNTING AND FINANCIAL STATEMENTS? • Introduction: What Is Accounting? • What Are Financial Statements? 2. A REVIEW OF THE ACCOUNTING CYCLE AND PREPARING FINANCIAL STATEMENTS • A Review of the Accounting Cycle • Reporting and Preparing Financial Statements 3. INTERNAL CONTROL IN ACCOUNTING SYSTEMS • Internal Control in Accounting Systems Part 1 • Internal Control in Accounting Systems – Part 2 4. MERCHANDISE MANAGEMENT & INVENTORY CONTROL • Merchandise Management & Inventory Control Part 1 • Merchandise Management & Inventory Control Part 2 5. LEARN BASIC RECEIVABLES ACCOUNTING, ACCOUNTING COMPENSATION AND EXPENSE ACCOUNTING • Learn Basic Receivables Accounting • Accounting for Sales, Property, Income Taxes and Employee Compensation • Depreciation Expense Accounting 6. ACCOUNTING FOR CURRENT AND LONG-TERM LIABILITIES • Accounting for Current and Long-Term Liabilities – Part 1 • Accounting for Current and Long-Term Liabilities – Part 2 7. INTRODUCTION TO CORPORATION AND STOCKHOLDERS’ EQUITY 8. FINANCIAL ACCOUNTING & FINANCIAL STATEMENT ANALYSIS • Financial Accounting & Financial Statement Analysis – part 1 • Financial Accounting & Financial Statement Analysis – part 2 Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Sage 50 Accounting Quickbooks-PT,Talley ERP Diploma Who should consider learning the Features of Sage 50 Accounting? • In-depth study and knowledge of different tools and features of the Sage 50 accounting software can help candidates add value to their team. • Similarly, Sage 50 software is also ideal for those who own their own businesses and wish to become self-sufficient in managing their own accounting and invoicing and so on. Expertise in Sage 50 accounting software helps reduce reliance on external accountants. • In addition, Sage 50 accounting software is recommended for those who wish to make a seamless transition from manual payroll processing to a computerised system. By opting to educate and update one’s skills in Sage 50, candidates can prove their ability to potential employers. The Sage 50 online course is suitable for individuals, business entrepreneurs and aspiring students who wish to learn the basics of computerised accounting and invoicing. • A detailed working knowledge of Sage 50 can help aspirants gain confidence and help them provide a high standard of accounting services to companies. • Candidates from all backgrounds and fields are free to learn the Sage 50 accounting course; it does not require any prerequisite academic qualifications. The only prerequisite condition is a basic working knowledge of numeracy, literacy and IT skills. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Payroll Diploma What you will learn This course is brimming with useful and valuable information for you to learn and start using. The course is designed to provide you with insight that you can start incorporating into your work without delay. Some of the things you can expect to learn when completing the payroll course include: • Get an understanding of what payroll systems are and why you need one. • Learn the basics of payroll systems. What you need to know, errors and the importance of communication. • Identify the payroll systems in the United Kingdom. What to include and working with HMRC. • Understand that you need to run an efficient payroll system. Staff training, reviews and record keeping plus so much more. • Get insight on how employees starting and leaving the business impacts payroll. This module will give you insight into what to do, P45's and time keeping. • Learn how to deal with HMRC when it comes to new employees, what information HMRC will need from you and how to ensure you pay the employee the correct amount each month or week. • Learn how to calculate gross and net pay. This module will teach you the difference between gross and net pay, how to calculate them and why you need wage slips for each employee. • Understand the different deductions you need to know about to come to net pay amounts. • Get insight into what is statutory pay, how long does an employee qualify, record keeping and reporting to HMRC. • Learn about the national minimum wage based on age groups. • Get an understanding of the national insurance contribution systems. This module includes why we pay, the different rates, employer contributions and more. • Learn how to manage the online PAYE system. • Identify what the employment allowance is. • Understand retirement schemes. • Learn the different programs available for payroll. • Tips to correct payroll errors. • Understand the importance of annual reporting. Benefits There are so many benefits of completing this payroll course, these include: • Fast track your career. • Gain insight into managing your own payroll within the United Kingdom. • Know what you need to have an effective payroll system in place. • Study online at your own pace and using any device. • Enjoy the convenience of information packed modules. • Industry recognised certification on successful completion, which is also verifiable online. • Comprehensive syllabus complete with online support. • Lifetime access to modules to revisit and refresh whenever you wish. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts Intermediate Diploma Once you have completed the intermediate course, you will be familiar with a comprehensive range of useful accounting functionalities provided by Sage 50 Accounts. What You Will Learn • How to set up a fixed asset record in Sage 50 • Three methods of calculating depreciation • How to use the Asset Disposal Wizard and record sale of an asset • What to do if depreciation has been missed for a month • How to manage cheque and remittance • Setting up purchase order defaults • How to set up and calculate discounts on invoices and purchase orders • How to record the delivery of stock and update cost prices • Creating product defaults and understanding stock transactions • How to correct an incorrectly entered AI, using the exact method and the average cost price method • How to incorporate stock adjustments using the FIFO or First-in-First-out rule • How to use the ‘Check bill of material’ (BOM) feature to track stock availability • How to create price lists • How to apply special prices, print and delete price lists • How to set up manual discounts on sales orders and invoices • How to create service invoices and enter details for item lines Benefits of the Sage 50 Intermediate Diploma • In-depth study and knowledge of different tools and features of the Sage 50 accounting software can help candidates add value to their team. • Similarly, Sage 50 software is also ideal for those who own their own businesses and wish to become self-sufficient in managing their own accounting and invoicing and so on. Expertise in Sage 50 accounting software helps reduce reliance on external accountants. • In addition, Sage 50 accounting software is recommended for those who wish to make a seamless transition from manual payroll processing to a computerised system. By opting to educate and update one’s skills in Sage 50, candidates can prove their ability to potential employers. The Sage 50 online course is suitable for individuals, business entrepreneurs and aspiring students who wish to learn the basics of computerised accounting and invoicing. • A detailed working knowledge of Sage 50 can help aspirants gain confidence and help them provide a high standard of accounting services to companies. • Candidates from all backgrounds and fields are free to learn the Sage 50 accounting course; it does not require any prerequisite academic qualifications. The only prerequisite condition is a basic working knowledge of numeracy, literacy and IT skills. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Point of Sale- Quickbooks-PT,Talley ERP Course details Overview QuickBooks Point of Sale helps retailers go far beyond the cash register with an easy-to use, affordable, scalable, customizable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. The solution can track inventory, sales, and customer information, giving retailers more time to think about what to stock, how to price merchandise, when to reorder, and how to serve their customers better. Course Description QuickBooks Point of Sale helps retailers go far beyond the cash register with an easy-to use, affordable, scalable, customizable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. The solution can track inventory, sales, and customer information, giving retailers more time to think about what to stock, how to price merchandise, when to reorder, and how to serve their customers better. This software allows retailers to easily ring up sales, incorporate bar code scanning, accept credit cards and track inventory. Retailers will be able to view their top-selling products, customer stats and more. This software integrates seamlessly with QuickBooks which will eliminate any need for double entry accounting. Setup of QuickBooks POS is very easy and retailers can be up and running in a day! Inventory is updated automatically as you ring up sales, returns, exchanges, and receive items so you instantly know what's in stock. Even better, built-in reorder points notify you when inventory is low, so you never run out of top sellers and lose a sale. This in-depth training course will teach learners how to use QuickBooks Point of Sale effectively. The course has no formal entry requirements, and is designed to give you real-world knowledge that you can put to use from day one. It's highly flexible, so you can set your own timetable and study at your own pace. You can start learning right away with an initial payment of £65.00. by using our 3 month interest-free payment plan. We train our students to the very best standards, offering expert instructor-led training via our state of the art eLearning platform. Who Is This Course For? Anyone that wants to learn how to use QuickBooks Point of Sale Requirements Anyone that wants to learn how to use QuickBooks Point of Sale Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

