Audit accounts society

Top sales list audit accounts society

Karachi (Sindh)

MBA qualified teacher for quick books, peachtree, tally ERP, online ERP Accounts Software. Asslam-o-Alyekum Hi Dear All, A Professional Accountant, MBA Qualified, Certified, Awarded & 12 years Experienced Teacher/ Consultant from Textile, Foods, Advertising, Printing Press Industries, Importer of Computers / Electronic Items, Property Dealer, Marble Exporter & Yarn Manufacturing Industries, already Lecturer in a Known well Institute/ College in Karachi named (Academy of Excellence / Excellence Intermediate College) offering you all to teach at your Office, Factory & Home. My students are mostly in Dubai, Ajman, S. Arab, Bahrain, South Africa, USA, Canada & South Korea. Please see the below detail of those Companies where I have already thought these software And I have also their Certificates. 1- M/s. Amour Textile Industries (Pvt.) Limited. (Exporter of Textile) Peachtree – 2007 (Completed) 2- M/s. Nacisey (Pvt.) Ltd. (Food Industry) Quick Books – 2011 (Completed) 3- M/s. TransformaX (Unilever Pakistan & Engro Foods Advertising Agency Vendor) Peachtree – 2010 (Completed) 4- M/s. Sana Enterprises. (Printing Press Ind. / GSK Pharmaceutical Vendor) Peachtree – 2007 (Completed) 5- M/s. Base System (Dubai Base Company Importer of Computers / Laptops Accessories) Peachtree - 2014 (Completed) 6- M/s. Legal Aid Society (NGO Organization) - Quick Books - 2014 (Completed) 7- M/s. SMB Marble Company (Exporter of Marble) – Peachtree – 2007 (Continued) 8- M/s. Syco Advertising Agency – Quick Books – 2010 (Continued) 9- M/s. Al-Razaq Fibers (Pvt.) Limited (Manufacturer & Trader of Yarn) – Peachtree Quantum 2010 (Continued) I am offering you Peachtree Complete, Tally ERP-9 Complete Quick Books Complete & Advance Excel Complete Computerized Accounting Software according to Pakistan Government Rules, FBR Tax Regulations, Complete Payroll with EOBI & Soc. Security & also Complete Inventory Manufacturing with FOH & Control System & its Valuation & Costing Report & many more. We also provide you Sales Tax, Income Tax & E-Filing Consultancy. Note: Peachtree-2007, 2010 & Quick Books all Versions are available with Original License, Serial & Reg. Code. We may also provide Quick Books & Tally ERP-9 License for all versions in Pakistan. We also provide Accountant, IT related & Net Working related person for Your Company & Factory. If you are interested to learn These Precious Courses than do not hesitate to contact us to our Contacts. We ensure you will learn complete courses. You may also contact us through E-Mail for Course Outline. Thanks & Regards Muhammad Asif Memon Karachi. Cell # 0321-2261353 & 0332-2208141 E-Mail: Sirasifmemon@gmail.com

See product

Islamabad (Islamabad Capital Territory)

House No. 608-B, Street No. 111-A, I – 8/4, Islamabad From 10 AM to 7 PM Chartered Accountant Available for Accounting, Cost Accounting Management Accounting, Audit both Annual and Internal for Students of I.Com, A/O Levels, B.Com, BBA, MBA, M.Com, ACCA, ICMA and CA. Three days free trial Classes. SATISFACTION GUARANTEE TAUQEER HUSSAIN Mobile 0303-5478158, 0312-5178701 tauqeerhussainmalik@hotmail.com

Rs 1,5

See product

Karachi (Sindh)

We THE EDUCATIONIST TUTOR PROVIDER Provide’s The Best, Experienced And Most Competent Male/Female Home Tutoring Experts, Professors and Teachers From All Field Of Studies in All Areas Of Karachi, We are Currently Serving Hundreds Of Students Nowadays in Mega City Karachi. Our Motivated Team Of Experienced Male/Female Teachers are Most Renowned and Among The One Of The Best Teachers Of Karachi and Pakistan. The Educationist Tutor Providers Offer Best Home Tutoring services at Your Place Any Where in Karachi @ Very Affordable Fee Structure. We Guide And Taught Our Students How To Polish Their Academic Skills Which Could Brought Up Them As A Professional in The Society. We Provide Experienced Home Tutors For All classes And Grades i.e sindh Board. Agha Khan Board. For Getting Outstanding Results And Grades Call Now:03323079987. FACEBOOK: THE EDUCATIONIST TUTOR PROVIDERS & TUTOR ACADEMY

Free

See product

Karachi (Sindh)

THE EDUCATIONIST TUTOR PROVIDER Offer’s The Best, Experienced And Most Competent Home Male/Female Tutors, Professors and Teachers From All Fields Of Studies in All Areas Of Karachi, We are Currently Serving Hundreds Of Students Nowadays in Mega City Karachi Our Motivated Team Of Experienced Male/Female Teachers & Home Tutors are Most Experienced, Renowned and Best Teachers Of Karachi and Pakistan. The Educationist Tutor Providers and Tutor Academy (Karachi) Offer’s Best Male/Female Home Tutors at Your Place @ Very Reasonable Fee Structure. We Guide And Taught Our Students To Polish Their Academic Skills Which Could Brought Up Them As A Professional in The Society. We Provide Experienced Home Tutors For All Classes And Grades i.e • Sindh Board. • Agha Khan Board. • O/A Levels. • Intermediate (All Boards). • BCOM, B.A, BBA And Etc. • MCOM, MA, MSC And Etc. • C.A, ACCA. • English Language, IELTS & TOEFL • Aptitude Test Preparation (ECAT/BCAT/MCAT) & Etc. We’re a Trusted and Well Reputed Name in The Education Sector of Karachi. For Getting Outstanding Results And Grades Call Now: 03323079987. For Tutor Registration: 03362144610. FACEBOOK: ETPOfficialPage SKYPE: ETPOfficial **Note For Teachers: Apply If Only If You Can Full Fill All The Term & Conditions Of The Educationist Tutor Providers & Tutor Academy, Karachi.

