Book order callsmswhatsapp features

Top sales list book order callsmswhatsapp features

Rawalpindi (Punjab)

Peachtree Pro Accounting 2009 If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Stock Management Basics Course details Stock signifies an ownership in a corporate setting. If you have stocks in a corporation then you have the right to claim a part of their assets and earnings. Learning how to manage your stocks is important to ensure you are not on the losing end. You are taught in this Stock Management Basics Online Course different ways to manage stocks and when you should buy or sell one. This course will also strengthen your ability to analyze the stock market. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Stock Management Basics Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Mastering Financial Accounting This online training course is comprehensive and designed to cover the topics listed under the curriculum. COURSE CURRICULUM 1. INTRODUCTION: WHAT IS ACCOUNTING AND FINANCIAL STATEMENTS? • Introduction: What Is Accounting? • What Are Financial Statements? 2. A REVIEW OF THE ACCOUNTING CYCLE AND PREPARING FINANCIAL STATEMENTS • A Review of the Accounting Cycle • Reporting and Preparing Financial Statements 3. INTERNAL CONTROL IN ACCOUNTING SYSTEMS • Internal Control in Accounting Systems Part 1 • Internal Control in Accounting Systems – Part 2 4. MERCHANDISE MANAGEMENT & INVENTORY CONTROL • Merchandise Management & Inventory Control Part 1 • Merchandise Management & Inventory Control Part 2 5. LEARN BASIC RECEIVABLES ACCOUNTING, ACCOUNTING COMPENSATION AND EXPENSE ACCOUNTING • Learn Basic Receivables Accounting • Accounting for Sales, Property, Income Taxes and Employee Compensation • Depreciation Expense Accounting 6. ACCOUNTING FOR CURRENT AND LONG-TERM LIABILITIES • Accounting for Current and Long-Term Liabilities – Part 1 • Accounting for Current and Long-Term Liabilities – Part 2 7. INTRODUCTION TO CORPORATION AND STOCKHOLDERS’ EQUITY 8. FINANCIAL ACCOUNTING & FINANCIAL STATEMENT ANALYSIS • Financial Accounting & Financial Statement Analysis – part 1 • Financial Accounting & Financial Statement Analysis – part 2 Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Sage 50 Accounting Quickbooks-PT,Talley ERP Diploma Who should consider learning the Features of Sage 50 Accounting? • In-depth study and knowledge of different tools and features of the Sage 50 accounting software can help candidates add value to their team. • Similarly, Sage 50 software is also ideal for those who own their own businesses and wish to become self-sufficient in managing their own accounting and invoicing and so on. Expertise in Sage 50 accounting software helps reduce reliance on external accountants. • In addition, Sage 50 accounting software is recommended for those who wish to make a seamless transition from manual payroll processing to a computerised system. By opting to educate and update one’s skills in Sage 50, candidates can prove their ability to potential employers. The Sage 50 online course is suitable for individuals, business entrepreneurs and aspiring students who wish to learn the basics of computerised accounting and invoicing. • A detailed working knowledge of Sage 50 can help aspirants gain confidence and help them provide a high standard of accounting services to companies. • Candidates from all backgrounds and fields are free to learn the Sage 50 accounting course; it does not require any prerequisite academic qualifications. The only prerequisite condition is a basic working knowledge of numeracy, literacy and IT skills. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Payroll Diploma What you will learn This course is brimming with useful and valuable information for you to learn and start using. The course is designed to provide you with insight that you can start incorporating into your work without delay. Some of the things you can expect to learn when completing the payroll course include: • Get an understanding of what payroll systems are and why you need one. • Learn the basics of payroll systems. What you need to know, errors and the importance of communication. • Identify the payroll systems in the United Kingdom. What to include and working with HMRC. • Understand that you need to run an efficient payroll system. Staff training, reviews and record keeping plus so much more. • Get insight on how employees starting and leaving the business impacts payroll. This module will give you insight into what to do, P45's and time keeping. • Learn how to deal with HMRC when it comes to new employees, what information HMRC will need from you and how to ensure you pay the employee the correct amount each month or week. • Learn how to calculate gross and net pay. This module will teach you the difference between gross and net pay, how to calculate them and why you need wage slips for each employee. • Understand the different deductions you need to know about to come to net pay amounts. • Get insight into what is statutory pay, how long does an employee qualify, record keeping and reporting to HMRC. • Learn about the national minimum wage based on age groups. • Get an understanding of the national insurance contribution systems. This module includes why we pay, the different rates, employer contributions and more. • Learn how to manage the online PAYE system. • Identify what the employment allowance is. • Understand retirement schemes. • Learn the different programs available for payroll. • Tips to correct payroll errors. • Understand the importance of annual reporting. Benefits There are so many benefits of completing this payroll course, these include: • Fast track your career. • Gain insight into managing your own payroll within the United Kingdom. • Know what you need to have an effective payroll system in place. • Study online at your own pace and using any device. • Enjoy the convenience of information packed modules. • Industry recognised certification on successful completion, which is also verifiable online. • Comprehensive syllabus complete with online support. • Lifetime access to modules to revisit and refresh whenever you wish. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts Intermediate Diploma Once you have completed the intermediate course, you will be familiar with a comprehensive range of useful accounting functionalities provided by Sage 50 Accounts. What You Will Learn • How to set up a fixed asset record in Sage 50 • Three methods of calculating depreciation • How to use the Asset Disposal Wizard and record sale of an asset • What to do if depreciation has been missed for a month • How to manage cheque and remittance • Setting up purchase order defaults • How to set up and calculate discounts on invoices and purchase orders • How to record the delivery of stock and update cost prices • Creating product defaults and understanding stock transactions • How to correct an incorrectly entered AI, using the exact method and the average cost price method • How to incorporate stock adjustments using the FIFO or First-in-First-out rule • How to use the ‘Check bill of material’ (BOM) feature to track stock availability • How to create price lists • How to apply special prices, print and delete price lists • How to set up manual discounts on sales orders and invoices • How to create service invoices and enter details for item lines Benefits of the Sage 50 Intermediate Diploma • In-depth study and knowledge of different tools and features of the Sage 50 accounting software can help candidates add value to their team. • Similarly, Sage 50 software is also ideal for those who own their own businesses and wish to become self-sufficient in managing their own accounting and invoicing and so on. Expertise in Sage 50 accounting software helps reduce reliance on external accountants. • In addition, Sage 50 accounting software is recommended for those who wish to make a seamless transition from manual payroll processing to a computerised system. By opting to educate and update one’s skills in Sage 50, candidates can prove their ability to potential employers. The Sage 50 online course is suitable for individuals, business entrepreneurs and aspiring students who wish to learn the basics of computerised accounting and invoicing. • A detailed working knowledge of Sage 50 can help aspirants gain confidence and help them provide a high standard of accounting services to companies. • Candidates from all backgrounds and fields are free to learn the Sage 50 accounting course; it does not require any prerequisite academic qualifications. The only prerequisite condition is a basic working knowledge of numeracy, literacy and IT skills. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Point of Sale- Quickbooks-PT,Talley ERP Course details Overview QuickBooks Point of Sale helps retailers go far beyond the cash register with an easy-to use, affordable, scalable, customizable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. The solution can track inventory, sales, and customer information, giving retailers more time to think about what to stock, how to price merchandise, when to reorder, and how to serve their customers better. Course Description QuickBooks Point of Sale helps retailers go far beyond the cash register with an easy-to use, affordable, scalable, customizable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. The solution can track inventory, sales, and customer information, giving retailers more time to think about what to stock, how to price merchandise, when to reorder, and how to serve their customers better. This software allows retailers to easily ring up sales, incorporate bar code scanning, accept credit cards and track inventory. Retailers will be able to view their top-selling products, customer stats and more. This software integrates seamlessly with QuickBooks which will eliminate any need for double entry accounting. Setup of QuickBooks POS is very easy and retailers can be up and running in a day! Inventory is updated automatically as you ring up sales, returns, exchanges, and receive items so you instantly know what's in stock. Even better, built-in reorder points notify you when inventory is low, so you never run out of top sellers and lose a sale. This in-depth training course will teach learners how to use QuickBooks Point of Sale effectively. The course has no formal entry requirements, and is designed to give you real-world knowledge that you can put to use from day one. It's highly flexible, so you can set your own timetable and study at your own pace. You can start learning right away with an initial payment of £65.00. by using our 3 month interest-free payment plan. We train our students to the very best standards, offering expert instructor-led training via our state of the art eLearning platform. Who Is This Course For? Anyone that wants to learn how to use QuickBooks Point of Sale Requirements Anyone that wants to learn how to use QuickBooks Point of Sale Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

