Audit account house

Top sales list audit account house

Pakistan

AD POSTING JOB NO physical Work,Just invest your skill & talent NO physical Work,Just invest your skill & talent NO physical Work,Just invest your skill & talent Make BIG Money monthly. Work Less and Earn More. Your payment will be sent to your account directly without any risk .To improve your business collect the source of income way and get more earning very quickly. Earn money from Home. All you need is a PC with Internet. Just Click on Website for more details. For More Details Visit Our Website: http://www.pureonlinejobs.weebly.com Phone: +923349742772, Skype id : Pureonline2

Free

See product

Pakistan

We are providing support/mentor opinion for those students who want to prepare their professional and academic assignments and thesis. we are specialized in these fields Account and Finance, Audit Assurance, Management, Marketing, Social studies and Fashion designing. further good supplier in these fields may contact with us. Online teaching and training are also available. please serious people contact with us on 03444164402

Rs 56

See product

Islamabad (Islamabad Capital Territory)

HOUSE NO. 608B, STREET NO. 111A, I – 8/4, ISLAMABAD Chartered Accountant Available for Accounting, Cost Accounting Management Accounting, Audit both Annual and Internal for Students of I.Com, A/O Levels, B.Com, BBA, MBA, M.Com, ACCA, ICMA and CA. Three days free trial Classes. SATISFACTION GUARANTEE TAUQEER HUSSAIN Phone: 051-4901494, 0303-5478158 tauqeerhussainmalik@hotmail.com

Rs 1,39

See product

Islamabad (Islamabad Capital Territory)

House No. 608-B, Street No. 111-A, I – 8/4, Islamabad From 10 AM to 7 PM Chartered Accountant Available for Accounting, Cost Accounting Management Accounting, Audit both Annual and Internal for Students of I.Com, A/O Levels, B.Com, BBA, MBA, M.Com, ACCA, ICMA and CA. Three days free trial Classes. SATISFACTION GUARANTEE TAUQEER HUSSAIN Mobile 0303-5478158, 0312-5178701 tauqeerhussainmalik@hotmail.com

Rs 1,5

See product

Rawalpindi (Punjab)