Free

See product

Pakistan (All cities)

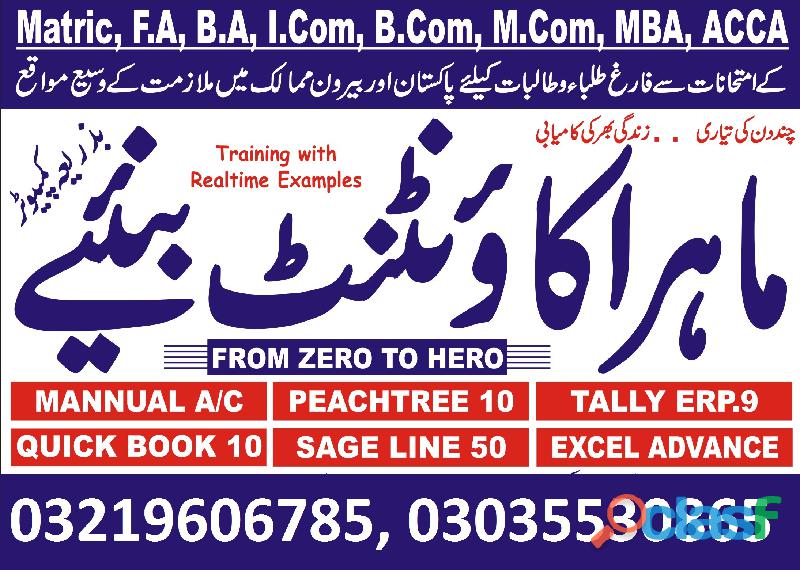

Quickbooks-PT,Talley ERP Accounting for Business If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM BOOKKEEPING AND PAYROLL MANAGEMENT • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts • Working with Ledgers • Reconciliation • Correcting Entries • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record • The Partnership & Corporations • Accounts Receivable and Bad Debts • Preparing Interim Statements • Year End – Inventory BUSINESS ACCOUNTING • Introduction to Bookkeeping • Defining a Business • Ethics and Accounting Principles • Accounting Equation & Transactions • Financial Statements • The Accounting Equation and Transactions • Transactions – Journalizing • Posting Entries and The Trial Balance • Finding Errors Using Horizontal Analysis • The Purpose of the Adjusting Process • Adjusting Entries • Vertical Analysis • Preparing a Worksheet • The Income Statement • Financial Statements- Definitions • Temporary vs. Permanent Accounts • Accounting Cycle • Financial Year • Spreadsheet Exercise How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2016 – Accounts, Payroll Management This QuickBooks Pro 2016 training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 20 guided learning hours. COURSE CURRICULUM: 01 • The Home Page • The Icon Bar • Creating a QuickBooks Company File • Setting Up Users • Using Lists 02 • The Sales Tax Process • Creating Sales Tax • Setting Up Inventory • Creating a Purchase Order • Setting Up Items 03 • Selecting a Sales Form • Creating a Sales Receipt • Using Price Levels • Creating Billing Statements • Recording Customer Payments 04 • Entering a Vendor Credit • Using Bank Accounts • Sales Tax • Graph and Report Preferences • Modifying a Report • Exporting Reports 05 • Using Graphs • Creating New Forms • Selecting Objects in the Layout Designer • Creating a job • Making Purchases for a Job • Time Tracking 06 • Payroll – The Payroll Process • Payroll – Setting Up Employee Payroll Information • Payroll – Creating Termination Paycheques • Payroll – Adjusting Payroll Liabilities 07 • Using Credit Card Charges • Assets and Liabilities • Creating Fixed Asset Accounts • Equity Accounts • Writing Letters with QuickBooks 08 • Company Management • Company File Cleanup • Using the Portable Company Files • Creating an Account’s Copy Course Duration: You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Finance For Non-Financial Professionals As a non-financial professional, you need to quickly understand and distinguish good information from poor-quality information, otherwise, your decisions may adversely affect business performance and your career prospects. This course is designed with a practical view to finance. It's suitable for professionals at all levels and entrepreneurs alike. In this course you will learn: • How to understand and use financial statements • Including; profit and loss, balance sheets and cash flow forecasts • Budgeting and forecasting techniques to improve decision-making • How to use Key Performance Indicators (KPIs) effectively • How to appraise an investment using financial techniques • The best way to develop a business plan Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP HR & Payroll Management This course has been specifically designed for those looking to learn the basics of being successful in the human resources and payroll management fields. As a bonus, we also share a few tricks for getting your foot in the door! We'll cover payroll management, hiring diversity, negotiations, working with a leadership team, payroll, benefits, insurance, payroll systems, and general management techniques. Everything you need to be a skilled, knowledgeable HR officer is in this course! Course for? For those who: • Are interested in a career in Human Resources and Payroll Management • Current HR and payroll employees who would like to improve their skills • Small business owners who are looking to make sure that they are providing a good work environment for employees • Those who would like to explore further the field of HR Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bookkeeping Diploma Level 3 The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Certification: Successful candidates will be awarded Diploma in Accounting and Bookkeeping – Level 3. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Managerial and Cost Accounting Course Description: This Campus based training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Benefits you will gain: By enrolling in this course, you’ll get: • High-quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • Includes step-by-step tutorial videos and an effective, professional support service. job roles this course is suitable for: Cost Accountant , Management Accountant , Accountant Assistant , Project Cost Accountant Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad The Complete Sage 50 Accounting Diploma Quickbooks-PT,Talley ERP The Sage 50 Intermediate Course This course builds on the concepts learned in the beginners’ course and assumes that you have a working knowledge of the basic features together with an understanding of simple transactions. You will begin by learning about accruals and prepayments, along with the calculation of assets and depreciation. You will not only learn how to undertake these more advanced transactions but also how to fix errors such as inaccurately processed assets.Stock control and monitoring are also covered in depth, enabling you to manage stock levels with confidence. You will also learn how to create an audit trail for complex transactions such as those involving discounted items and credit notes.The Sage 50 Advanced CourseThis course moves beyond everyday transactions and emphasises the processes required in chasing debt and credit control. You will learn why quotations are important, and how they can improve sales. You will gain an understanding into how businesses recover credit and payment from customers, and how to keep accurate records during the process.Audit trails are a key aspect of accurate accounting and you will gain further knowledge and insight into this process during the course. You will also gain a better understanding of budgeting, as well as how to correct common mistakes in record-keeping. Finally, you will also develop your skills in producing customised reports. The Benefits of Our Complete Sage 50 Accounting Course This course will give you a complete overview of all the main accounting tools Sage 50 offers, from the basic to the advanced. This will make you an attractive candidate for any position that entails company accounts including invoicing and debt management. You will not only be a proficient user of Sage 50 software, but you will also be able to demonstrate an in-depth understanding of how financial matters are controlled within a business. Benefits of taking the Complete Sage 50 Accounting Diploma: • Study at home and online • Study at your own pace • Access to full online support whilst completing the course • Easy-to-read modules packed with information • No entry requirements • A chance to receive an accredited qualification upon completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Certificate in Finance & Budgeting Quickbooks-PT,Talley ERP Course details Understanding the basics of finance and budget is helpful for everyone but upgrading these skills will help you achieve financial stability. This course can also help professionals who want to learn more knowledge and skills in budgeting to improve the financial management of their organization. This Level 2 Certificate in Finance & Budgeting lets you know more financial terms and concepts that you can implement to your business. You will be able to manage financial and budget plans through proper financial management and analysis. Course Highlights • The price is for the whole course including final exam - no hidden fees • Accredited Certificate upon successful completion at an additional cost • Efficient exam system with instant results Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Pro 2012 & 2013 COURSE CURRICULUM 1. What’s new in Quickbook Pro 2013 2. Quickbook Overview 3. The Company file 4. Setting up for Multiple users 5. Navigation in Quickbook 6. Adjusting preferences 7. The Chart of Account 8. Company lists 9. Importing data 10. Working ith the Bank Account 11. Creating items 12. The Basic of working with Inventory 13. Working with Vendors & paying bills 14. Customers, Jobs & Recording sales 15. Sales Adjustments & Statements 16. Customizing templates & forms 17. Accounts Receivable & Deposits 18. Sales tax 19. Report & The Report center 20. Managing Employees 21. Working with Credit cards 22. Loans & Liabilities 23. Reconciling Accounts 24. Online Banking 25. What’s new in Quickbook 2012 26. Finalizing your Accounting How will I be assessed? • You will have one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts for Beginner Learners why not improve your chances of gaining professional skills and better earning potential. Course Curriculum • Module 1: Program Basics– Set up your program, discover more about the user interface such as toolbar and keyboard options • Module 2: Restoring and Backing-up Data – Learn about data storage, creating back-ups and restoring them • Module 3: Basic Setting and Details – Manage financial dates, company details and program dates • Module 4: The Chart of Accounts – Create, modify and review chart of accounts • Module 5: Bank Receipts – Enter bank receipts • Module 6: Bank Payments – Oversee VAT, overheads, assets and bank payments • Module 7: Financials – Observe the financial state of your company • Module 8: Customers – Add new customers, use the new customer wizard, and manage their details • Module 9: Suppliers – Add and edit supplier records • Module 10: Working with Lists – Utilize lists to sort out records • Module 11: Batch Invoices – Create customer invoices, check bank accounts and nominals • Module 12: Service Invoices – Create service, manage line and invoice • Module 13: Processing Invoices – Process invoices and update ledgers • Module 14: Product and Services – Duplicate, add items, services and products • Module 15: Stock Control – Control your stocks through adjustments, activity and returns • Module 16: Product Invoices – Invoice management for products utilizing multiple platforms • Module 17: Product Credit Notes – Create credit notes • Module 18: Reviewing Your Accounts – Review the financial state of your company • Module 19: Aged Debtors and Statements – Analyse account balances, aged debtors, statements and customer communication history • Module 20: Customer Receipts – Allocate receipts automatically, manually or partially using discounts and payments on account • Module 21: Customer Activity – Observe customer activity • Module 22: Supplier Batch Invoices – Add new suppliers, their account balances and batch invoices • Module 23: Supplier Payments – Record and observe supplier payments, activity, print remittance and cheques • Module 24: More about the Nominal Ledger – Journal entries, nominal code activity, ledger graphs and records • Module 25: More about bank accounts – Learn about bank transfers, combined payments and petty cash transactions • Module 26: Using the Cash Register – Recording and depositing with the cash register • Module 27: Bank Reconciliation – Reconcile bank account and carry out group transactions • Module 28: Recurring Entries – Recurring entry processes including bank set up, adding journals, and deleting recurring entries • Module 29: VAT Returns – Produce, make, print, reconcile and complete VAT related transactions • Module 30: More About Reports – Follow the audit trail, period trial balance, profit and loss, and the balance sheet report • Module 31: Using Dashboards – Use the dashboards effectively Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Business Basics Course details Overview This course will be extremely useful for business owners, or those hoping to go into business accounting. Get to grips with all the financial basics of business, how to set up and maintain an effective payroll system, how to get your business out there, and how to use SEO effectively. Learners will come away from this course with a whole host of useful skills, which will help you to gain employment in the accounting and business world. Description This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Introduction 2: Business Entities 3: Beginning Your Business 4: Financial Basics Part 1-2 5: Employees Payroll 6: Getting Your Business Out There 7: Seo 8: Other Topics 9: Closing Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 it can be done at any time by extending your subscription. Course Curriculum 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgeting for your Daily Life This course aims to help individuals who are having a difficult time budgeting to successfully control their money and limit spending on unnecessary items. In this course, you will learn how to set goals, create your own budget effectively, overcome debts and overspending, and also acquire strategies that will help in making long-term budgeting effective and successful. Take back control of your finances and become a savvy spender! COURSE CURRICULUM 1. Learning how to budget 2. Realizing, where your money goes 3. Self- assessment 4. Setting up the budget 5. Creating monthly vs. Yearly budgets 6. Sticking to your budget using strategies 7. Long term budgeting The method of Assessment: At the end of the course, learners will take an online multiple choice questions assessment test. This test is marked automatically, so you will receive an instant grade and know whether you have passed the course. Certification: Successful candidates will be awarded certificate in Budgeting for your Daily Life. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Assessment This course will be assessed on the basis of one assignment. We believe doing practical assignments are the best way to assess the ability of the students and also it is the best way to make them apply what they have learnt into practice. Students can start their assignments from day one and complete the course as soon as they submit their assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Managerial and Cost Accounting This Diploma in Managerial Cost Accounting will prepare you for employment within this exciting industry, and will allow you to become highly skilled when it comes to cost accounting. The course covers a whole range of exciting topics, including: Overview of Managerial Accounting, Planning and Directing, Key Components of Cost, and Cost of Flow Concept. Become a successful Cost Accountant with this excellent course. Course Description: This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Method of Assessment: At the end of the course, learners will take an online multiple choice question assessment test. The online test is marked straight away, so you will know immediately if you have passed the course. Certification: Successful candidates will be awarded a certificate for Diploma in Managerial and Cost Accounting. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Peachtree Pro Accounting 2009 This excellent Peachtree Pro Accounting 2009 course will provide an in depth introduction to the general accounting features of Peachtree Pro Accounting, as well as step-by-step instructions on how to set up a new company, vendors, and employee payroll on Peachtree Pro Accounting. During this excellent Peachtree Pro Accounting course, you will learn how to achieve better business results, whether you’re business is new, or you’re an experience business manager. This Peachtree Pro Accounting course is taught by an expert instructor, and is packed full of insider knowledge and tips, to help your business improve. If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. • You will only need to pay £19 for assessment when you submit your assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

