Accounts tax accounting

Top sales list accounts tax accounting

Pakistan

Accounting software peachtree, quick books, tally trainer in karachi. Asslam-o-Alyekum Hi Dear All, A Professional Accountant, MBA Qualified, Certified, Awarded & 12 years Experienced Teacher/ Consultant from Textile, Foods, Advertising, Printing Press Industries, Importer of Computers / Electronic Items, Property Dealer, Marble Exporter & Yarn Manufacturing Industries, already Lecturer in a Known well Institute/ College in Karachi named (Academy of Excellence / Excellence Intermediate College) offering you all to teach at your Office, Factory & Home. My students are mostly in Dubai, Ajman, S. Arab, Bahrain, South Africa, USA, Canada & South Korea. Please see the below detail of those Companies where I have already thought these software And I have also their Certificates. 1- M/s. Amour Textile Industries (Pvt.) Limited. (Exporter of Textile) Peachtree – 2007 (Completed) 2- M/s. Nacisey (Pvt.) Ltd. (Food Industry) Quick Books – 2011 (Completed) 3- M/s. TransformaX (Unilever Pakistan & Engro Foods Advertising Agency Vendor) Peachtree – 2010 (Completed) 4- M/s. Sana Enterprises. (Printing Press Ind. / GSK Pharmaceutical Vendor) Peachtree – 2007 (Completed) 5- M/s. Base System (Dubai Base Company Importer of Computers / Laptops Accessories) Peachtree - 2014 (Completed) 6- M/s. Legal Aid Society (NGO Organization) - Quick Books - 2014 (Completed) 7- M/s. SMB Marble Company (Exporter of Marble) – Peachtree – 2007 (Continued) 8- M/s. Syco Advertising Agency – Quick Books – 2010 (Continued) 9- M/s. Al-Razaq Fibers (Pvt.) Limited (Manufacturer & Trader of Yarn) – Peachtree Quantum 2010 (Continued) I am offering you Peachtree Complete, Tally ERP-9 Complete Quick Books Complete & Advance Excel Complete Computerized Accounting Software according to Pakistan Government Rules, FBR Tax Regulations, Complete Payroll with EOBI & Soc. Security & also Complete Inventory Manufacturing with FOH & Control System & its Valuation & Costing Report & many more. We also provide you Sales Tax, Income Tax & E-Filing Consultancy. Note: Peachtree-2007, 2010 & Quick Books all Versions are available with Original License, Serial & Reg. Code. We may also provide Quick Books & Tally ERP-9 License for all versions in Pakistan. We also provide Accountant, IT related & Net Working related person for Your Company & Factory. If you are interested to learn These Precious Courses than do not hesitate to contact us to our Contacts. We ensure you will learn complete courses. You may also contact us through E-Mail for Course Outline. Thanks & Regards Muhammad Asif Memon Karachi. Cell # 0321-2261353 & 0332-2208141 E-Mail: Sirasifmemon@gmail.com

See product

Karachi (Sindh)

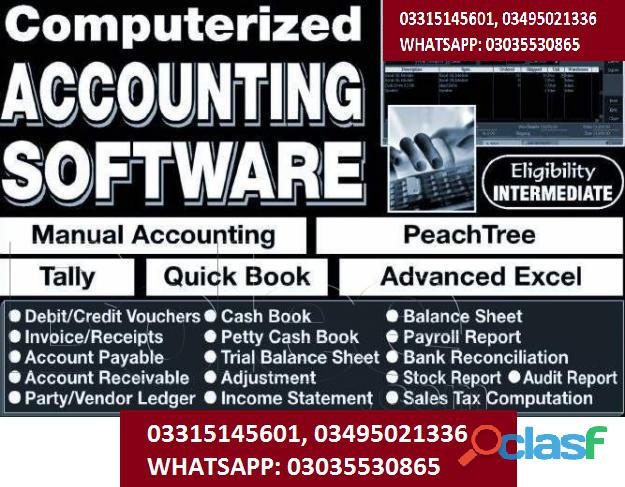

Yes! Join E-SHARP Institute of Computerized Accounting a Course Name: Managerial Computerized Accounting (MCA) Duration: 1 Months Teacher: SIR NADEEM SHAH (Writer of Computer Books) Course Detail: Introduction to ERP & Accounting System Peachtree Tally QuickBooks Excel Advanc Address: E-SHARP Institute, NIPA Chowrangi, Gulshan-e-Iqbal, Momin Square, 2nd Floor, Office No. B6, Opp: Shan Hospital and Anglophile, Near Nijlas Beauty Parlor, Up: Ghanis Uniform, Karachi. Visit Timing: 12pm to 9pm, Friday OFF, Sun: 2pm to 6pm. Note: SIR NADEEM SHAH is the writer of Peachtree, Tally, QuickBooks, Excel Advanced, Excel Financial Modeling, Ms-Office Advanced, ICMAP Practical Guide, & other I.T. Books in Pakistan. He has 15 years Experience in I.T. Field, he has extensively worked with ICMAP. THANKS TO VISIT THIS ADD.