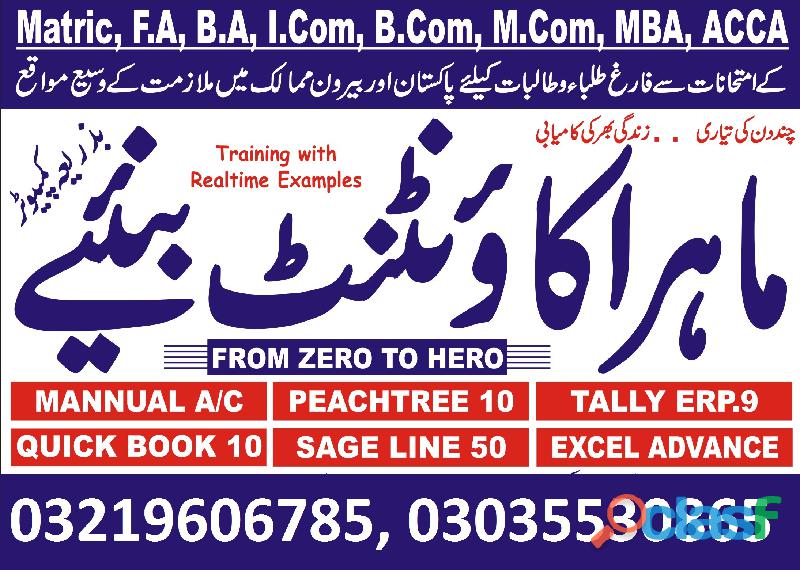

Certificate in Finance & Budgeting Quickbooks-PT,Talley ERP Course details Understanding the basics of finance and budget is helpful for everyone but upgrading these skills will help you achieve financial stability. This course can also help professionals who want to learn more knowledge and skills in budgeting to improve the financial management of their organization. This Level 2 Certificate in Finance & Budgeting lets you know more financial terms and concepts that you can implement to your business. You will be able to manage financial and budget plans through proper financial management and analysis. Course Highlights • The price is for the whole course including final exam - no hidden fees • Accredited Certificate upon successful completion at an additional cost • Efficient exam system with instant results Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks Pro 2012 & 2013 COURSE CURRICULUM 1. What’s new in Quickbook Pro 2013 2. Quickbook Overview 3. The Company file 4. Setting up for Multiple users 5. Navigation in Quickbook 6. Adjusting preferences 7. The Chart of Account 8. Company lists 9. Importing data 10. Working ith the Bank Account 11. Creating items 12. The Basic of working with Inventory 13. Working with Vendors & paying bills 14. Customers, Jobs & Recording sales 15. Sales Adjustments & Statements 16. Customizing templates & forms 17. Accounts Receivable & Deposits 18. Sales tax 19. Report & The Report center 20. Managing Employees 21. Working with Credit cards 22. Loans & Liabilities 23. Reconciling Accounts 24. Online Banking 25. What’s new in Quickbook 2012 26. Finalizing your Accounting How will I be assessed? • You will have one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sage 50 Accounts for Beginner Learners why not improve your chances of gaining professional skills and better earning potential. Course Curriculum • Module 1: Program Basics– Set up your program, discover more about the user interface such as toolbar and keyboard options • Module 2: Restoring and Backing-up Data – Learn about data storage, creating back-ups and restoring them • Module 3: Basic Setting and Details – Manage financial dates, company details and program dates • Module 4: The Chart of Accounts – Create, modify and review chart of accounts • Module 5: Bank Receipts – Enter bank receipts • Module 6: Bank Payments – Oversee VAT, overheads, assets and bank payments • Module 7: Financials – Observe the financial state of your company • Module 8: Customers – Add new customers, use the new customer wizard, and manage their details • Module 9: Suppliers – Add and edit supplier records • Module 10: Working with Lists – Utilize lists to sort out records • Module 11: Batch Invoices – Create customer invoices, check bank accounts and nominals • Module 12: Service Invoices – Create service, manage line and invoice • Module 13: Processing Invoices – Process invoices and update ledgers • Module 14: Product and Services – Duplicate, add items, services and products • Module 15: Stock Control – Control your stocks through adjustments, activity and returns • Module 16: Product Invoices – Invoice management for products utilizing multiple platforms • Module 17: Product Credit Notes – Create credit notes • Module 18: Reviewing Your Accounts – Review the financial state of your company • Module 19: Aged Debtors and Statements – Analyse account balances, aged debtors, statements and customer communication history • Module 20: Customer Receipts – Allocate receipts automatically, manually or partially using discounts and payments on account • Module 21: Customer Activity – Observe customer activity • Module 22: Supplier Batch Invoices – Add new suppliers, their account balances and batch invoices • Module 23: Supplier Payments – Record and observe supplier payments, activity, print remittance and cheques • Module 24: More about the Nominal Ledger – Journal entries, nominal code activity, ledger graphs and records • Module 25: More about bank accounts – Learn about bank transfers, combined payments and petty cash transactions • Module 26: Using the Cash Register – Recording and depositing with the cash register • Module 27: Bank Reconciliation – Reconcile bank account and carry out group transactions • Module 28: Recurring Entries – Recurring entry processes including bank set up, adding journals, and deleting recurring entries • Module 29: VAT Returns – Produce, make, print, reconcile and complete VAT related transactions • Module 30: More About Reports – Follow the audit trail, period trial balance, profit and loss, and the balance sheet report • Module 31: Using Dashboards – Use the dashboards effectively Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Business Basics Course details Overview This course will be extremely useful for business owners, or those hoping to go into business accounting. Get to grips with all the