2 photos

Pakistan (All cities)

DESCRIPTION Century 21 Texas Edition (Keyboarding b'&' Word Processing, Texas edition.For Typing and computer Learning. Century 21 Keyboarding b'&' Information Processing which reflects the changing keyboarding course. The complete course contains 150 keyboarding and word processing lessons, 54 computer apps lessons, and 15 new key learning lessons (in the Resources section. Century 21 Computer Applications b'&' Keyboarding 7E, a revision of Century 21 Keyboarding b'&' Information processing, reflects the changing keyboarding course. New key learning is still included, its just moved to the Resources section. The book starts with Review lessons that cover the entire keyboard, just more quickly than the new key sections. Computer Apps have been moved into the main part of the text (as opposed to the Appendix) and expanded significantly. Coverage of Computer Apps includes spreadsheet, database, electronic presentations, speech recognition, web search, and web page design. The Cycles continue to be a part of the pedagogy, with complete integration of cross-curricular themes in each cycle: Arts and Literature, Science, Environment and Health, Social Studies, and Technology. The Seventh edition continues with its non-software specific approach to word processing, using Transparency Masters to support commercial software functionality. The complete course contains 150 keyboarding and word processing lessons, 54 computer apps lessons, and 15 new key learning lessons (in the Resources section). Century 21 Computer Keyboarding, available in soft- or hard-cover versions, includes the 75 keyboarding and word processing lessons. All over cargo or delivery service available on demand. Lahore, Lahore, Punjab, Pakistan

See product

Islamabad (Islamabad Capital Territory)