2 photos

Rawalpindi (Punjab)

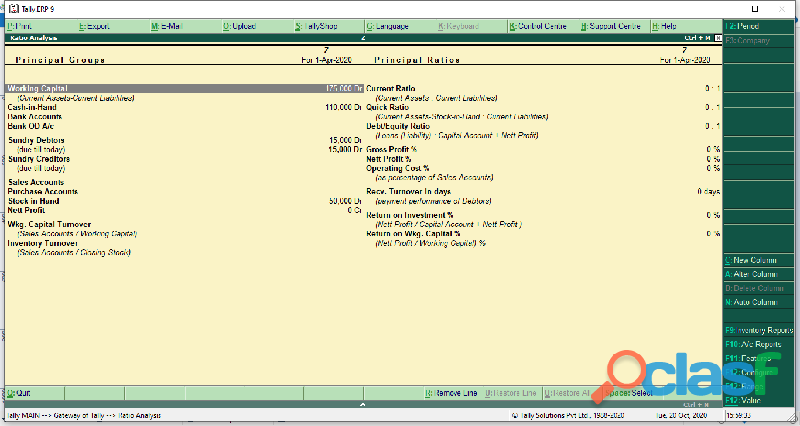

Tally course in Rawalpindi,Tally course in Rawalpindi,Tally is best course in Rawalpindi, Islamabad, Lahore.International college of technical education is best institute for that course.admission open for boys and girls,for more detail o3115193625.This online training course on Tally ERP 9 for Beginners is a foundation course delivered by a Chartered Accountant and a Finance expert with rich domain experience. Tally ERP is a renowned and leading accounting software used by many companies the world over.This online training course on Tally ERP 9 for Beginners is a foundation course delivered by a Chartered Accountant and a Finance expert with rich domain experience. Tally ERP is a renowned and leading accounting software used by many companies the world over. It is one of the most widely used and easy to understand accounting softwares.This online training course on Tally ERP 9 for Beginners is a foundation course delivered by a Chartered Accountant and a Finance expert with rich domain experience.Tally ERP is a renowned and leading accounting software used by many companies the world over. It is one of the most widely used and easy to understand accounting softwares. This course will give insights into its features, configurations, creation of company info, gateway of tally and much more.If you belong to an Accounting or non accounting arts or science and looking for job in accounting taxation or payroll, if you in search of a course which shines your career bright? ICTE is introducing an Accounting package Tally ERP. It is very popularly accounting software which indeed helps a small and medium business. It has all functions of accounting taxation and payroll that a particularly midsized business needs. Most people think that Tally may only function for a small or business , but it has much more capabilities than that. Tally is not just accounting software, after becoming ERP it has much more widened and in great extent.ICTE has designed Tally ERP course can be learnt just 2 (two) months. First month takes the basic understanding and second month focus on advanced features like GST, TDS, Service Tax Payroll , however freshers are advised to do long term Tally Diploma Courses for 12 months.The main core features of tally are explained hereby. ACCOUNTING: Accounting is the most important feature of Tally ERP The main thought that comes in mind of a person when hearing about tally is accounting. BILLING: Billing is important part of business, this feature is included Tally. Actually billing is included in accounting feature when ever you pass an accounting entry simultaneously a bill is generated which can be used for raising or sending invoice. PAYROLL: This feature is of use when you are having a good number of employees. For maintaining payroll in tally, there are functions like employee categories, employee groups, attendance, pay heads and course employees. INVENTORY: Maintenance of stock is very important part of business as it gives better control on business sales hence movement of stock is integral part which can be kept under control . BANKING: In this era of digitalization, without banking no business can survive. Banking functionality is very well covered by Tally. Though it was not present in earlier versions of Tally but it can be usage in ERP-9 TAXATION: TDS GST both direct and indirect tax can be calculsated automatically and its returns are also filed online with the help of Tally ERP.Tally ERP 9 Online Course with GST covers in-depth knowledge to meet the accounting requirements of the industry. We not only teach the concepts but also helps you learn how you can Practically implement those concepts in your Day to Day Accounting Process with practical examples and entries in tally. Anyone :- who wants to learn and perform accounting, inventory and taxation work on Tally.Accountants :- Accounting Job Persons, Tax Consultants, Chartered Accountants, Cost Accountants, or any other professional who need to work on Tally