financial basics of business, how to set up and maintain an effective payroll system, how to get your business out there, and how to use SEO effectively. Learners will come away from this course with a whole host of useful skills, which will help you to gain employment in the accounting and business world. Description This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Introduction 2: Business Entities 3: Beginning Your Business 4: Financial Basics Part 1-2 5: Employees Payroll 6: Getting Your Business Out There 7: Seo 8: Other Topics 9: Closing Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Accounting and Bookkeeping Diploma Level 3 it can be done at any time by extending your subscription. Course Curriculum 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgeting for your Daily Life This course aims to help individuals who are having a difficult time budgeting to successfully control their money and limit spending on unnecessary items. In this course, you will learn how to set goals, create your own budget effectively, overcome debts and overspending, and also acquire strategies that will help in making long-term budgeting effective and successful. Take back control of your finances and become a savvy spender! COURSE CURRICULUM 1. Learning how to budget 2. Realizing, where your money goes 3. Self- assessment 4. Setting up the budget 5. Creating monthly vs. Yearly budgets 6. Sticking to your budget using strategies 7. Long term budgeting The method of Assessment: At the end of the course, learners will take an online multiple choice questions assessment test. This test is marked automatically, so you will receive an instant grade and know whether you have passed the course. Certification: Successful candidates will be awarded certificate in Budgeting for your Daily Life. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Investment Analyst/Portfolio Manager Diploma Course details Overview Upon completion of this diploma course including having understood the entire study material you will be able to work successfully as an Investment Analyst and/or Portfolio Manager. Description Content: • The Investment Setting • The Asset Allocation Decision • Efficient Capital Markets • Portfolio Management • Stock Market Analysis • Technical Analysis • Equity Portfolio Management Strategies • Bond Portfolio Management Strategies • Swap Contracts, Convertible Securities, and Other Embedded Derivatives etc. Assessment This course will be assessed on the basis of one assignment. We believe doing practical assignments are the best way to assess the ability of the students and also it is the best way to make them apply what they have learnt into practice. Students can start their assignments from day one and complete the course as soon as they submit their assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Managerial and Cost Accounting This Diploma in Managerial Cost Accounting will prepare you for employment within this exciting industry, and will allow you to become highly skilled when it comes to cost accounting. The course covers a whole range of exciting topics, including: Overview of Managerial Accounting, Planning and Directing, Key Components of Cost, and Cost of Flow Concept. Become a successful Cost Accountant with this excellent course. Course Description: This online training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Method of Assessment: At the end of the course, learners will take an online multiple choice question assessment test. The online test is marked straight away, so you will know immediately if you have passed the course. Certification: Successful candidates will be awarded a certificate for Diploma in Managerial and Cost Accounting. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Peachtree Pro Accounting 2009 This excellent Peachtree Pro Accounting 2009 course will provide an in depth introduction to the general accounting features of Peachtree Pro Accounting, as well as step-by-step instructions on how to set up a new company, vendors, and employee payroll on Peachtree Pro Accounting. During this excellent Peachtree Pro Accounting course, you will learn how to achieve better business results, whether you’re business is new, or you’re an experience business manager. This Peachtree Pro Accounting course is taught by an expert instructor, and is packed full of insider knowledge and tips, to help your business improve. If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM 1. Gaap And How Peachtree Works To Ensure Your Accounting Complies To The Standards 2. How To Set Up Company Defaults 3. Peachtree Tools For Entering And Managing Accounting Components 4. Form And Report Customization 5. Securing, Backing Up And Restoring Critical Data How will I be assessed? • You will have one assignment. • You will only need to pay £19 for assessment when you submit your assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