Othm Safety Level 6 Diploma for GradIosh in Islamabad, Othm Safety Level 6 Diploma for GradIosh in Rawalpindi, Othm Safety Level 6 Diploma for GradIosh in Gujranwala, Othm Safety Level 6 Diploma for GradIosh in Sialkot, Othm Safety Level 6 Diploma for GradIosh in Sargodha, Othm Safety Level 6 Diploma for GradIosh in Gujrat, Othm Safety Level 6 Diploma for GradIosh in Lahore, Othm Safety Level 6 Diploma for GradIosh in Faisalabad, Othm Safety Level 6 Diploma for GradIosh in Multan, Othm Safety Level 6 Diploma for GradIosh in Mandi Bahauddin, Othm Safety Level 6 Diploma for GradIosh in Bahawalpur, Othm Safety Level 6 Diploma for GradIosh in Attock, Othm Safety Level 6 Diploma for GradIosh in Chakwal, Othm Safety Level 6 Diploma for GradIosh in Mirpur, Othm Safety Level 6 Diploma for GradIosh in Bagh, Othm Safety Level 6 Diploma for GradIosh in Rawala kot, Othm Safety Level 6 Diploma for GradIosh in Kotli, Othm Safety Level 6 Diploma for GradIosh in Karachi, Othm Safety Level 6 Diploma for GradIosh in Hyderabad, Othm Safety Level 6 Diploma for GradIosh in Mardan, Othm Safety Level 6 Diploma for GradIosh in Peshawar, Othm Safety Level 6 Diploma for GradIosh in Swat, Othm Safety Level 6 Diploma for GradIosh in Rawat, Othm Safety Level 6 Diploma for GradIosh in Sawabi, Othm Safety Level 6 Diploma for GradIosh in Sahiwal, Othm Safety Level 6 Diploma for GradIosh in Sakkar, Othm Safety Level 6 Diploma for GradIosh in Haripur, Othm Safety Level 6 Diploma for GradIosh in Pakistan O3165643400, O3119903317,Othm Safety Level 6 Diploma for GradIosh in Islamabad, Pakistan O3165643400, O3119903317 The IEHSAS OTHM Level 6 Diploma Qualification in Occupational Health and Safety is designed to give Learners who have or are hoping to form into, a senior Position in an organization for overseeing health and safety policy and practice. Through this qualification, Learners will pick up the Core abilities and information to comprehend the Legal and administrative foundation to occupational health and safety policy, to have the option to assess policies, just as to suggest and execute strategy changes. Learners will create information and aptitudes and standards pertinent to the putting policy into practice, utilizing management systems, resources, occupational risk, and incident management. OTHM Level 6 Diploma in Occupational Health and Safety Qualification Structure: The IEHSAS OTHM Level 6 Diploma Qualification in Occupational Health and Safety consists of 6 mandatory units for combined total credits 48 hours, 480 hours Total Qualification Time and 180 Guided Learning Hours. All the units of this qualification also have a unique reference number of each unit. The qualification title and the reference numbers of each unit will appear on learners’ final certification documentation. There is no written exam at OTHM level 6 diploma in Occupational Health and Safety. Though there are 7 unit assignments. The learner must pass all unit assignments by demonstrating their professional portfolio and by research work with particular ranges of the word at paperwork. To ‘pass’ a unit, the learner must give evidence to show that they have satisfied all the learning outcomes and satisfy the guidelines indicated by all assessment criteria. Eligibility Criteria Unlike other Level 6 Diploma in Occupational Health and Safety, IDSE requires candidate to meet any of the following criteria for registration. The criteria have been established so that only competent professional may apply for IDSE to increase the success rate of the qualification. -Level 3 certification in OH&S (IOSH Accredited only) + 3 years OH&S experience, Or -A graduate degree in Science subjects from reputable university (60% score) + 1 years OH&S experience, Or -Four years engineering degree (B.E or BS Engg Min 60% aggregate) from a reputable university Exam Pattern IDSE is assessed via 2 closed book written exams ( Each units) comprising total 150 Marks in each exam. Time allowed for each examination is 5 hours. Note: There will be two sections in each exam i.e. Section A and Section B. Both section need to be completed the same day without any break in between. 10 Reasons your should prefer IDSE -It has 2 units assessed through 2 subjective type written exams (No reports/ Projects). -The contents of IDSE are more professional and skill oriented. -Assessments are more relevant and believe us, it will not be an English language test like other HSE Diploma do -Result within 15 working days after the exam and certificates within 15 working days after the result (in case you qualify) -You can sit both exam separately i.e. with a gap of 2 months to 12 months between both unit exams -You can opt to have exam date of your choice (You will need to confirm exam date by payment and 4 weeks prior to your date of choice) -IDSE fee package is much competitive than other HSE level 6 diploma -It is being offered in Distance Learning so you can study at your own pace. Our online trainer support will guide you whenever you will find any difficulty -It has eligibility criteria for registration. So all registered professional will meet the minimum eligibility criteria to ensure maximum pass rate for IDSE. -Diploma awarding body is NCFE UK which is an Ofqual regulated largest Certification Body with a history of more than 150 years IDSE Syllabus and Scheme of Assessment Unit 01 Achieving Continual Improvement in OH&S Management System 1.Assess the planning of an OH&S Management System from continual improvement perspective 1.1 Assess and evaluate the context of organization based on complexity of the processes and nature & scale of the organizations i.e. from small simple organizations to very large organizations with complex operations 1.2 Assess and review the OH&S policy for its effectiveness, continual improvement of OH&S MS and the alignment with strategic direction of the organization 1.3 Design an OH&S Management system with clear inputs and outputs using process approach to management system 1.4 Outline the key processes in the OH&S Management system 1.5 Assess the risks and opportunities inherent with the planning of an OH&S Management System from the organization’s context 1.6 Report on the effectiveness of planning an OH&S Management system 1.7 Investigate loopholes in the planning phase for the OH&S Management system 1.8 Justify the competence of personnel involved in the planning of an OH&S management system commensurate with nature and scale of the organization 1.9 Present a case for cost benefit analysis of an effective OH&S Management system to the top management 2 Assess the established & Implemented OH&S Management System from the continual improvement perspective 2.1 Identify and manage the resources for the implementation of an OH&S Management system 2.2 Review and evaluate the sufficiency and adequacy of documented procedures as per nature and scale of the organization 2.3 Outline the competencies requirements for the implementation of key processes of OH&S Management system 2.4 Present a case for the requirement of operational controls as required 2.5 Review and assess the requirement for maintaining & retaining documented information 2.6 Justify the implementation of an OH&S Management system in the organization from the health and safety culture perspective 2.7 Review the internal and external communications necessary for effective implementation of an OH&S Management system 2.8 Justify the arrangements necessary for complying with applicable legal and other requirements 2.9 Identify and report on risks and opportunities pertaining to implementation of an OH&S Management system 2.10 Evaluate the arrangements for control on subcontractors regarding OH&S Matters 2.11 Review and evaluate the established performance indicators for measuring the effectiveness of implementation 2.12 Justify the OH&S Objectives and goals commensurate with OH&S Policy 2.13 Compile a report on the utilization of resources for OH&S to be efficient and effective in view of continual improvement for an OH&S Management system 2.14 Evaluate and report the relevance of the implemented OH&S Management system with planned one 2.15 Report on the effectiveness of the implemented OH&S Management system 2.16 Review and evaluate the sufficiency and adequacy of the arrangements against potential emergency situations 3 Review and assess the efficiency and effectiveness of the inspection and audit process for OH&S Management System 3.1 Justify the frequency and type of inspections and audits (Internal & External) for the OH&S Management system in the context of organization 3.2 Review and assess the necessary competencies requirement for the personnel involved in inspections and audits 3.3 Manage the provisioning of effective training as per the complexity of processes and evaluate the effectiveness of imparted training 3.4 Evaluate the quality of inspections and audits 3.5 Present a case for the requirement of resources for inspections and audits 3.6 Review and assess the effectiveness of inspection/ audit criteria 3.7 Identify the requirements for any measuring and monitoring equipments including any calibration arrangements for OH&S Management system processes 3.8 Review and assess the risks pertaining to inspections and audits 3.9 Evaluate the arrangements to measure the degree of conformance of the OH&S Management system against the established criteria 3.10 Review and interpret the legal requirements and incorporate them into the