Software.Commerce Students :- Every commerce students must learn Tally ERP 9 Online Course with GST, because majority of Indian Small and Medium Businesses use Tally ERP9 for their Day to Day Accounting work.Business Owners :- Even if a business owner or top management don’t do data entry work in tally, then need to have knowledge of Tally Software so that they can analyze data, keep an eye on cash and fund flows, profits, finance, reporting and other valuable information that helps them in Decision Making.This course revisits topics covered in Introductory Financial Accounting (Accounting 101), with a focus on the asset side of the balance sheet: Cash, accounts and notes receivable, inventory, marketable securities, equity investments, PPE, and intangibles. The course also covers revenue and expense recognition issues, and generally accepted accounting principles that affect the format and presentation of the financial statements. Understand what is an accounting cycle, Understand the rules for the accounting. Understand journal entries. Understand ledger posting method. Understand what is income statement. Understand what is balance sheet. Introduction to Tally.ERP 9. Features of Tally. Enhancement in Tally.ERP 9. Installation Procedure of Tally.ERP 9. Tally.ERP 9 Screen Components. Creating a Company. Stock and Godwon in Tally. Stock Groups. Stock Categories. Stock Items. Units of Measure. Godowns. Groups, Ledgers, Vouchers and Orders. Introducing Groups. Introducing Ledgers. Introducing Vouchers. Introducing Purchase Orders. Introducing a Sales Order. Introducing Invoices. Reports in Tally.ERP 9. Working with Balance Sheet. Working with Profit & Loss A/c Report. Working with Stock Summary Report. Understanding Ratio Analysis. Working with Trial Balance Report. Working with Day Book Report. Payroll. Exploring Payroll in Tally.ERP 9. Working with Payroll Vouchers. Payroll Reports. Describing Salary Disbursement. Taxation. Statutory & Taxation Features. Tax Deducted at Source in Tally.ERP 9. Create a Tax Ledger. TDS Vouchers. Tax Collected at Source in Tally.ERP 9. VAT (Value Added Tax). Creating Masters for VAT. VAT Vouchers & Invoices. VAT Reports. Central Sales Tax (CST). Service Tax. Back & Restore in Tally.ERP 9. Taking Backup in Tally.ERP 9. Restoring Data in Tally. ERP 9. Using E-mail in Tally.ERP 9. Restoring Data from Tally 7.2. Tally.NET in Tally.ERP 9. Configuring the Tally.NET Feature. Assigning Security Levels. Connecting a Company to the Tally.NET Server. Logging as a Remote User. Rawalpindi, Islamabad, Lahore, Karachi, Gilgit, Skardu, Ghangche, taxila, Shigar, Astore, Diamer, Ghizer, Kharmang, Gultari, Rondo, Hunza Nagar, Gupi, Azad Jammu and Kashmir, Muzaffarabad, Mirpur, Bhimber, Kotli, Rawlakot, Bagh, Bahawalpur, Bhakkar, Chakwal, Chiniot, Dera Ghazi Khan, Faisalabad, Gujranwala, Gujrat, Hafizabad, Jhang, Jhelum, Kasur, Khanewal, Khushab, Layyah, Lodharan, Mandi-Bahuddin, Mianwali, Multan, Muzaffargarh, Nankana Sahib, Narowal, Okara, Pakpattan, Rahim Yar Khan, Rajanpur, Sahiwal, Sargodha, Sheikhupura, Sialkot, Toba tek Singh, Vehari, Attock, Taxila, Wah Cantt, Rawalpindi, Balochistan, Khyber-Pakhtunkhwa, Punjab, Sindh, Gilgit Baltistan, Turbat, Sibi, Chaman, Lasbela, Zhob, Gwadar, Nasiraba, Jaffarabad, Hub, Dera Murad Jamali, Dera Allah Yar, Khyber-Pakhtunkhwa, Peshawar, Mardan, Abbottabad, Mingor, Kohat, Bannu, Swabi, Dera Ismail Khan, Charsadda, Nowshera, Mansehra, Hyderabad, Sukkur, Larkana, Nawabshah, Nanak wara, Mirpur Khas, Jacobabad, Shikarpur, Khairpur, Pakistan.Experienced Based Diploma in Ac Technician ,Electronic , Mechanical , Plumbing , Auto Electrician , Efi Auto Electrician , Civil Surveyor , Quantity surveyor civil lab material testing , Best Institute in Rawalpindi islamabad Pakistan Lahore , Lowest fee course in pakistan , lowest fee professional practical training course in pakistan rawalpindi peshawar kashmir bagh lahore islamabad kahuta chakwal rahimyar khan gujarat gujarawala multan , attock Best institute in rawalpindi professional teacher and qualified staff.