3 photos

Pakistan (All cities)

Quickbooks-PT,Talley ERP Accounting for Business If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM BOOKKEEPING AND PAYROLL MANAGEMENT • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts • Working with Ledgers • Reconciliation • Correcting Entries • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record • The Partnership & Corporations • Accounts Receivable and Bad Debts • Preparing Interim Statements • Year End – Inventory BUSINESS ACCOUNTING • Introduction to Bookkeeping • Defining a Business • Ethics and Accounting Principles • Accounting Equation & Transactions • Financial Statements • The Accounting Equation and Transactions • Transactions – Journalizing • Posting Entries and The Trial Balance • Finding Errors Using Horizontal Analysis • The Purpose of the Adjusting Process • Adjusting Entries • Vertical Analysis • Preparing a Worksheet • The Income Statement • Financial Statements- Definitions • Temporary vs. Permanent Accounts • Accounting Cycle • Financial Year • Spreadsheet Exercise How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2016 – Accounts, Payroll Management This QuickBooks Pro 2016 training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 20 guided learning hours. COURSE CURRICULUM: 01 • The Home Page • The Icon Bar • Creating a QuickBooks Company File • Setting Up Users • Using Lists 02 • The Sales Tax Process • Creating Sales Tax • Setting Up Inventory • Creating a Purchase Order • Setting Up Items 03 • Selecting a Sales Form • Creating a Sales Receipt • Using Price Levels • Creating Billing Statements • Recording Customer Payments 04 • Entering a Vendor Credit • Using Bank Accounts • Sales Tax • Graph and Report Preferences • Modifying a Report • Exporting Reports 05 • Using Graphs • Creating New Forms • Selecting Objects in the Layout Designer • Creating a job • Making Purchases for a Job • Time Tracking 06 • Payroll – The Payroll Process • Payroll – Setting Up Employee Payroll Information • Payroll – Creating Termination Paycheques • Payroll – Adjusting Payroll Liabilities 07 • Using Credit Card Charges • Assets and Liabilities • Creating Fixed Asset Accounts • Equity Accounts • Writing Letters with QuickBooks 08 • Company Management • Company File Cleanup • Using the Portable Company Files • Creating an Account’s Copy Course Duration: You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Finance For Non-Financial Professionals As a non-financial professional, you need to quickly understand and distinguish good information from poor-quality information, otherwise, your decisions may adversely affect business performance and your career prospects. This course is designed with a practical view to finance. It's suitable for professionals at all levels and entrepreneurs alike. In this course you will learn: • How to understand and use financial statements • Including; profit and loss, balance sheets and cash flow forecasts • Budgeting and forecasting techniques to improve decision-making • How to use Key Performance Indicators (KPIs) effectively • How to appraise an investment using financial techniques • The best way to develop a business plan Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP HR & Payroll Management This course has been specifically designed for those looking to learn the basics of being successful in the human resources and payroll management fields. As a bonus, we also share a few tricks for getting your foot in the door! We'll cover payroll management, hiring diversity, negotiations, working with a leadership team, payroll, benefits, insurance, payroll systems, and general management techniques. Everything you need to be a skilled, knowledgeable HR officer is in this course! Course for? For those who: • Are interested in a career in Human Resources and Payroll Management • Current HR and payroll employees who would like to improve their skills • Small business owners who are looking to make sure that they are providing a good work environment for employees • Those who would like to explore further the field of HR Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bookkeeping Diploma Level 3 The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Certification: Successful candidates will be awarded Diploma in Accounting and Bookkeeping – Level 3. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Managerial and Cost Accounting Course Description: This Campus based training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Benefits you will gain: By enrolling in this course, you’ll get: • High-quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • Includes step-by-step tutorial videos and an effective, professional support service. job roles this course is suitable for: Cost Accountant , Management Accountant , Accountant Assistant , Project Cost Accountant Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad The Complete Sage 50 Accounting Diploma Quickbooks-PT,Talley ERP The Sage 50 Intermediate Course This course builds on the concepts learned in the beginners’ course and assumes that you have a working knowledge of the basic features together with an understanding of simple transactions. You will begin by learning about accruals and prepayments, along with the calculation of assets and depreciation. You will not only learn how to undertake these more advanced transactions but also how to fix errors such as inaccurately processed assets.Stock control and monitoring are also covered in depth, enabling you to manage stock levels with confidence. You will also learn how to create an audit trail for complex transactions such as those involving discounted items and credit notes.The Sage 50 Advanced CourseThis course moves beyond everyday transactions and emphasises the processes required in chasing debt and credit control. You will learn why quotations are important, and how they can improve sales. You will gain an understanding into how businesses recover credit and payment from customers, and how to keep accurate records during the process.Audit trails are a key aspect of accurate accounting and you will gain further knowledge and insight into this process during the course. You will also gain a better understanding of budgeting, as well as how to correct common mistakes in record-keeping. Finally, you will also develop your skills in producing customised reports. The Benefits of Our Complete Sage 50 Accounting Course This course will give you a complete overview of all the main accounting tools Sage 50 offers, from the basic to the advanced. This will make you an attractive candidate for any position that entails company accounts including invoicing and debt management. You will not only be a proficient user of Sage 50 software, but you will also be able to demonstrate an in-depth understanding of how financial matters are controlled within a business. Benefits of taking the Complete Sage 50 Accounting Diploma: • Study at home and online • Study at your own pace • Access to full online support whilst completing the course • Easy-to-read modules packed with information • No entry requirements • A chance to receive an accredited qualification upon completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen.Auditor Diploma Course Content: Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen. Auditor Diploma Course Content: Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