organization’s inspection and audit process 3.11 Investigate the root causes for the non conformances/ incidents and suggest corrective actions 3.12 Review and assess the inspection and audit objectives and deliverables 3.13 Evaluate the arrangements for preventive actions in context of the organization 4 Review and assess the efficiency and effectiveness of Management Review process for the OH&S Management System 4.1 Review and evaluate the arrangements for analysis of the OH&S Management system performance 4.2 Review and evaluate the arrangements for evaluation of the OH&S Management system performance 4.3 Review and evaluate the quality and number of inputs for management review 4.4 Report on performance of the OH&S Management system to the top management 4.5 Present a case for the resource requirements to implement the decisions made by top management 4.6 Review and evaluate the requirements to change the OH&S management system and its possible implications 4.7 Manage the change in the OH&S Management system subsequent to Management review decisions 4.8 Report on progress of action plans for implementation of decisions subsequent to Management Review 4.9 Explain the OH&S Management system deliverables in context of continual improvement in quantified manner subsequent to decisions made in Management Review Unit 02 Principles and Application of Science and Technology in Safety 1 Assess and apply basic principles of Chemistry at the workplace for occupational health and safety 1.1 Evaluate the hazards due to the nature and form of chemical agents and suggest control measures from hierarchy of control perspective. This should include the transportation hazards associated with the chemical agents. 1.2 Explain the current developments in identification, measuring and monitoring and control of chemical agents at the workplace 1.3 Identify and interpret the legal requirements for use, storage and transportation of chemical agents 1.4 Explain the human physiology with natural immunity and defence mechanism against chemical agents 1.5 Identify the requirements and application of personal protective equipments in a chemical environment for sufficiency and adequacy including future design requirements of PPEs 1.6 Explain the features of an emergency preparedness and response procedure for accidents related to chemical agents 1.7 Identify the requirement of operational controls with clear direction to what and how should the human involvement be eliminated/ reduced 1.8 Outline the physio chemical hazards of inflammables at the workplaces 1.9 Present a case for the possibility for use of clean energy with cost benefit analysis and implications on occupational health and safety 2 Assess and apply basic principles of Physics at the workplace for occupational health and safety 2.1 Evaluate the hazards due to the physical properties of materials and suggest control measures from hierarchy of control perspective 2.2 Explain various forms of energy including the law of conservation of energy and their potential implications on health and safety at workplace 2.3 Explain Momentum, Inertia, Moment, Acceleration, Impulse, force, load, power, work, pressure, material stress, strain, heat, friction, Flow, Light, Noise, Vibration, and their significance from occupational health and safety perspective 2.4 Explain lever, pulley, screws, slope, wheels, pendulum and their significance from occupational health and safety perspective 2.5 Inspect & Evaluate a mechanical structure for its strength and durability in a given condition 2.6 Explain the human physiology with capabilities and capacities from an ergonomics perspective 3 Assess various inspection techniques and their applications for mechanical equipments 3.1 Explain current/ prevailing non destructive testing methods and their utility for ensuring safety of tools and equipments 3.2 Explain current/ prevailing destructive testing methods and their utility for ensuring the safety of tools and equipment 3.3 Identify and evaluate the cost benefit analysis and the frequency of inspections and testing of tools and equipments 3.4 Identify and justify the testing requirements for a bespoke designed product (Tools/ Equipments) 3.5 Review and identify the testing requirements for a refurbished/ modified product for occupational safety and health provisions 3.6 Justify the preference of an inspection method (From choice of prevailing NDT methods or any other prevailing destructive testing methods) over the others in a given environment for a specific work equipment etc. 3.7 Explain the reasons and contributory factors for material failures of tools, equipments or structures leading to unsafe conditions at the workplaces 3.8 Assess the risks of measurement uncertainty including the calibration frequency and its provisions 4 Assess the designs of tools, equipments or structures for their reliability for use in a given environment from an occupational health and safety perspective 4.1 Explain the common end user requirements for tools and equipments to be incorporated in design 4.2 Explain the role of a well designed tool, equipment or structure in occupational safety and health 4.3 Evaluate the design with respect to stated and implied use of tools, equipments and structures 4.4 Explain the design flaws which may compromise occupational safety and health at the workplaces 4.5 Explain the requirement of international standards of ASME (American Society of Mechanical engineers) in occupational safety and health from product design perspective 4.6 Explain the requirements of current/ prevailing design testing software and their implications on occupational health and safety provisions 4.7 Review a material failure investigation and suggest the design or any other changes 5 Assess the occupational health and safety risks from electricity at the workplaces 5.1 Explain the principle of electricity 5.2 Explain common terminology related to electricity including current (Alternating and Direct), resistance, voltage, single phase, 3 phase, circuits (Series and parallel), arcing, short circuiting. 5.3 Assess various electrical protection devices for their suitability of use in a specific work environment 5.4 Assess various electrical appliances for the risks to their users and other persons in varying work environments 5.5 Review and evaluate the sufficiency and adequacy of engineering controls against electricity hazards at the workplaces to ensure health and safety provisions 5.6 Analyze and evaluate the emergency preparedness and response procedure for its relevancy and completeness from electricity risks perspective 5.7 Evaluate the training and skill requirement by the workforce for safe use and maintenance of electrical appliances 5.8 Identify and assess prevailing electrical appliances and machinery being used in various industries with detailed hazards and risks in familiar and unfamiliar situations and environments. 5.9 Identify the potential risks of explosions from electrical appliances including any contributory factors which may give rise to the likelihood or severity 6 Assess the occupational health and safety risks from fire at the workplaces 6.1 Explain the principle of fire in context of fire initiation and propagation control 6.2 Identify type of raw materials being used at workplaces from fire propagation perspective 6.3 Justify the fire plan of the organization for its effectiveness with respect to its nature of work, size and context 6.4 Evaluate the emergency preparedness and response for potential fire occurrences within the workplaces due to the nature of work they carry out. 6.5 Review the organizational arrangements for controlling the fire spread and suggest the corrective actions 6.6 Explain common fire initiation causes in the organizations including the suitable control measures commensurate with nature, size and their context 6.7 Identify the current technologies being used across the globe for escape and rescue during fire and/ or other emergency situations and their use in specific workplaces 6.8 Outline the latest developments for fire extinguishing and their possible use in specific workplaces 6.9 Describe the training and skill requirements for emergency escape, fire control in specific organizations with varying nature and scope of work 6.10 Identify and interpret the legal requirements for safety arrangements against fire occurrences and how to incorporate them into organizational arrangements for compliance. 7 Assess the occupational health and safety risks from nuclear and other radiations hazards 7.1 Explain the principle of fission and fusion reactions in atomic power plants with emphasis on the requirements of occupational safety and health 7.2 Evaluate known type of radiations for their potential effects on OH&S 7.3 Explain the available engineering controls for containment of radiations and the limitation of their uses 7.4 Identify and interpret the applicable legal requirements for the exposure limits of various radiations 7.5 Explain the role of International Atomic Energy Agency (IAEA) regarding occupational safety and health against nuclear radiations 8 Assess the Biological health hazards at the workplace and the application of suitable controls 8.1 Explain common biological agents at the workplaces and the occupations which pose most risks 8.2 Assess the significance of health hazards due to presence of biological agents within the workplace 8.3 Justify the control measures commen.