Rs 6.000

See product

10 photos

Pakistan (All cities)

Tally ERP 9 - Your Business Companion Tally ERP 9 is the ideal software for your business. It is used by over a million businesses across India. We understand that every business has its own complexities, exceptions and unique needs. Tally ERP 9 is designed with flexibility to handle all of these. The needs of your business change as it grows and Tally ERP 9 is designed to scale. Let Tally manage your accounting and compliance, while you focus to grow your business. Introduction to Tally ERP 9 • Features of Tally • Enhancement in Tally ERP 9 • Installation Procedure of Tally ERP 9 • Tally ERP 9 Screen Components • Creating a Company Stock and Godon in Tally • Stock Groups • Stock Categories • Stock Items • Units of Measure • Godowns Groups, Ledgers, Vouchers and Orders • Introducing Groups • Introducing Ledgers • Introducing Vouchers • Introducing Purchase Orders • Introducing a Sales Order • Introducing Invoices Reports in Tally ERP 9 • Working with Balance Sheet • Working with Profit & Loss A/c Report • Working with Stock Summary Report • Understanding Ratio Analysis • Working with Trial Balance Report • Working with Day Book Report Taxation • Statutory & Taxation Features • Tax Deducted at Source in Tally ERP 9 • Create a Tax Ledger • TDS Vouchers • Tax Collected at Source in Tally ERP 9 • VAT (Value Added Tax) • Creating Masters for VAT • VAT Vouchers & Invoices • VAT Reports • Central Sales Tax (CST) • Service Tax Back & Restore in Tally ERP 9 • Taking Backup in Tally ERP 9 • Restoring Data in Tally. ERP 9 • Using E‐mail in Tally ERP 9 • Restoring Data from Tally 7.2 Tally.NET in Tally ERP 9 • Configuring the Tally.NET Feature • Assigning Security Levels • Connecting a Company to the Tally.NET Server • Logging as a Remote User