3 photos

Islamabad (Islamabad Capital Territory)

Othm Safety Level 6 Diploma for GradIosh in Islamabad, Othm Safety Level 6 Diploma for GradIosh in Rawalpindi, Othm Safety Level 6 Diploma for GradIosh in Gujranwala, Othm Safety Level 6 Diploma for GradIosh in Sialkot, Othm Safety Level 6 Diploma for GradIosh in Sargodha, Othm Safety Level 6 Diploma for GradIosh in Gujrat, Othm Safety Level 6 Diploma for GradIosh in Lahore, Othm Safety Level 6 Diploma for GradIosh in Faisalabad, Othm Safety Level 6 Diploma for GradIosh in Multan, Othm Safety Level 6 Diploma for GradIosh in Mandi Bahauddin, Othm Safety Level 6 Diploma for GradIosh in Bahawalpur, Othm Safety Level 6 Diploma for GradIosh in Attock, Othm Safety Level 6 Diploma for GradIosh in Chakwal, Othm Safety Level 6 Diploma for GradIosh in Mirpur, Othm Safety Level 6 Diploma for GradIosh in Bagh, Othm Safety Level 6 Diploma for GradIosh in Rawala kot, Othm Safety Level 6 Diploma for GradIosh in Kotli, Othm Safety Level 6 Diploma for GradIosh in Karachi, Othm Safety Level 6 Diploma for GradIosh in Hyderabad, Othm Safety Level 6 Diploma for GradIosh in Mardan, Othm Safety Level 6 Diploma for GradIosh in Peshawar, Othm Safety Level 6 Diploma for GradIosh in Swat, Othm Safety Level 6 Diploma for GradIosh in Rawat, Othm Safety Level 6 Diploma for GradIosh in Sawabi, Othm Safety Level 6 Diploma for GradIosh in Sahiwal, Othm Safety Level 6 Diploma for GradIosh in Sakkar, Othm Safety Level 6 Diploma for GradIosh in Haripur, Othm Safety Level 6 Diploma for GradIosh in Pakistan O3165643400, O3119903317,Othm Safety Level 6 Diploma for GradIosh in Islamabad, Pakistan O3165643400, O3119903317 The IEHSAS OTHM Level 6 Diploma Qualification in Occupational Health and Safety is designed to give Learners who have or are hoping to form into, a senior Position in an organization for overseeing health and safety policy and practice. Through this qualification, Learners will pick up the Core abilities and information to comprehend the Legal and administrative foundation to occupational health and safety policy, to have the option to assess policies, just as to suggest and execute strategy changes. Learners will create information and aptitudes and standards pertinent to the putting policy into practice, utilizing management systems, resources, occupational risk, and incident management. OTHM Level 6 Diploma in Occupational Health and Safety Qualification Structure: The IEHSAS OTHM Level 6 Diploma Qualification in Occupational Health and Safety consists of 6 mandatory units for combined total credits 48 hours, 480 hours Total Qualification Time and 180 Guided Learning Hours. All the units of this qualification also have a unique reference number of each unit. The qualification title and the reference numbers of each unit will appear on learners’ final certification documentation. There is no written exam at OTHM level 6 diploma in Occupational Health and Safety. Though there are 7 unit assignments. The learner must pass all unit assignments by demonstrating their professional portfolio and by research work with particular ranges of the word at paperwork. To ‘pass’ a unit, the learner must give evidence to show that they have satisfied all the learning outcomes and satisfy the guidelines indicated by all assessment criteria. Eligibility Criteria Unlike other Level 6 Diploma in Occupational Health and Safety, IDSE requires candidate to meet any of the following criteria for registration. The criteria have been established so that only competent professional may apply for IDSE to increase the success rate of the qualification. -Level 3 certification in OH&S (IOSH Accredited only) + 3 years OH&S experience, Or -A graduate degree in Science subjects from reputable university (60% score) + 1 years OH&S experience, Or -Four years engineering degree (B.E or BS Engg Min 60% aggregate) from a reputable university Exam Pattern IDSE is assessed via 2 closed book written exams ( Each units) comprising total 150 Marks in each exam. Time allowed for each examination is 5 hours. Note: There will be two sections in each exam i.e. Section A and Section B. Both section need to be completed the same day without any break in between. 10 Reasons your should prefer IDSE -It has 2 units assessed through 2 subjective type written exams (No reports/ Projects). -The contents of IDSE are more professional and skill oriented. -Assessments are more relevant and believe us, it will not be an English language test like other HSE Diploma do -Result within 15 working days after the exam and certificates within 15 working days after the result (in case you qualify) -You can sit both exam separately i.e. with a gap of 2 months to 12 months between both unit exams -You can opt to have exam date of your choice (You will need to confirm exam date by payment and 4 weeks prior to your date of choice) -IDSE fee package is much competitive than other HSE level 6 diploma -It is being offered in Distance Learning so you can study at your own pace. Our online trainer support will guide you whenever you will find any difficulty -It has eligibility criteria for registration. So all registered professional will meet the minimum eligibility criteria to ensure maximum pass rate for IDSE. -Diploma awarding body is NCFE UK which is an Ofqual regulated largest Certification Body with a history of more than 150 years IDSE Syllabus and Scheme of Assessment Unit 01 Achieving Continual Improvement in OH&S Management System 1.Assess the planning of an OH&S Management System from continual improvement perspective 1.1 Assess and evaluate the context of organization based on complexity of the processes and nature & scale of the organizations i.e. from small simple organizations to very large organizations with complex operations 1.2 Assess and review the OH&S policy for its effectiveness, continual improvement of OH&S MS and the alignment with strategic direction of the organization 1.3 Design an OH&S Management system with clear inputs and outputs using process approach to management system 1.4 Outline the key processes in the OH&S Management system 1.5 Assess the risks and opportunities inherent with the planning of an OH&S Management System from the organization’s context 1.6 Report on the effectiveness of planning an OH&S Management system 1.7 Investigate loopholes in