See product

4 photos

Rawalpindi (Punjab)

Quickbooks-PT,Talley ERP Book-Keeping Bundle Course details Overview In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Course Description Accounting and book-keeping skills are always in demand in any organisation. As well as finding employment, many learners go on to set up their own book-keeping business by offering their services to local companies. In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Sage Line 50 is essential if you want to work in an accounts office, finance department or as a book-keeper. This is because Sage Accounts is one of the most popular accounting package in the UK, particularly in Small and Medium Enterprises (SMEs) QuickBooks is the and book-keeping software for small and medium sized businesses. It is easy to use and gives you much-needed control over your business finances. QuickBooks Point of Sale provides retailers with an easy-to-use, affordable, scalable, customisable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. Each course teaches you everything you need to know so you can run an entire business within either program. It's the easiest and most affordable way to dive into each program in order to decide which one is right for you! Who Is This Course For? Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Requirements Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Trainings In this course, you will learn HOW TO USE AND INVEST IN CRYPTOCURRENCIES WITHOUT LOSING MONEY. You will also learn: 1. How to analyze investments of all asset classes to identify intrinsic value 2. How to compare the different cryptocurrencies and analyze them as investments 3. How to build wealth over time in the safest and fastest way possible 4. How the psychology of investing can make you rich or poor and how to use it to your advantage 5. The dangers of FOMO in investing 6. How to save money on taxes when making investing decisions 7. How to avoid getting in trouble with the law when investing in Cryptocurrencies 8. How to think clearly about investing and building wealth 9. How to use human emotion to your advantage when it comes to investing 10. Much more Do yourself a favor and educate yourself about how cryptocurrencies work so that you don't make the same mistake as countless others, and lose your money! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2013 Training - Bookkeeping Made Easy This QuickBooks 2013 Training for Beginners will show you how to unlock the power of Quickbooks 2013 and take direct control of your business finances. Expert author Barbara Harvie teaches you how to setup and manage the accounting for your business using QuickBooks 2013. This video based Quickbooks tutorial removes the barriers to learning by breaking down even the most complex of operations into easy to understand, bite-sized pieces, making it fast and fun for you to learn. This Quickbooks training course is designed for the absolute beginner, and no previous accounting software experience is required. You will start with the basics of using an accounting package - setting up your company file. You will quickly learn how to manage day to day operations by setting up items, services, customers and jobs right in the QuickBooks 2013 interface. You will learn how to create invoices and manage them once the customer has paid. Barbara shows you how to enter and pay bills, track your inventory, and manage all your banking tasks. In this video based tutorial, you will also learn how to create reports, customize reports, and maybe most importantly, how to back up your company file. By the time you have completed the computer based training QuickBooks tutorial course for Beginners course for Intuit QuickBooks 2013, you will have a clear understanding of how to setup and manage your company finances on a day to day basis, as well as access the financial information you need to help you be successful in your endeavour. Working files are included, allowing you to follow along with the author throughout the lessons. Take this ultimate QuickBooks tutorial right now and learn QuickBooks 2013. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sales Tax with QuickBooks Course details This, step by step course shows you exactly how to record and manage ANY sales tax related situation for people using QuickBooks for their business. You will learn how to record, collect and pay sales tax. You will learn how to find and interpret the results of sales tax reports. You will learn how to adjust sales tax and fix sales tax mistakes. You will learn both the cash and accrual method of paying sales tax. You will lean how to manage maximum sales tax situations and situations where there are multiple sales tax in 1 transactions. Sales tax is something that effects most business. If you are working with more than one company, then you need to be able to create new sales tax items and manage these special situations. Accountants will sometimes adjust only the general ledger account called "sales tax payable" and they will forget to adjust the balance owed to the specific tax agency. This course will give you the ability to do that. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Quickbooks-PT,Talley ERP Course details This course has been specifically designed for beginners / investors new to the stock market. It is one of the most comprehensive toolkit for stock market trading/ investing. How is the course structured? 1. The first three sections in the course deal with the common queries most beginners have with respect to the stock market. 2. The next three sections deal with understanding & analyzing Financial Statement of companies. 3. The rest of the sections deal with Technical Analysis. These techniques are not just applicable to stocks but also other asset classes. Why should I take this course? Do you have questions like: 1. How do I start trading in the stock market? 2. What is share or stock? 3. What is a stock exchange? 4. I have less money, Should I trade in Futures & Options? 5. How do I select a stock broker? 6. How much money should I invest in the stock market? 7. What is algorithmic trading & Should I be doing it? Great! The first 3 sections in this course answers many such questions for beginners. The next 3 sections deal with understanding & the financial statements of any company. Now you need not be intimidated with terms like Balance Sheet, Cash Flow Statement, Statement of Income. Everything is explained using a real financial statement so that you can start reading financial statements just like you read any other book! To add to it you learn how to perform Financial Ratio Analysis & Common Size Analysis of companies which would help you better understand the underlying business of a stock & its performance. This is a must have input before you invest in a stock! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bank Reconciliation Statement (College Level) Course details Welcome to Accounting Bank Reconciliation Statement Course. Business entities will be having large number of Bank transactions and these transactions will be recorded by them in their Cash Book (Bank Column). The bank balance as per Cash Book should be balanced with Bank Balance as per pass book. However, there will be certain differences due to timing difference between recording the transactions by the parties, namely the business entity and the Banker. This difference have to be identified and sorted at the earliest to avoid fraud and error. This difference can be identified by preparing a Statement known as Bank Reconciliation Statement and this course will teach you a) What is Bank Reconciliation Statement. b) What is Cash Book and Pass Book. c) Difference between Cash Book and Pass Book d) Causes for disagreement between the balance shown by Cash Book and Pass Book e) Procedure for preparing BRS f) Preparing BRS when bank balance is favourable / unfavourable. This course is structured in self paced learning style. Video lectures / screen cast are used for presenting the course content. Take this course to understand practical aspects of BRS. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Investment: Quickbooks-PT,Talley ERP Analyzing Software Companies Course details Are you looking to invest into software companies? What are the important characteristics andtrends of this industry? Dothese companies have any moat? How do they spend their cash? What are therisks? In this course, I will teach how to analyse and invest into software companies. We start off by learning about the different sub segments of the software industry. Then wemove onto quantitative financial analysis. After which, we will continue intoqualitative non financial discussion. All this will give us a holistic view of software companies before we commit investments into them. Unlike some other courses out there where you just hear instructors talking endlessly, and you only see boring text intheir presentation, this course will include animations, images, charts anddiagrams help you understand the various concepts. This is also not a motivation class whereI preach to you that you must work hard to succeed, or you must have disciplineto profit from the market. In this course, you will learn actionablemethods and frame work. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Financial Model Builder Course We go through 7 financial models: 1. Financial Model Basics - you learn the basics of financial models 2. Beyond The Basics - best practice, working capital, balance sheets and cash flows 3. Debt Equity Model - equity calculations and debt calculations incorporated into a model 4. Investment Scenario Model - a model for investments that includes multiple scenarios 5. Corporate Scenario Model - a full corporate model that incorporates multiple scenarios 6. Capital Investment Appraisal Model - a model for evaluating a capital investment 7. Pricing Model - a model for determining optimum pricing to customers. We go through many different company types: Pet Food Wholesaler, Clothing Wholesaler, Chemical Manufacturer, Investment Fund, Platinum Mine,Electricity Provider and an Office Equipment Company. If you are a • business owner • manager • finance professional or • business student and want to learn all-round financial model building skills, then this course is for you. By the end of the course, you will be able to • build accurate models • understand all essential Excel formulas and functions for financial models • create flexible models for multiple scenarios • adapt your skills to a variety of industries and requirements. In summary, this is one of the best value-for-money courses on financial models. Hope to have you as a student soon. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Computer Essentials-DIT CIT Web Development Presented with high-quality video lectures, this course will visually show you how to easily do everything with computers. This is just some of what you will learn in this course: • Learn the basic principles of hardware including circuits, coding schemes, binary, the five generations of computers, Moore's Law, IPOS, registers, cache, RAM, magnetic storage, optical storage, solid-state storage, ROM, BIOS, the motherboard, buses, and the CPU. • Learn how to operate a computer including a vast array of hands-on skills just to mention a few for example: managing files, backing up files, right clicking, taking screenshots, determining your computer's properties, upgrading your computer, changing settings on your computer. • Learn how to use word processing software including the creation of a title page, document sections, headers and footers, styles, an automatically generated table of contents, the insertion of images, references, and the insertion of an automatically generated citation of works referenced. • Learn how to use spreadsheet software including formulas, functions, relative references, absolute references, mixed references, and the creation of a graph or chart. • Learn how to use video editing software including adding credits and transitions then publishing that video to a video hosting website such as YouTube. • Learn how to use databases including table creation, the setting of a primary key, the establishment of table relationships, the setting of referential integrity, and the creation and execution of a query. • Learn how to use presentation software to more effectively give presentations. • Learn to do some simple programing including designing, coding, testing, debugging, and running a program. • Learn about the world wide web including sending email, conducting searches , having familiarity with online educational resources such as Khan Academy, and having an awareness of online "cloud computing" tools such as Google Word Processing, Google Spreadsheets, and the many other online tools offered by Google. • Learn about application software and system software including operating systems, utilities, and drivers. • Learn about networks including architecture, topology, firewalls, security, wireless networks, and securing wireless networks. • Learn about the Internet, the World Wide Web, censorship, the digital divide, net neutrality, differing legal jurisdictions, website creation, multimedia, social media, and eCommerce. • Learn about information systems, systems development, and the systems development life cycle. • Learn about program development, programming languages, and the program development life cycle. • Learn about databases including table creation, primary keys, relationships, referential integrity, queries, and structured query language. • Learn about privacy and security issues related to computers. • Learn about robots and artificial intelligence including the Turing test. • Learn about intellectual property including patents, trademarks, copyrights, and the creative commons. • Learn about ethics and ethical issues relating to the use of technology. • Learn about health ramifications of using computers including repetitive stress injury, carpal tunnel syndrome, and ergonomics. • Learn about e-Waste and other environmental concerns related to technology. Lifetime access to this course allows you to easily review material and continue learning new material. After taking this course, you will have a thorough understanding of how to use computers well. From beginners, to advanced users, this course is perfect for all ability levels. This course will add value to everyone's skillset. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Professional Bookkeeping & Accounting 2 - Bank Daybook Do you need to understand and record petty cash or banking transactions for your business? Are you considering a career in Bookkeeping or Accounting? Are you studying for Professional Accounting or Bookkeeping exams? THEN REGISTER NOW Course Overview Section 1 of this course is an introduction section. After the course introduction we will begin this course by introducing you to both the prime books of entry and cross totting as you will need a working understanding of these through out this course. You will also be presented with the case study that we will use in the activities in section 2 and 3 of this course. In section 2 we will move into Petty Cash. We will walk through each step of the petty cash process from raising petty cash vouchers, entering data to the daybook and reconciling and replenishing the petty cash. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Raise petty cash vouchers • Enter petty cash transactions to the petty cash daybook • Close the daybook and calculate the balance carried down • Reconcile the petty cash • Replenish the petty cash Section 3 of this course is about Banking Transactions. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Check remittance advice • Enter payments and receipts to the 3 column and analysis cash book • Close the cash book and calculate the balance carried down • Reconcile the bank This course contains: A case study that we will use through out this course Workbooks to download Activities to complete Quiz Certificate of Completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Islamabad (Islamabad Capital Territory)