See product

Rawalpindi (Punjab)

Auditor diploma course in Rawalpindi, Islamabad, Pakistan. Auditing Diploma in Rawalpindi, Islamabad, Pakistan. Auditing course in Rawalpindi, Islamabad, Pakistan. Internal or External Audit course in Pakistan. Safety Auditor course in rawalpindi, Islamabad, Pakistan. Auditor course experiance based Govt Registered diploma for Overseas Pakistani in Middle East, Bahrain, Iraq, Kuwait, Oman, Qatar, United Arab Emirates, UAE, Saudi Arabia, Yemen. Fundamentals of Auditing Auditor?s report Advantages and Disadvantages Auditing Objective and General Principal Governing an Audit of Financial Statements Reasonable Assurance Legal consideration Regarding Auditing Rights, Duties and liabilities of Auditor Books of account & Financial Statements Statutory Requirements Regarding Company Accounts Understanding the Entity & Its Environment & Assessing the Risk of Material Misstatement Documenting the Internal Control System Evaluating the Internal Control System Internal Control Questionnaire Audit Tests

Rs 30.000

See product

Karachi (Sindh)

Somic Teacher & Tutors We provide home tuition in all areas of Karachi by qualified, experienced, dedicated, honest teachers & tutors. We have the team of professional home tutors. All courses expert teachers & tutors are available for home tuition services. Contact: 03158299962 Zeeshan Call: 03158299962 We have also a professional team for commerce session, such as, Inter commerce, Bachelor of commerce, I.com, B.com, BS, BBA (finance), BBA (marketing), MBA (finance), and MBA (marketing). Every teacher or tutor is perfect or expert in Accounting, Statistics, Economics, Business studies, Business laws, applied mathematics and other subjects. Teacher & tutor are also being provided for those students who are doing or attempting CA, ACCA, CAT and CIMA certificates. Just call at: 03158299962 – Zeeshan Pre-Medical, Pre-Engineering, Science, Arts home private tuitions are also taught by the best teachers & tutors from different places of Karachi. All teachers & tutors are well aware about each subject, such as, Biology, Chemistry, Physics, Maths, Botany, Zoology and all others. Make a Call: 03158299962 DIAL: 03158299962, accounting, statistics, maths, mathematics, economics, Advance, cost, GAAP, FASB, IAS, CA, CAT, Landhi, Korangi, Malir, Kalaboard, Shah Faisal, PECHS, Johar, Gulistan-e-Johar, Gulshan-e-Iqbal, North Karachi, North Nazimabad, Saddar, Clifton, Defence, Orangi Town, Malir Cantt, Quaid-e-Azam, Mazar-e-Quaid, Zainab Market, KFC, Pizza, Shopping Mall, hospitals, tuition, biology, physics, chemistry, zoology, English language, SEO, search engine optimizer, playing, 03158299962, game, cricket, football, books, markets, offices, company, corporation, zong, telenor, ufone, mobilink, jazz, warid, life ka network, hockey, baseball, English, batany, doctor, engineer, Karachi, numaish, university, college, school, students, Iqra University, IBA, Institute, Al Hamd Accountancy, Tabani’s School of Accountancy, Anis Hussain, Drig road, Nipa, Civic Centre, Stadium, 03158299962, Bahadurabad, Tariq road, M A Jinnah road, Light house, Mango Pir, Peer, Pictures, Cell Phones, Mobile Phone packages, home tutor for child, children, men, man, woman, women, girl, boy, awesome, beautiful, personality, jorya bazaar, Disco Backery, The Millenium Mall, Pizza Hut, Deal, Make a Deal, Introduction to Business, Faisal Bank, Habib Bank, Bank Al-Habib, National Bank of Pakistan, Faysal Bank, Dubai Islami Bank, Allied Bank, Muslim Bank, saving account, PLS account, current account, fixed account, deposit, check, cheque book, qualified, 03158299962, experience, medical, Dow University of Health & Sciences, NED University, Sir Syed University, Urdu University, Gulshan College of Commerce, Domino English Learning Institute,stop, building, room, colour, electrician, meson, Pakistan, Zeeshan Ahmed, 03158299962