Rs 15.000

See product

5 photos

Faisalabad (Punjab)

Civil Surveyor Approved Course in Faisalabad Sialkot,Civil Surveyor Approved Course in Bagh Muzaffarabad,international college of technical education in rawalpindi bagh muzaffarabad punjab pakistan,best civil surveyor approved course in rawalpindi bagh muzaffarabad pakistan,professional civil surveyor course in rawalpindi bagh muzaffarabad pakistan,The Civil and Surveying Technology: Land Surveying major prepares students for technical positions in the land surveying, mapping, land development and land planning professions. Civil engineering and land surveying are the oldest, largest and most diverse disciplines of the engineering profession. The Civil and Surveying Technician with a land surveying emphasis may help plan, develop, layout, map and maintain: public works, land development, and transportation projects, horizontal and vertical control networks, and land and geographic information systems.Employment is available in surveying, mapping, land planning, plan checking and review, project administration and management. The land surveying and mapping professions continue to offer excellent employment opportunities. Opportunities are available in both public service and private enterprise, offering a wide range of career opportunities to satisfy individual interests, aptitudes, and goals. Employers generally report that it is very difficult to find applicants who meet their hiring standards. This indicates a very good outlook for qualified job seekers.The Civil & Surveying Technician may choose a land surveying, planning or mapping occupational path. Regardless of the choice of discipline, the career ladder is very similar. Some firms or agencies have more than one discipline represented.Students interested in a suggested order for taking classes in this program, can view the recommended course sequence. For students interested in a Certificate of Achievement, a Civil and Surveying Technology: Land Surveying certificate is available.The history of surveying started with plane surveying when the first line was measured. Today the land surveying basics are the same but the instruments and technology has changed. The surveying equipments used today are much more different than the simple surveying instruments in the past. The land surveying methods too have changed and the surveyor uses more advanced tools and techniques in Land survey.Civil Engineering survey is based on measuring, recording and drawing to scale the physical features on the surface of the earth. For different survey sites, different tools and survey equipment is used. The surveyor uses instruments for measuring, a field book for recording and nowadays surveying softwares for plotting and drawing to scale the site features.The earth appears to “fall away” with distance. The curved shape of the earth means that the level surface through the telescope will depart from the horizontal plane through the telescope as the line of sight proceeds to the horizon.Refraction is largely a function of atmospheric pressure and temperature gradients, which may cause the bending to be up or down by extremely variable amounts.Geodetic or trigonometric surveying takes into account the curvature of earth. Since very extensive areas and very large distances are involved, curvature of the earth has to be consodered. In geodic surveying highly refined instruments and methods are used for taking measurements. Geodetic work is usually undertaken by a state agency e.g. Survey of Pakistan. Chain Surveying Compass Surveying Leveling Contouring Tachometry Theodolite Work Total Station Chain Surveying Offsetting (Right and oblique offsets) Chain Survey of an area and Plotting work Compass Surveying Leveling Contouring Tachometry Theodolite work Total Station Work

Rs 25.000

See product

7 photos

Ahmadpur East (Punjab)

Quick book Training Regardless of your business size, payroll requirements are confusing and frustrating. But payroll features in QuickBooks enable you to generate checks, calculate payroll tax and withholding pay liabilities and create reports with slight effort. As the demand of QuickBooks software is increasing, the demand of professionals who are proficient in using this software is also rising in business market. Small and large business also appreciates individuals having this training this education in order to control the payroll department effortlessly. So call us now to get further information on QuickBooks Training & our other skill enhancement practical accountancy courses like Advance Excel, excel financial modeling,peach tree and many more! Contact: KBM Training & Recruitment for details. KBM Training & Recruitment (Your Career Progression Is Our Ambition) Contact # 0331-8433334 / 0311-3993222 Office Address : 18 B-2 Model Town Lahore. website : www kbmtr com Facebook : fb com/kbmtrpk

Rs 100

See product