Learn quicksBooks Peach tree Tally erp 09 sage line 50 UK & Myob Australia Software in one roof Expert in accounting concept and accounting software such as bookkeeping Ledger maintaining and financial Reporting Get job after successful completion of this software in Pakistan as well as gulf sector Dubai Oman & UAE COURSE OUTLINE Introduction Details of Debit & Credit Accounting Concept Basic & Advance Need of Accounting Software Details of Opening Balance Company Create Voucher Details Group Create Inventory Detail Sub-Group Create Inventory Entry Ledger Create Ledger Posting Entries Suppler Customer Ledger Charts of Accounts Detail review of Class to Inventory Details Reports Final Accounts Review All & Revised All Topics Project We also give home Tuition and also online training on Skype all over Pakistan& WE GIVE TRAINING ON ALL INDUSTRY RETAIL SERVICE AND MANUFACTURING WITH LIVE COMPANIES DATA Deal NO 1 Quicks Book & Peachtree Course Fees =5000 Per Course Only Deal NO 2 Tally & Quicks Books Course Fees = 6000 Per Course Only Deal NO 3 Tally & Quicks Books & Advance Excel Course Fees = 4000 Per Course Only Feel Free to contacts NEW ERRA INSTITUTE OF IT SkypeId:targetsys_nw WhatsApp:+923238549230 FaceBook Page:New Erra Instiute Of It Sir Nouman wasi MS & CIMA(Accounting & Finance)

Rs 15

See product

Lahore (Punjab)

Web Designing Course duration (3 months) AWARENESS & FUTURE TRENDS HTML CSS PHOTOSHOP COREL DRAW DREAMWEAVER JavaScript JQUERY XML MAKING DYNAMIC LAYOUTS PSD TO HTML CSS CONVERSION GRAPHICS DESIGN LOGICS PRINT MEDIA & ADVERTISEMENTS MAKING ALMOST ALL DIFFERENT TYPES OF WEBSITES DESIGNS & LAYOUTS BANNERS & LOGOS Web Development Course duration (3 months) Logics In Designs Xhtml And Css Review Jquery XML Ajax Php Mysql Word Press Joomla Drupal Open Cart Complete Custom Web Application Development Project Make Possible How You Can Make Any Type Of Web Based Application SEO Course duration (2 months) Introduction and future trends Keyword Research & Analysis Target Market Analysis Competitor Analysis Google Updates Search Engines Key Rules Basic Html Word Press Keyword Analysis Competition Analysis Initial Reporting Testing Website And Full Analysis Meta Tags Optimizing Images Links And Meta Elements Headings And Contents Optimization Campaigns Articles Press Release Blog Contents Writing Social Media Face Book Twitter Google Plus Directories And Social Bookmarking Classified Adds Back Links Article Submission And Analysis Report Final Report Url Redirection W3c Validation Canonical Name Resolution Links Structure Optimization Graphics Designing Course duration (4 months) With Hands On Practice On Latest Softwares Used In The Market Become Professional Adobe Photoshop Corel Draw Adobe Flash Swish Max Adobe Fireworks Adobe After Effects In Page Professional Java Course duration (3 months) Oject Oriented Concepts Java Introduction Java Environment Setting And Programming Java Database Connectivity Java In Web Programming Jsp & Servlet Java Network Programming Java Applet Java Libraries IT BASIC Course Duration (3 months) The Basics Of Computer To Join This Field Necessary Every Where Windows Introduction Typing Microsoft Word Microsoft Excel Microsoft Power point Outlook Internet In Page Photoshop Flash Swish Max HTML& CSS Hardware And Local Area Networking Guidelines And Directions For Your Future Planning (MCITP) Course Duration(4 months) Essential of Networks Computer network structure in any organization Window 7 window 8 Active directory Configuration and management Windows Server 2008 designing configuration and management

See product

Pakistan

Academic Galaxy Dissertation and Thesis Writing Services is providing following services to clients. Our services: Essay Recommendation Letters Book Report Movie Review Term Paper Research Paper Summary Dissertation Case Study SWOT Analysis Reflection Paper Report Proposal Outline Argumentative Essay Lab Report Business Plan Formal Letter Informal Letter Speech/Presentation Annotated Bibliography Dissertation Thesis PowerPoint Presentation ( Academic Galaxy Thesis and Dissertation Writing Service Providers) Contact : +923315675039 (Available on whats app) E-mail: academicgalaxy@gmail.com

See product

Gujranwala (Punjab)

Revit 3D Interior Exterior Advance Best Training Course in Chakwal , Revit 3D Interior Exterior Advance Best Training Course in Chakwal , 3115193625 , Revit 3D Interior Exterior Advance Best Training Course in Chakwal , Revit 3D Interior Exterior Advance Best Training Course in Chakwal , 3115193625 Revit 3D Interior Exterior Advance Best Training Course in Rawalpindi 3115193625 , International College Of Technical Education is Best Training Institute in Rawalpindi pakistan , While design, construction and maintenance firms around the world are realizing the business benefits of BIM integration, many are also coming to terms with the challenges associated with implementing and maintaining BIM skills on their teams. Further, the technology landscape is constantly evolving and many firms do not have the necessary resources, expertise or internal staff to keep pace. This is where Microdesk’s training and mentoring program comes in.By putting our years of experience working with hundreds of firms worldwide to put a BIM implementation strategy in place, our team of certified professionals can provide the expertise, support and training needed to help take that plan from concept to reality.Instructor-led training can be taken from a virtual classroom setting, or one of our training labs. Review the course catalog selection below and contact us to book your training session,Customized training is developed based on your specific needs. We work closely with clients to design solutions based on your process and workflows.Onsite training is offered where it’s most convenient to you and your team, whether it be your office space or one our high-tech training labs,Rawalpindi, Islamabad, Lahore, Karachi, Gilgit, Skardu, Ghangche, taxila, Shigar, Astore, Diamer, Ghizer, Kharmang, Gultari, Rondo, Hunza Nagar, Gupi, Azad Jammu and Kashmir, Muzaffarabad, Mirpur, Bhimber, Kotli, Rawlakot, Bagh, Bahawalpur, Bhakkar, Chakwal, Chiniot, Dera Ghazi Khan, Faisalabad, Gujranwala, Gujrat, Hafizabad, Jhang, Jhelum, Kasur, Khanewal, Khushab, Layyah, Lodharan, Mandi-Bahuddin, Mianwali, Multan, Muzaffargarh, Nankana Sahib, Narowal, Okara, Pakpattan, Rahim Yar Khan, Rajanpur, Sahiwal, Sargodha, Sheikhupura, Sialkot, Toba tek Singh, Vehari, Attock, Taxila, Wah Cantt, Rawalpindi, Balochistan, Khyber-Pakhtunkhwa, Punjab, Sindh, Gilgit Baltistan, Turbat, Sibi, Chaman, Lasbela, Zhob, Gwadar, Nasiraba, Jaffarabad, Hub, Dera Murad Jamali, Dera Allah Yar, Khyber-Pakhtunkhwa, Peshawar, Mardan, Abbottabad, Mingor, Kohat, Bannu, Swabi, Dera Ismail Khan, Charsadda, Nowshera, Mansehra, Hyderabad, Sukkur, Larkana, Nawabshah, Nanak wara, Mirpur Khas, Jacobabad, Shikarpur, Khairpur, Pakistan.Experienced Based Diploma in Ac Technician ,Electronic , Mechanical , Plumbing , Auto Electrician , Efi Auto Electrician , Civil Surveyor , Quantity surveyor civil lab material testing , Best Institute in Rawalpindi islamabad Pakistan Lahore , Lowest fee course in pakistan , lowest fee professional practical training course in pakistan rawalpindi peshawar kashmir bagh lahore islamabad kahuta chakwal rahimyar khan gujarat gujarawala multan , attock Best institute in rawalpindi professional teacher and qualified staff.Dubai , Abu Dabi , Muscat , Oman , Doha , Qatar ,South Africa , Saudia Arabia , kawat , Behrain , Kotli Sattian , Murree , UK , UAE , Sharja,Civil Technology Courses Diploma in Civil Surveyor Diploma in Quantity Surveyor Diploma in Civil Draftman Diploma in Civil Lab Technician Diploma in Civil Architecture Diploma in Civil Engineering One Year Diploma in Civil Engineering Two Years OSHA Construction Civil Safety Electrical Technology Courses Diploma in Electrical Engineering one year Diploma in Electrical Engineering Two years Electrician Course in Rawalpindi Electrician Course in Lahore Electrician Course in Peshawar Telecommunication Technology Courses