Rs 1.000

See product

Shekhüpura (Punjab)

Solar Panel Technician Course in Sheikhupura Rahimyar Khan, Solar Panel Technician Course in Rawalpindi Attock Chakwal, International College Of Technical Education Offer Solar Panel Technician Course in Rawalpindi Attock Chakwal 03115193625, Professional Solar Panel Technician Course in Rawalpindi Attock Chakwal 03354176949, Best Solar Panel Technician Course in Rawalpindi Attock Chakwal 03115193625, Lowest Fee Practical Work Solar Panel Technician Course in Rawalpindi Attock Chakwal 03115193625, Admission open for admission and queries call 03115193625,03354176949. INTERNATIONAL COLLEGE OF TECHNICAL EDUCATION Pakistan No.1 IT Training, Technical, Management and Safety Officer Institute, For More Information Visit Our Website http://www.icollegete.com/ https://courses.com.pk/ Certification acceptable in Government job and Worldwide UK USA KSA UAE Canada Dubai Muscat Oman Bahrain Kuwait Qatar Saudia Japan China, This course gives you an introduction to the fundamentals of solar power as it applies to solar panel system installations. You will learn to compare solar energy to other energy resources and explain how solar panels, or photovoltaics (PV for short), convert sunlight to electricity. You will be able to identify the key components needed in a basic photovoltaic (solar panel) system, such as is found on a house or building, and explain the function of each component in the system. You will also learn how to calculate the electrical demand of a building, how to reduce the overall demand, and then how to design a solar panel system that can meet that annual demand at a given location. You will also compare the different types of pricing models that are being used and key regulatory considerations for grid tied systems (where a house or building is connected to the electrical grid and also generates electricity from solar panels). A capstone design project that entails both the simple audit of a building to determine demand, and a selection of components to design a solar panel system to meet that demand.Our Solar Energy Technician Program prepares individuals to apply basic engineering principles and technical skills in support of engineers and other professionals engaged in developing solar-powered energy systems. Course includes instruction in solar energy principles, energy storage and transfer technologies, testing and inspection procedures, system maintenance procedures, and report preparation.Other topics include site analysis, system sizing, array configuration, and electricity basics; electrical design characteristics such as wiring, overcurrent protection, and grounding; a detailed look at module and inverter specifications and characteristics; mounting methods for various roof structures and ground mounts; and an introduction to safety, construction management, commissioning and more. Renewable energy developers Electric utility design or planning engineers Power system dispatchers Consulting engineers Project managers Managers of design departments Engineering technicians Introduction to PV systems Solar radiation Site surveys and preplanning System components and configuration Test Cells, modules and arrays Inverters System sizing and design Mechanical integration Electrical integration Designing a complete system (Each student designs a full system under different conditions) Safety instructions according to OSHA regulations Installing different brands of mounting hardware and tracks Installing panels Electrical connection Codes regulations Permits, Grants and Regulations Final test Admission open for admission and queries call 03115193625,03354176949. INTERNATIONAL COLLEGE OF TECHNICAL EDUCATION Pakistan No.1 IT Training, Technical, Management and Safety Officer Institute, For More Information Visit Our Website http://www.icollegete.com/ https://courses.com.pk/ Certification acceptable in Government job and Worldwide UK USA KSA UAE Canada Dubai Muscat Oman Bahrain Kuwait Qatar Saudia Japan China http://www.icollegete.com/course/solar-system-technician-course-in-rawalpindi-pakistan/ http://www.icollegete.com/course/competency-experience-based-diploma-course-in-rawalpindi-pakistan/ https://courses.com.pk/technical-training/solar-system-technician-course-training-in-pakistan-4f5f.html

Rs 35.000

See product

8 photos

Pakistan

Softax - Workshop “ADVANCE TAXATION” Federal & Provincial SALES TAX LAWS. Learn how to handle critical issues relevant to identification & input adjustment of taxable goods & services, withholding, e-filing etc. at Regent Plaza, Karachi on 28-01-2016. Contact Mr. Mujtaba Qayyum at 0333-3358711 or 021-32640313 Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Pakistan

Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Pakistan (All cities)