the planning phase for the OH&S Management system 1.8 Justify the competence of personnel involved in the planning of an OH&S management system commensurate with nature and scale of the organization 1.9 Present a case for cost benefit analysis of an effective OH&S Management system to the top management 2 Assess the established & Implemented OH&S Management System from the continual improvement perspective 2.1 Identify and manage the resources for the implementation of an OH&S Management system 2.2 Review and evaluate the sufficiency and adequacy of documented procedures as per nature and scale of the organization 2.3 Outline the competencies requirements for the implementation of key processes of OH&S Management system 2.4 Present a case for the requirement of operational controls as required 2.5 Review and assess the requirement for maintaining & retaining documented information 2.6 Justify the implementation of an OH&S Management system in the organization from the health and safety culture perspective 2.7 Review the internal and external communications necessary for effective implementation of an OH&S Management system 2.8 Justify the arrangements necessary for complying with applicable legal and other requirements 2.9 Identify and report on risks and opportunities pertaining to implementation of an OH&S Management system 2.10 Evaluate the arrangements for control on subcontractors regarding OH&S Matters 2.11 Review and evaluate the established performance indicators for measuring the effectiveness of implementation 2.12 Justify the OH&S Objectives and goals commensurate with OH&S Policy 2.13 Compile a report on the utilization of resources for OH&S to be efficient and effective in view of continual improvement for an OH&S Management system 2.14 Evaluate and report the relevance of the implemented OH&S Management system with planned one 2.15 Report on the effectiveness of the implemented OH&S Management system 2.16 Review and evaluate the sufficiency and adequacy of the arrangements against potential emergency situations 3 Review and assess the efficiency and effectiveness of the inspection and audit process for OH&S Management System 3.1 Justify the frequency and type of inspections and audits (Internal & External) for the OH&S Management system in the context of organization 3.2 Review and assess the necessary competencies requirement for the personnel involved in inspections and audits 3.3 Manage the provisioning of effective training as per the complexity of processes and evaluate the effectiveness of imparted training 3.4 Evaluate the quality of inspections and audits 3.5 Present a case for the requirement of resources for inspections and audits 3.6 Review and assess the effectiveness of inspection/ audit criteria 3.7 Identify the requirements for any measuring and monitoring equipments including any calibration arrangements for OH&S Management system processes 3.8 Review and assess the risks pertaining to inspections and audits 3.9 Evaluate the arrangements to measure the degree of conformance of the OH&S Management system against the established criteria 3.10 Review and interpret the legal requirements and incorporate them into the organization’s inspection and audit process 3.11 Investigate the root causes for the non conformances/ incidents and suggest corrective actions 3.12 Review and assess the inspection and audit objectives and deliverables 3.13 Evaluate the arrangements for preventive actions in context of the organization 4 Review and assess the efficiency and effectiveness of Management Review process for the OH&S Management System 4.1 Review and evaluate the arrangements for analysis of the OH&S Management system performance 4.2 Review and evaluate the arrangements for evaluation of the OH&S Management system performance 4.3 Review and evaluate the quality and number of inputs for management review 4.4 Report on performance of the OH&S Management system to the top management 4.5 Present a case for the resource requirements to implement the decisions made by top management 4.6 Review and evaluate the requirements to change the OH&S management system and its possible implications 4.7 Manage the change in the OH&S Management system subsequent to Management review decisions 4.8 Report on progress of action plans for implementation of decisions subsequent to Management Review 4.9 Explain the OH&S Management system deliverables in context of continual improvement in quantified manner subsequent to decisions made in Management Review Unit 02 Principles and Application of Science and Technology in Safety 1 Assess and apply basic principles of Chemistry at the workplace for occupational health and safety 1.1 Evaluate the hazards due to the nature and form of chemical agents and suggest control measures from hierarchy of control perspective. This should include the transportation hazards associated with the chemical agents. 1.2 Explain the current developments in identification, measuring and monitoring and control of chemical agents at the workplace 1.3 Identify and interpret the legal requirements for use, storage and transportation of chemical agents 1.4 Explain the human physiology with natural immunity and defence mechanism against chemical agents 1.5 Identify the requirements and application of personal protective equipments in a chemical environment for sufficiency and adequacy including future design requirements of PPEs 1.6 Explain the features of an emergency preparedness and response procedure for accidents related to chemical agents 1.7 Identify the requirement of operational controls with clear direction to what and how should the human involvement be eliminated/ reduced 1.8 Outline the physio chemical hazards of inflammables at the workplaces 1.9 Present a case for the possibility for use of clean energy with cost benefit analysis and implications on occupational health and safety 2 Assess and apply basic principles of Physics at the workplace for occupational health and safety 2.1 Evaluate the hazards due to the physical properties of materials and suggest control measures from hierarchy of control perspective 2.2 Explain various forms of energy including the law of conservation of energy and their potential implications on health and safety at workplace 2.3 Explain Momentum, Inertia, Moment, Acceleration, Impulse, force, load, power, work, pressure, material