Rs 15.000

See product

Pakistan (All cities)

Bookkeeping and Payroll Diploma *New Year Offers* Quickbooks-PT,Talley ERP Description Course Curriculum 1. MODULE 01 • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts 2. MODULE 02 • Working with Ledgers • Reconciliation • Correcting Entries 3. MODULE 03 • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets 4. MODULE 04 • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash 5. MODULE 05 • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record 6. MODULE 06 • The Partnership & Corporations • Accounts Receivable and Bad Debts 7. MODULE 07 • Preparing Interim Statements • Year End – Inventory 8. MODULE HANDOUTS • Module Handouts- Bookkeeping and Payroll Management 9. ADDITIONAL STUDY MATERIALS • Additional Study Materials- Business Accounting 10. REFERENCE BOOKS • Reference Books- Business Accounting Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Administration Skills and Payroll- Quickbooks-PT,Talley ERP Course Description Course Syllabus As part of the Administration & Payroll course students will learn a range of topics including the following: • Working as an Administrative Assistant • The role of the administrator • Working practices • Meetings • Business departments • Business travel • Effective customer service • Telecommunications • Internet and office technologies • Payroll: Understanding the Basics • Payroll in the United Kingdom • Introduction to Payroll Systems • Running payroll • Starters and Leavers • Tell HMRC about a new employee • Gross Pay • Minimum wage for different types of work • Statutory Pay • Employment Allowance • The PAYE regime • PAYE Online for employers • The NIC Regime • Employees who pay less National Insurance • Statutory and Voluntary Deductions and Net Pay • Correcting payroll errors • RTI and working the Computerised Payroll System • Payroll: annual reporting and tasks • Final Assessment Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBook 2017 - Accounting, Payroll and Book Keeping Description Session 1 Section A: Course Opening • Introduction • How to Study for This Exam Section B: QuickBooks Setup • Before Setting Up a Company • Create a Company and EasyStep Interview • Remove Old Transactions • Customize the Home Page • Set Up Customer and Vendor Lists • Set Up Item Lists Section C: Navigation and Data Files • Navigate the Home Page • Navigate Menus and the Icon Bar • Navigate the Icon Bar • Back Up a Data File • Restore a Data File Section D: Program Information and Preferences • Determine the Release Number • Update QuickBooks • QuickBooks Modes • QuickBooks Versions • Password Protection • Preferences • Domain 1 and 2 Test Tips Session 2 Section A: List Management • Add Customers • Add Vendors • Add Items • General List Management • Edit List Entries • Merge List Entries Section B: Items • Items for Accounting Entries • Item Types • Products for a Specific Price • Services for a Specific Price • Unique Pricing Entries • Single Service or Product Section C: Session 2 Recap • Domain 3 and 4 Test Tips Session 3 Section A: Sales • Customer Center Lists • Navigate the Customer Center • Sales Workflow • Invoicing • Sales Receipts • Undeposited Funds • View Accounts Receivable and Checking • Customer Credits • Sales Statements • Handle Bounced Checks Section B: Purchases • Vendor Center Lists • Navigate the Vendor Center • Enter and Pay Bills • Write Checks • Use Credit Cards • Use Debit Cards • Purchase Workflow Transactions • Vendor Credits Section C: Inventory, Taxes, and Reconciliation • Inventory Workflows • Set Up and Collect Sales Taxes • Pay Sales Taxes • Bank Reconciliation Session 4 Section A: Payroll • Available Payroll Services • Starting the Payroll Setup Wizard • Employee Earnings • Employee Sick and Vacation Time • Finish the Payroll Setup Wizard • Set Up Payroll Schedules • Run Payroll • Pay Payroll Liabilities • Prepare Payroll Forms • Track Time and Invoice Customers Section B: Reports • Report Center • Customize Reports • Expand and Collapse Report Data • Report Descriptions • Process Multiple Reports • Send Reports to Excel • Memorize Reports Session 5 Section A: Basic Accounting • Financial Statements • Cash vs. Accrual Reports • Set a Closing Date • Enter a Journal Entry Section B: Customization and Shortcuts • Memorize Transactions • Set Up Multiple Users and Access • Create Custom Fields • Apply Custom Fields • Customize an Invoice Section C: Session 5 and Course Recap • Domain 9 and 10 Test Tips • Final Test Tips • Conclusion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Diploma in Bookkeeping & Payroll Management - Quickbooks-PT,Talley ERP Module 1 This module will teach you about Basic Terminology. So, the good thing about accounting is that you can start out wherever you want, at the beginning, the middle, or the end and you will still wind up at the same place, nowhere (Just kidding). You really have to start at the beginning, or you will get lost. So, let’s start there, with some basic terminology. Some of this stuff may ring a bell for those of you who took accounting previously, were hired to keep the books at the corner Mom & Pop’s shop, or, were too cheap to hire a “real Accountant” and tried to do your own books. (How did that work out for you?). Either way, when we are done here, you are bound to be familiar with a lot of these basic bookkeeping and accounting terms. Module 2 This module will teach you about Basic Terminology (II). In this unit, we will finish up with the basic accounting terms that are bound to impress at the next corporate fundraiser for the IRS. I know what you’re thinking. There is no such thing as a corporate fundraiser for the IRS because the only funds the IRS will be raised are those out of our wallets. Below are the next few terms you will need to know. Module 3 This module will teach you about Accounting Methods. Since the preceding units of this course were a piece of cake, now let’s talk about accounting methods, starting with the topics of cash and accrual. When you were a child, if your parents allowed you to go door to door selling items for your school’s fundraiser, you have used cash and accrual methods. It’s a simple concept that allows you to record the sale or purchase of an item even if you have not yet received payment. Module 4 This module will teach you about Keeping Track of Your Business. knowing how to keep track of your business will prove to be very valuable in the short run and long run. There are a number of different aspects involved in keeping track of any business the right way. Many businesses go out of business within the first year or two if things are not handled properly. Have you ever been up late at night, just craving one of those good old roast beef sandwiches from thelocal24 hour deli? You find that the craving gets so bad, you get up, leave (in your plaid jammies) and take a ride over there, with your mouth watering the whole way. You pull up, and hop out of the car(very excited), only to find that your favourite business is no longer “in business.” One could assume they did not keep very good track of their business or, they moved. Module 5 This module will teach you about Understanding the Balance Sheet. n this unit we will be discussing the accounting equation, double-entry accounting, types of assets, types of liabilities and equity. The balance sheet will help provide balance to your business. It helps keep everything organized and on point. One of the worst things in accounting is un-organization. So, don’t treat your balance sheet like your sock drawer at home or that mysterious junk drawer in your kitchen that no one wants to organize. Module 6 This module will teach you about Other Financial Statements. In this unit, we will introduce the income statement, cash flow statement, capital statement, and budget versus actual. These terms all involve money or the use of money in some form. When we are done, you will have a better understanding of how the use of these methods will help your business run more efficiently. You’ll be swapping accounting terms with that hotshot accountant friend of yours in no time. Module 7 In this module, you will learn all about Payroll Accounting Terminology. In this unit, we will be discussing many terms which involve dealing with the financial aspects of your business. We will also be discussing the accounting methods and terms used in reference to your employees, by briefly going over the following terms: gross wages, net wages, employee tax withholdings, employer tax expenses, salary deferrals, employee payroll, employee benefits, tracking accrued leave, and government payroll returns and reports. Module 8 In this module, you will learn all about What Is Payroll. If your business has employees, you’ll have to do payroll. There’s no way to avoid it, but what is payroll, A payroll is a company’s list of its employees, but the term is common. Module 9 In this module, you will learn all about Principles Of Payroll Systems. The business of employing people in the UK is regulated by government legislation designed to protect workers. Employees are entitled to receive the regular financial reward for their work. The amount is specified in their contract of employment. Module 10 In this module, you will learn all about Confidentiality And Security Of Information. As for any other financial information in business, you must be aware of the requirements of the Data Protection Act and the need for security and confidentiality of data at all times. This is particularly relevant to employee payroll records. Module 11 In this module, you will learn all about Effective Payroll Processing. Effective payroll processing isn’t just an essential business function. It also plays a key role in maintaining a high level of employee satisfaction. Employees depend on getting paid promptly and consistently with the correct amount. A payroll process that’s slow, prone to errors or overly complicated can result in a strained relationship between an employer and workers and unnecessarily tax the time of the HR team. Module 12 In this module, you will learn all about Increasing Payroll Efficiency. Payroll is a mission-critical function. Across the enterprise, no other department is under the same pressure to deliver every transaction, on-time and error-free. It’s not an option to make mistakes or hold up the pays while you finish something else. This pressure means that many payroll departments don’t have time to review their processes and procedures with an eye for efficiency gains. Enhancing the efficiency of your payroll will not only strengthen compliance, but it also has the potential to deliver significant cost and time savings. In today’s competitive business landscape most organisations are striving to do more with less. Implementing efficient processes will ease the burden and free up time for more strategic activities. Module 13 In this module, you will learn all about Risk Management in Payroll. Because it is considered to be well established and routine in nature, organisations often fail to adopt a strategic risk framework at the payroll process level. Organisations may not adequately recognise the risk associated with changes to regulations that impact payroll processing. Some organisations focus on risk relating to fraud and IT issues and often fail to consider all potential risks across the payroll lifecycle. Module 14 This module will teach you about Time Management. Timesheets, time cards, the Bundy-clock or a Time & Attendance system – no matter which system you use, whether it’s paper-based or web-enabled, time records are a core part of the payroll process. It goes without saying though, that an online, automated system will enhance productivity and efficiency. Module 15 This module will teach you about Personnel Filing. The records can be kept electronically or on paper (but back them up if they’re electronic) and should be in English. As an employer, you have flexibility over what form records take Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Faisalabad (Punjab)