OTHM Level 6 Diploma in Occupational Health & Safety in Islamabad, Rawalpindi, Karachi, Peshawar, Lahore and Pakistan O3165643400, O3119903317 The objective of the OTHM Level 6 Diploma in Health and Social Care Management qualification is to equip learners with the underpinning knowledge, understanding and skills required for a career in the health and social care sector at a managerial level. The programme enables learners to demonstrate their skills by producing evidence from their work activities, to meet national occupational standards. Learners will acquire care management skills in the Health and Social Care sector. OTHM qualifications at RQF Level 6 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent to Bachelor’s Degrees with Honours, Bachelor’s Degrees, Professional Graduate Certificate in Education (PGCE), Graduate Diplomas and Graduate Certificates. The Diploma in Occupational Health and Safety Management – Level 6 (Accredited by Eduqual, UK) is a qualification for aspiring health and safety professionals. It is aimed at learners who are responsible for developing and applying health and safety procedures day-to-day in an organisation. They are likely to be managers looking to improve their knowledge and skills. Qualifications Our qualifications are made up of the Regulated Qualification Framework (RQF) rules which provides flexible ways to get a qualification. Qualifications at the same level are a similar level of difficulty, but the size and content of the qualifications can vary. The Level 4, 5 and 6 diploma qualifications are equivalent to Year 1, 2 and 3 (Final year) respectively of a three-year UK Bachelor’s degree. Each level consists of 120 credits. Completing any of the level 4, 5 and 6 qualifications will enable learners a progression to the next level of higher education at UK universities. The Level 6 qualifications in Clinical Aesthetic Injectable Therapies are designed to enable learners / practitioners to provide the highest standards of patient and client care during all stages of delivering cosmetic / aesthetic injectable therapies. By achieving these qualifications, learners will acquire the knowledge, skills and competence to administer treatments safely and appropriately, adhering to the principles of ‘do no harm’ and promoting public health at all times. Registered healthcare professionals e.g. doctors, dentists, nurse prescribers, allied health professionals, independent pharmacist prescribers. In addition to formal identification documentation and previous qualification certificates, learners must produce evidence of registration with an appropriate professional body* e.g. GMC, GDC, NMC.HCPC Registered healthcare professionals from any group who do not hold prescribing rights must provide evidence of working under the clinical oversight of a professional who has regulated prescribing rights. *Learners may not be registered for either qualification if they have any conditions noted on their professional body (PRSB) registration. OTHM require centres to check applicants’ status with regards to PRSB registration prior to registration on the qualification and evidence of this retained for scrutiny by OTHM. Nurses and Allied-healthcare professionals (and those registered with the Health and Care Professions Council) who are not independent prescribers are subject to CPSA / JCCP requirements for working under the clinical oversight of an appropriate professional i.e. they must have access to, and support from, experienced clinicians who are able to deal with medical emergency situations and complications and, have independent prescribing rights. Applicants registered with non UK regulatory bodies Applicants who provide evidence of registration on non UK regulatory bodies e.g. The Medical Board of Australia; will have their registration confirmed and vetted on that register and their eligibility to practice in the UK must be confirmed through the appropriate professional register. If there is no evidence of registration, or conditions are noted on that registration, the applicant will not be eligible to register for the qualification. Non UK regulatory bodies must be nationally recognised to be considered a suitable register. Each application will be evaluated on a case by case or individual basis. English requirements: If a learner is not from a majority English-speaking country, they must provide evidence of English language competency. For more information visit English Language Expectations page in the OTHM website. Equivalences OTHM qualifications at RQF Level 7 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent in level to Master’s Degrees, Integrated Master’s Degrees, Postgraduate Diplomas, Postgraduate Certificate in Education (PGCE) and Postgraduate Certificates. Overview Accounting and finance are at the very heart of business operations. From banking to manufacturing, from huge service industries to micro businesses, the ability to manage, plan and account for money is still the ultimate measure of business success and the key driver of growth. Many accountants occupy key managerial positions in business, yet few are qualified managers. In the increasingly complex modern business environment, there is a high demand for skilled professionals who can work flexibly in teams across business boundaries. The objective of the OTHM Level 6 Diploma in Accounting and Business qualification is to provide learners with the knowledge and skills required by a middle or senior manager in an organisation, and who may be involved in managing organisational finances, investment and risk, audit and assurance, or research. Entry requirements For entry onto the OTHM Level 6 Diploma in Accounting and Business qualification, learners must possess: Relevant NQF/QCF/RQF Level 5 diploma or equivalent recognised qualification Mature learners (over 21) with management experience (learners must check with the delivery centre regarding this experience prior to registering for the programme) Learner must be 18 years or older at the beginning of the course English requirements: If a learner is not from a majority English-speaking country must provide evidence of English language competency. For more information visit English Language Expectations page in this website Equivalences OTHM qualifications at RQF Level 6 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent to Bachelor’s Degrees with Honors, Bachelor’s Degrees, Professional Graduate Certificate in Education (PGCE), Graduate Diplomas and Graduate Certificates. The level 6 Diploma in Occupational Health and Safety is a qualification for aspiring health and safety professionals. It is aimed at learners who are responsible for developing and applying health and safety procedures day-to-day in an organization. They are likely to be managers looking to improve their knowledge and skills. The Diploma is designed to provide learners with the expertise required to undertake a career as a health and safety practitioner and it also provides a sound basis for progression to postgraduate study. OTHM Level 6 Diploma in Occupational Health & safety in Islamabad, OTHM Level 6 Diploma in Occupational Health & safety in Rawalpindi, OTHM Level 6 Diploma in Occupational Health & safety in Gujranwala, OTHM Level 6 Diploma in Occupational Health & safety in Sialkot, OTHM Level 6 Diploma in Occupational Health & safety in Sargodha, OTHM Level 6 Diploma in Occupational Health & safety in Gujrat, OTHM Level 6 Diploma in Occupational Health & safety in Lahore, OTHM Level 6 Diploma in Occupational Health & safety in Faisalabad, OTHM Level 6 Diploma in Occupational Health & safety in Multan, OTHM Level 6 Diploma in Occupational Health & safety in Mandi Bahauddin, OTHM Level 6 Diploma in Occupational Health & safety in Bahawalpur, OTHM Level 6 Diploma in Occupational Health & safety in Attock, OTHM Level 6 Diploma in Occupational Health & safety in Chakwal, OTHM Level 6 Diploma in Occupational Health & safety in Mirpur, OTHM Level 6 Diploma in Occupational Health & safety in Bagh, OTHM Level 6 Diploma in Occupational Health & safety in Rawala kot, OTHM Level 6 Diploma in Occupational Health & safety in Kotli, OTHM Level 6 Diploma in Occupational Health & safety in Karachi, OTHM Level 6 Diploma in Occupational Health & safety in Hyderabad, OTHM Level 6 Diploma in Occupational Health & safety in Mardan, OTHM Level 6 Diploma in Occupational Health & safety in Peshawar, OTHM Level 6 Diploma in Occupational Health & safety in Swat, OTHM Level 6 Diploma in Occupational Health & safety in Rawat, OTHM Level 6 Diploma in Occupational Health & safety in Sawabi, OTHM Level 6 Diploma in Occupational Health & safety in Sahiwal, OTHM Level 6 Diploma in Occupational Health & safety in Sakkar, OTHM Level 6 Diploma in Occupational Health & safety in Haripur, OTHM Level 6 Diploma in Occupational Health & safety in Pakistan O3165643400, O3119903317,