stress, strain, heat, friction, Flow, Light, Noise, Vibration, and their significance from occupational health and safety perspective 2.4 Explain lever, pulley, screws, slope, wheels, pendulum and their significance from occupational health and safety perspective 2.5 Inspect & Evaluate a mechanical structure for its strength and durability in a given condition 2.6 Explain the human physiology with capabilities and capacities from an ergonomics perspective 3 Assess various inspection techniques and their applications for mechanical equipments 3.1 Explain current/ prevailing non destructive testing methods and their utility for ensuring safety of tools and equipments 3.2 Explain current/ prevailing destructive testing methods and their utility for ensuring the safety of tools and equipment 3.3 Identify and evaluate the cost benefit analysis and the frequency of inspections and testing of tools and equipments 3.4 Identify and justify the testing requirements for a bespoke designed product (Tools/ Equipments) 3.5 Review and identify the testing requirements for a refurbished/ modified product for occupational safety and health provisions 3.6 Justify the preference of an inspection method (From choice of prevailing NDT methods or any other prevailing destructive testing methods) over the others in a given environment for a specific work equipment etc. 3.7 Explain the reasons and contributory factors for material failures of tools, equipments or structures leading to unsafe conditions at the workplaces 3.8 Assess the risks of measurement uncertainty including the calibration frequency and its provisions 4 Assess the designs of tools, equipments or structures for their reliability for use in a given environment from an occupational health and safety perspective 4.1 Explain the common end user requirements for tools and equipments to be incorporated in design 4.2 Explain the role of a well designed tool, equipment or structure in occupational safety and health 4.3 Evaluate the design with respect to stated and implied use of tools, equipments and structures 4.4 Explain the design flaws which may compromise occupational safety and health at the workplaces 4.5 Explain the requirement of international standards of ASME (American Society of Mechanical engineers) in occupational safety and health from product design perspective 4.6 Explain the requirements of current/ prevailing design testing software and their implications on occupational health and safety provisions 4.7 Review a material failure investigation and suggest the design or any other changes 5 Assess the occupational health and safety risks from electricity at the workplaces 5.1 Explain the principle of electricity 5.2 Explain common terminology related to electricity including current (Alternating and Direct), resistance, voltage, single phase, 3 phase, circuits (Series and parallel), arcing, short circuiting. 5.3 Assess various electrical protection devices for their suitability of use in a specific work environment 5.4 Assess various electrical appliances for the risks to their users and other persons in varying work environments 5.5 Review and evaluate the sufficiency and adequacy of engineering controls against electricity hazards at the workplaces to ensure health and safety provisions 5.6 Analyze and evaluate the emergency preparedness and response procedure for its relevancy and completeness from electricity risks perspective 5.7 Evaluate the training and skill requirement by the workforce for safe use and maintenance of electrical appliances 5.8 Identify and assess prevailing electrical appliances and machinery being used in various industries with detailed hazards and risks in familiar and unfamiliar situations and environments. 5.9 Identify the potential risks of explosions from electrical appliances including any contributory factors which may give rise to the likelihood or severity 6 Assess the occupational health and safety risks from fire at the workplaces 6.1 Explain the principle of fire in context of fire initiation and propagation control 6.2 Identify type of raw materials being used at workplaces from fire propagation perspective 6.3 Justify the fire plan of the organization for its effectiveness with respect to its nature of work, size and context 6.4 Evaluate the emergency preparedness and response for potential fire occurrences within the workplaces due to the nature of work they carry out. 6.5 Review the organizational arrangements for controlling the fire spread and suggest the corrective actions 6.6 Explain common fire initiation causes in the organizations including the suitable control measures commensurate with nature, size and their context 6.7 Identify the current technologies being used across the globe for escape and rescue during fire and/ or other emergency situations and their use in specific workplaces 6.8 Outline the latest developments for fire extinguishing and their possible use in specific workplaces 6.9 Describe the training and skill requirements for emergency escape, fire control in specific organizations with varying nature and scope of work 6.10 Identify and interpret the legal requirements for safety arrangements against fire occurrences and how to incorporate them into organizational arrangements for compliance. 7 Assess the occupational health and safety risks from nuclear and other radiations hazards 7.1 Explain the principle of fission and fusion reactions in atomic power plants with emphasis on the requirements of occupational safety and health 7.2 Evaluate known type of radiations for their potential effects on OH&S 7.3 Explain the available engineering controls for containment of radiations and the limitation of their uses 7.4 Identify and interpret the applicable legal requirements for the exposure limits of various radiations 7.5 Explain the role of International Atomic Energy Agency (IAEA) regarding occupational safety and health against nuclear radiations 8 Assess the Biological health hazards at the workplace and the application of suitable controls 8.1 Explain common biological agents at the workplaces and the occupations which pose most risks 8.2 Assess the significance of health hazards due to presence of biological agents within the workplace 8.3 Justify the control measures commen.