Civil Surveyor Approved Course in Faisalabad Sialkot,Civil Surveyor Approved Course in Bagh Muzaffarabad,international college of technical education in rawalpindi bagh muzaffarabad punjab pakistan,best civil surveyor approved course in rawalpindi bagh muzaffarabad pakistan,professional civil surveyor course in rawalpindi bagh muzaffarabad pakistan,The Civil and Surveying Technology: Land Surveying major prepares students for technical positions in the land surveying, mapping, land development and land planning professions. Civil engineering and land surveying are the oldest, largest and most diverse disciplines of the engineering profession. The Civil and Surveying Technician with a land surveying emphasis may help plan, develop, layout, map and maintain: public works, land development, and transportation projects, horizontal and vertical control networks, and land and geographic information systems.Employment is available in surveying, mapping, land planning, plan checking and review, project administration and management. The land surveying and mapping professions continue to offer excellent employment opportunities. Opportunities are available in both public service and private enterprise, offering a wide range of career opportunities to satisfy individual interests, aptitudes, and goals. Employers generally report that it is very difficult to find applicants who meet their hiring standards. This indicates a very good outlook for qualified job seekers.The Civil & Surveying Technician may choose a land surveying, planning or mapping occupational path. Regardless of the choice of discipline, the career ladder is very similar. Some firms or agencies have more than one discipline represented.Students interested in a suggested order for taking classes in this program, can view the recommended course sequence. For students interested in a Certificate of Achievement, a Civil and Surveying Technology: Land Surveying certificate is available.The history of surveying started with plane surveying when the first line was measured. Today the land surveying basics are the same but the instruments and technology has changed. The surveying equipments used today are much more different than the simple surveying instruments in the past. The land surveying methods too have changed and the surveyor uses more advanced tools and techniques in Land survey.Civil Engineering survey is based on measuring, recording and drawing to scale the physical features on the surface of the earth. For different survey sites, different tools and survey equipment is used. The surveyor uses instruments for measuring, a field book for recording and nowadays surveying softwares for plotting and drawing to scale the site features.The earth appears to “fall away” with distance. The curved shape of the earth means that the level surface through the telescope will depart from the horizontal plane through the telescope as the line of sight proceeds to the horizon.Refraction is largely a function of atmospheric pressure and temperature gradients, which may cause the bending to be up or down by extremely variable amounts.Geodetic or trigonometric surveying takes into account the curvature of earth. Since very extensive areas and very large distances are involved, curvature of the earth has to be consodered. In geodic surveying highly refined instruments and methods are used for taking measurements. Geodetic work is usually undertaken by a state agency e.g. Survey of Pakistan. Chain Surveying Compass Surveying Leveling Contouring Tachometry Theodolite Work Total Station Chain Surveying Offsetting (Right and oblique offsets) Chain Survey of an area and Plotting work Compass Surveying Leveling Contouring Tachometry Theodolite work Total Station Work

Rs 25.000

See product

7 photos