See product

4 photos

Islamabad (Islamabad Capital Territory)

OTHM Level 6 Diploma in Occupational Health & safety in Islamabad, OTHM Level 6 Diploma in Occupational Health & safety in Rawalpindi, OTHM Level 6 Diploma in Occupational Health & safety in Gujranwala, OTHM Level 6 Diploma in Occupational Health & safety in Sialkot, OTHM Level 6 Diploma in Occupational Health & safety in Sargodha, OTHM Level 6 Diploma in Occupational Health & safety in Gujrat, OTHM Level 6 Diploma in Occupational Health & safety in Lahore, OTHM Level 6 Diploma in Occupational Health & safety in Faisalabad, OTHM Level 6 Diploma in Occupational Health & safety in Multan, OTHM Level 6 Diploma in Occupational Health & safety in Mandi Bahauddin, OTHM Level 6 Diploma in Occupational Health & safety in Bahawalpur, OTHM Level 6 Diploma in Occupational Health & safety in Attock, OTHM Level 6 Diploma in Occupational Health & safety in Chakwal, OTHM Level 6 Diploma in Occupational Health & safety in Mirpur, OTHM Level 6 Diploma in Occupational Health & safety in Bagh, OTHM Level 6 Diploma in Occupational Health & safety in Rawala kot, OTHM Level 6 Diploma in Occupational Health & safety in Kotli, OTHM Level 6 Diploma in Occupational Health & safety in Karachi, OTHM Level 6 Diploma in Occupational Health & safety in Hyderabad, OTHM Level 6 Diploma in Occupational Health & safety in Mardan, OTHM Level 6 Diploma in Occupational Health & safety in Peshawar, OTHM Level 6 Diploma in Occupational Health & safety in Swat, OTHM Level 6 Diploma in Occupational Health & safety in Rawat, OTHM Level 6 Diploma in Occupational Health & safety in Sawabi, OTHM Level 6 Diploma in Occupational Health & safety in Sahiwal, OTHM Level 6 Diploma in Occupational Health & safety in Sakkar, OTHM Level 6 Diploma in Occupational Health & safety in Haripur, OTHM Level 6 Diploma in Occupational Health & safety in Pakistan O3165643400, O3119903317,OTHM Level 6 Diploma in Occupational Health & Safety in Islamabad, Rawalpindi, Karachi, Peshawar, Lahore and Pakistan O3165643400, O3119903317 The objective of the OTHM Level 6 Diploma in Health and Social Care Management qualification is to equip learners with the underpinning knowledge, understanding and skills required for a career in the health and social care sector at a managerial level. The programme enables learners to demonstrate their skills by producing evidence from their work activities, to meet national occupational standards. Learners will acquire care management skills in the Health and Social Care sector. OTHM qualifications at RQF Level 6 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent to Bachelor’s Degrees with Honours, Bachelor’s Degrees, Professional Graduate Certificate in Education (PGCE), Graduate Diplomas and Graduate Certificates. The Diploma in Occupational Health and Safety Management – Level 6 (Accredited by Eduqual, UK) is a qualification for aspiring health and safety professionals. It is aimed at learners who are responsible for developing and applying health and safety procedures day-to-day in an organisation. They are likely to be managers looking to improve their knowledge and skills. Qualifications Our qualifications are made up of the Regulated Qualification Framework (RQF) rules which provides flexible ways to get a qualification. Qualifications at the same level are a similar level of difficulty, but the size and content of the qualifications can vary. The Level 4, 5 and 6 diploma qualifications are equivalent to Year 1, 2 and 3 (Final year) respectively of a three-year UK Bachelor’s degree. Each level consists of 120 credits. Completing any of the level 4, 5 and 6 qualifications will enable learners a progression to the next level of higher education at UK universities. The Level 6 qualifications in Clinical Aesthetic Injectable Therapies are designed to enable learners / practitioners to provide the highest standards of patient and client care during all stages of delivering cosmetic / aesthetic injectable therapies. By achieving these qualifications, learners will acquire the knowledge, skills and competence to administer treatments safely and appropriately, adhering to the principles of ‘do no harm’ and promoting public health at all times. Registered healthcare professionals e.g. doctors, dentists, nurse prescribers, allied health professionals, independent pharmacist prescribers. In addition to formal identification documentation and previous qualification certificates, learners must produce evidence of registration with an appropriate professional body* e.g. GMC, GDC, NMC.HCPC Registered healthcare professionals from any group who do not hold prescribing rights must provide evidence of working under the clinical oversight of a professional who has regulated prescribing rights. *Learners may not be registered for either qualification if they have any conditions noted on their professional body (PRSB) registration. OTHM require centres to check applicants’ status with regards to PRSB registration prior to registration on the qualification and evidence of this retained for scrutiny by OTHM. Nurses and Allied-healthcare professionals (and those registered with the Health and Care Professions Council) who are not independent prescribers are subject to CPSA / JCCP requirements for working under the clinical oversight of an appropriate professional i.e. they must have access to, and support from, experienced clinicians who are able to deal with medical emergency situations and complications and, have independent prescribing rights. Applicants registered with non UK regulatory bodies Applicants who provide evidence of registration on non UK regulatory bodies e.g. The Medical Board of Australia; will have their registration confirmed and vetted on that register and their eligibility to practice in the UK must be confirmed through the appropriate professional register. If there is no evidence of registration, or conditions are noted on that registration, the applicant will not be eligible to register for the qualification. Non UK regulatory bodies must be nationally recognised to be considered a suitable register. Each application will be evaluated on a case by case or individual basis. English requirements: If a learner is not from a majority English-speaking country, they must provide evidence of English language competency. For more information visit English Language Expectations page in the OTHM website. Equivalences OTHM qualifications at RQF Level 7 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent in level to Master’s Degrees, Integrated Master’s Degrees, Postgraduate Diplomas, Postgraduate Certificate in Education (PGCE) and Postgraduate Certificates. Overview Accounting and finance are at the very heart of business operations. From banking to manufacturing, from huge service industries to micro businesses, the ability to manage, plan and account for money is still the ultimate measure of business success and the key driver of growth. Many accountants occupy key managerial positions in business, yet few are qualified managers. In the increasingly complex modern business environment, there is a high demand for skilled professionals who can work flexibly in teams across business boundaries. The objective of the OTHM Level 6 Diploma in Accounting and Business qualification is to provide learners with the knowledge and skills required by a middle or senior manager in an organisation, and who may be involved in managing organisational finances, investment and risk, audit and assurance, or research. Entry requirements For entry onto the OTHM Level 6 Diploma in Accounting and Business qualification, learners must possess: Relevant NQF/QCF/RQF Level 5 diploma or equivalent recognised qualification Mature learners (over 21) with management experience (learners must check with the delivery centre regarding this experience prior to registering for the programme) Learner must be 18 years or older at the beginning of the course English requirements: If a learner is not from a majority English-speaking country must provide evidence of English language competency. For more information visit English Language Expectations page in this website Equivalences OTHM qualifications at RQF Level 6 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent to Bachelor’s Degrees with Honors, Bachelor’s Degrees, Professional Graduate Certificate in Education (PGCE), Graduate Diplomas and Graduate Certificates. The level 6 Diploma in Occupational Health and Safety is a qualification for aspiring health and safety professionals. It is aimed at learners who are responsible for developing and applying health and safety procedures day-to-day in an organization. They are likely to be managers looking to improve their knowledge and skills. The Diploma is designed to provide learners with the expertise required to undertake a career as a health and safety practitioner and it also provides a sound basis for progression to postgraduate study.

See product

4 photos