See product

4 photos

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen.Auditor Diploma Course Content: Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen. Auditor Diploma Course Content: Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen. Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

Rs 30.000

See product

Jhelum (Punjab)

QuickBooks 2010: New Features Course details New Features in QuickBooks 2010 will introduce you to the significant changes in this latest version of the software. In this course you’ll learn about a variety of time-saving task and data entry features, learn how to easily customize professional, elegant forms, be introduced to the completely revised Report Centre, as well as discover a variety of connected services available at your fingertips. Course outline: This course consists of the following: 1. Saving time in Quickbooks 2010 2. Optimizing data entry 3. Improving form functionality 4. The Redesigned report center 5. The new Document Management System 6. Capitalizing on connected services Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Business Accounting Diploma We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at any time. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Professional Bookkeeper Introduction • Introduction to Accounting and Business • The Accounting Equation • Analyzing Transactions • Entering Information - Posting Entries • Adjusting Process • Adjusting Entries • Adjustment Summary • Preparing a Worksheet • Financial Statements • Completing the Accounting Cycle • The Accounting Cycle Illustrated • Fiscal Year • Spreadsheet Exercise Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Advance Accounting & Bookkeeping Diploma training course is comprehensive and is designed to cover the following key topics are listed under the curriculum. This course has been designed for 40 guided learning hours. COURSE CURRICULUM UNIT 01. ADVANCED ACCOUNTING • Type of Business Ownership • Accounting Concepts • Accounting Journals and Ledgers • Formulas & Equations • Financial Statements • Analysing of Financial Statements • Inventory Management • Accounting for Depreciation • Accounting for Compensation, Taxes & Liabilities • Closing and Adjusting Entries • Corporate Accounts UNIT 02. FINANCIAL ACCOUNTING • Introduction to Accounting • What are Financial Statements in Accounting • The Accounting Cycles • Preparing Financial Statements • Control in Accounting • Inventory Management in Accounting • Accounts Receivable • Operating Cycle in Accounting • Asset Management Section 02 • Liabilities in Accounting • Equity in Accounting- Section 2 • Cash Flow Statement Patterns • Analysing Financial Statements in Accounting UNIT 03. BOOKKEEPING TRAINING MANUAL • Bookkeeping Training Manual UNIT 04. ADDITIONAL STUDY MATERIALS • Additional Study Materials- Advance Accounting Certification: Successful candidates will be awarded certificate for “Diploma in Advance Accounting & Bookkeeping”. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 offers quality online, professional qualifications to individuals worldwide, catered to the way in which those looking to progress within their careers and business are wanting to learn. And, because the training is online – at times and locations that best suit your lifestyle. The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Payroll Management Level 3 Payroll Management Training Diploma Level 3 has been given SPTTC Punjab Board accreditation and is one of the best-selling courses available to students worldwide. This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you’re an individual looking to excel within this field then Payroll Management Training Diploma Level 3 is for you. We’ve taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept – from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success. All our courses offer 3 months access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full SPTTC accredited qualification. And, there are no hidden fees or exam charges. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Diploma in Payroll Management Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Peachtree Quickbook Tally course in Rawalpindi 03335671497 Peachtree Quickbook Tally course in Rawalpindi 03335671497 Peachtree Quickbook Tally course in Rawalpindi 03335671497 Peachtree Quickbook Tally course in Rawalpindi 03335671497 Peachtree Computerized Accounting Course Course Outline Review Basic Peachtree Features General Ledger Accounts Payable Inventory Accounts Receivable Payroll Time and Billing Utilities and Special Processing Class Timing Daily 1 Hour Course Duration : One Month Total Fee: PKR.6000/- IIT PAKISTAN (Inspire Institute of Technologies Pakistan) is a Professional organization established in 2009, affiliated with BSC(UK), SDC, TTB Government of Pakistan.IITP also have affiliations from International Bodies like ISO, Nebosh, Icertosh etc. We are providing education regarding almost every field of Technical Courses, like HSE, IT, ENGINEERING, MANAGEMENT, TECHNICAL etc. The vision of IITP is: establishing unique identity by development of high quality human and knowledge resources in diverse areas of technologies to meet local, national, and global economic and social need and human society at large in self-sustained manner. "The field of Health & Safety Management provides a glorious opportunity for a marvelous future worldwide. Those who aim to glow on the horizon of enviable success, feel free to contact us. We, at Inspire Institute Of Technologies - IIT Pakistan offer IDIPOSH, NEBOSH Diploma, Level 6 Health & Safety Diploma for GRADIOSH, NEBOSH OIL & GAS Course, ICERTOSH, NEBOSH IGC ITC & HSW, IOSH MS , OSHA IASP NASP,IBOEHS, IADC RIG PASS, EMS, QMS, OHSAS, HRM, TQM,QC,QA, DISASTER MANAGEMENT,BMS (Building Management System), CCTV, REVIT, 3d SOLID Work, INTERIOR DESIGNING, SAFETY OFFICER, CIVIL & QUANTITY SURVEYOR, WEB DEVELOPMENT,Peachtree, Quickbooks,AUTOCAD etc, courses to help you open professional doors for you globally. The mission of IIT is to train and transform young men and women into responsible thinking engineers, technologists and scientists, to motivate them to attain professional excellence and to inspire them to proactively engage themselves for the betterment of the society. We have trained alot of students almost every city and area of Pakistan Like; Azad Kashmir|Bagh|Bhimber|khuiratta|Kotli|Course in Mangla|Mirpur|Muzaffarabad| Plandri|Rawalakot |Punch|Balochistan|Amir Chah|Bazdar |Bela| Bellpat|Bagh|Burj|Chagai|Chah Sandan|Chakku |Chaman|Chhatr|Dalbandin|Dera Bugti|Dhana Sar|Diwana|Duki| Dushi|Duzab|Gajar |Gandava|Garhi Khairo|Garruck|Ghazluna|Girdan|Gulistan| Gwadar|Gwash|Hab Chauki|Hameedabad|Harnai|Hinglaj|Hoshab|Ispikan|Jhal|Jhal Jhao|Jhatpat|Jiwani|Kalandi |Kalat| Kamararod|Kanak|Kandi|Kanpur|Kapip|Kappar|Karodi|Katuri| Kharan| Khuzdar|Kikki|Kohan|Kohlu|Korak|Lahri|Lasbela|Liari|Loralai|Mach |Mand|Manguchar|Mashki Chah|Maslti |Mastung|Mekhtar|Merui|Mianez|Murgha Kibzai|Musa Khel Bazar|Nagha KalatNal|Naseerabad|Nauroz Kalat|Nur Gamma|Nushki|Nuttal|Ormara|Palantuk| Panjgur|Pasni|Piharak| Pishin|Qamruddin|Karez|Qila Abdullah|Qila Ladgasht|Qila Safed |Qila Saifullah| Quetta |Rakhni |Robat| Thana|Rodkhan|Saindak|Sanjawi|Saruna|Shabaz Kalat|Shahpur|Sharam Jogizai|Shingar |Shorap|Sibi|Sonmiani|Spezand|Spintangi|Sui|Suntsar|Surab|Thalo|Tump|Turbat|Umarao|pirMahal|Uthal|Vitakri|Wadh|Washap|Wasjuk|Yakmach |ZhobFederally Administered Northern Areas /FANA|Astor|Baramula|Hunza|Gilgit| Nagar|Skardu|Shangrila|Shandur |Federally Administered Tribal Areas/FATA|Bajaur|Hangu|Malakand|Miran Shah|Mohmand|Khyber|Kurram|North Waziristan|South Waziristan|Wana|NWFP|Abbottabad|Ayubia|Adezai|Banda Daud Shah|Bannu|Batagram| Birote|Buner|Chakdara|Charsadda|Chitral|Dargai|Darya Khan |Dera Ismail Khan| Drasan|Drosh|Hangu|Haripur|Kalam|Karak|Khanaspur|Kohat|Kohistan |Lakki Marwat|Latamber| Lower Dir|Madyan| Malakand|Mansehra|Mardan|Mastuj|Mongora|Nowshera| Paharpur| Peshawar|Saidu Sharif|Shangla|Sakesar|Swabi|Swat|Tangi|Tank|ThallTordher|Upper Dir|Punjab|Ahmedpur East |Ahmed Nager Chatha|Ali Pur|Arifwala|Attock|Basti Malook|Bhagalchur|Bhalwal|Bahawalnagar|Bahawalpur|Bhaipheru|Bhakkar|BurewalaChailianwala |Chakwal| Chichawatni|Chiniot|Chowk Azam|Chowk Sarwar Shaheed|Daska|Darya Khan|Dera Ghazi Khan|Derawar Fort|Dhaular|Dina City|Dinga|Dipalpur|Faisalabad| Fateh Jang|Gadar| Ghakhar Mandi|Gujranwala|Gujrat| Gujar Khan|Hafizabad|Haroonabad|Hasilpur| Haveli LakhaJampur|Jhang| Jhelum|Kalabagh |Karor Lal Esan|Kasur|Kamalia| Kamokey|Khanewal|Khanpur|Kharian|Khushab|Kot Addu|Jahania|Jalla Araain|Jauharabad|Laar|Lahore|Lalamusa|Layyah|Lodhran|Mamoori|Mandi|Bahauddin|Makhdoom Aali|Mandi Warburton| Mailsi| Mian Channu|Minawala|Mianwali|Multan| Murree|Muridke|Muzaffargarh|Narowal| Okara| Renala Khurd|Rajan Pur|Pak Pattan|Panjgur|Pattoki| Pirmahal| Qila Didar Singh| Rabwah|Raiwind| Rajan Pur|Rahim Yar Khan|Rawalpindi|Rohri|Sadiqabad|Safdar Abad – (Dhaban Singh)|Sahiwal|Sangla Hill|Samberial|Sarai Alamgir|Sargodha|Shakargarh|Shafqat Shaheed Chowk| Sheikhupura|Sialkot|Sohawa| Sooianwala| Sundar (city)| Talagang| Tarbela| Takhtbai| Taxila| Toba Tek Singh|| Vehari|Wah Cantonment| Wazirabad |Sindh |Ali Bandar| Baden|Chachro|Dadu|Digri| |Diplo| Dokri| Gadra|Ghanian|Ghauspur| Ghotki| Hala| Hyderabad| Islamkot| Jacobabad| Jamesabad| Jamshoro| Nebosh IGC safety course in Janghar| IOSH MS Safety Course in Jati (Mughalbhin)|Jhudo|Jungshahi| Kandiaro| Karachi| Kashmor| Keti Bandar |Khairpur |Khora |Klupro|Khokhropur| Korangi| Kotri| Kot Sarae| Larkana| Lund| Mathi|Matiari| Mehar| Mirpur Batoro | Mirpur Khas |Mirpur Sakro |Mithi| Mithani|Moro|Nagar Parkar|Naushara|Naudero|Noushero Feroz |Nawabshah |Nazimabad| Naokot|Pendoo|Pokran| Qambar|Qazi Ahmad|Ranipur|Ratodero|Rohri|Saidu Sharif|Sakrand| Sanghar|Shadadkhot |Shahbandar| Shahdadpur| Shahpur Chakar| Shikarpur| Sujawal| Sukkur| Tando Adam| Tando Allahyar| Tando Bago| Tar Ahamd Rind| Thatta| Tujal|Umarkot|Veirwaro|Warah..Inspire Institute of Technologies Pakistan.

See product

Pakistan

Softax - Workshop “ADVANCE TAXATION” Federal & Provincial SALES TAX LAWS. Learn how to handle critical issues relevant to identification & input adjustment of taxable goods & services, withholding, e-filing etc. at Regent Plaza, Karachi on 28-01-2016. Contact Mr. Mujtaba Qayyum at 0333-3358711 or 021-32640313 Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Pakistan

Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Pakistan (All cities)

DESCRIPTION Running Stationary shop for sale at Miltry Accounts housing society college road near smart school Mention that you found this ad on DealMarkaz.pk when you call.

See product