Rs 10

See product

Lahore (Punjab)

KBM Training & Recruitment, being one of the most productive business ventures of KBM Group UK, is dedicated in providing practical training on such accounting applications relevant and in accordance with the Dubai market. KBM Training & Recruitment Offers wide Range of Courses and Practical Training programs regarding accountancy & Business administration our courses include: -)Sage Line 50 -)Sage Payroll -)Tally ERP -)Advance Excel -)Peachtree -)QuickBooks -)Guaranteed Work Placement -)SAP -)Import and Export -)Sales and Taxes Golden opportunity to avail the Golden Discounts Offer Contact us or visit our Lahore Office to get registered.

See product

Islamabad (Islamabad Capital Territory)

I am offering for tutoring services in the following area of education. I.Com,B.Com ,BBA and MBA all subjects ,preparation for mid term and final term examination,preparation assignment and final project (finance). Preparation for GCSE, O-A level exam with reasonable price only commerce group(Principal of Accounts ,Business studies ....) only bahria town and DHA Islamabad resident can avail this offer

See product

Rawalpindi (Punjab)

Quickbooks-PT,Talley ERP Diploma Who should consider learning the Features of Sage 50 Accounting? • Sage 50 Accounting Software is a fast, efficient and powerful accounting and invoicing solution that is ideally suited for small businesses. It is particularly recommended (but not restricted) for businesses that employ roughly 5 to 99 employees. • The software incorporates different versions for different levels of financial activity and is considered one of the most user-friendly accounting applications for SMEs (small and medium-sized enterprises). • Sage 50 is an intensive software package and in order to maximise the benefit, one would need to cover all aspects of the course in detail. It incorporates strong reporting features coupled with flexible tools for management, accounting as well as taxation. • By choosing to study a comprehensive course on Sage 50, candidates can expect to accurately manage company invoicing, produce financial and sales reports as well as process VAT records. • In-depth study and knowledge of different tools and features of the Sage 50 accounting software can help candidates add value to their team. • Similarly, Sage 50 software is also ideal for those who own their own businesses and wish to become self-sufficient in managing their own accounting and invoicing and so on. Expertise in Sage 50 accounting software helps reduce reliance on external accountants. • In addition, Sage 50 accounting software is recommended for those who wish to make a seamless transition from manual payroll processing to a computerised system. By opting to educate and update one’s skills in Sage 50, candidates can prove their ability to potential employers. The Sage 50 online course is suitable for individuals, business entrepreneurs and aspiring students who wish to learn the basics of computerised accounting and invoicing. • A detailed working knowledge of Sage 50 can help aspirants gain confidence and help them provide a high standard of accounting services to companies. • Candidates from all backgrounds and fields are free to learn the Sage 50 accounting course; it does not require any prerequisite academic qualifications. The only prerequisite condition is a basic working knowledge of numeracy, literacy and IT skills. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Tax Accounting Certificate Finally, there are a number of international standards when it comes to taxation and accounting reporting and the course provides an overview of how the existing tax standards came into being and which international and British organisations enforce these regulations. Keeping up with the recent news, it also outlines the possible impact that the upcoming exit from the European Union may have on taxation What you will learn: • What tax is and how the taxation system in the United Kingdom operates • What taxes apply to individuals residing in the United Kingdom • What benefits and allowances exist to support people in underprivileged positions • How to calculate National Insurance contributions based on individual earnings • What the different National Insurance classes are and who they apply to • How to calculate Income Tax and demystify tax codes • What income can be tax free and the various tax reliefs for individuals • How to calculate Corporation Tax that companies get charged on their sales • The mechanics of VAT and the VAT schemes are used to reclaim VAT on purchases • What charges apply to international imports and exports in the EU and outside the EU • How to import and export goods and services and prevent double taxation • What double entry accounting is and how debit and credit operations affect accounts • How to do your own company accounting, preparing and submitting Annual Returns Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Diploma in Accounting with Intuit QuickBooks Furthermore, you can check the validity of your qualification and verify your certification on our website at any time. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM Module 1 • Getting the Facts Straight • The Accounting Cycle • The Key Reports • A Review of Financial Terms • Understanding Debits and Credits • Your Financial Analysis Toolbox • Identifying High and Low Risk Companies • The Basics of Budgeting • Working Smarter Module 2 • Opening QuickBooks Pro 2008 • Accounting Basics, Part One • Accounting Basics, Part Two • Getting Started with QuickBooks • Getting Help in QuickBooks • Lists, Forms, and Registers • Using the Chart of Accounts • Using the Journal • Adding Items and Services • Adding Vendors • Adding Customers • Adding Employees • Sales Receipts • Customer Payments • Finance Charges • Setting up Invoices • Finishing Invoices • Tracking Invoices • Issuing Credit Memos Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Technical Analyst Diploma Course details Overview A core principle of technical analysis is that a market's price reflects all relevant information impacting that market. A technical analyst therefore looks at the history of a security or commodity's trading pattern rather than external drivers such as economic, fundamental and news events. It is believed that price action tends to repeat itself due to the collective, patterned behavior of investors. Hence technical analysis focuses on identifiable price trends and conditions. If you believe in this approach or want to combine it with the fundamental analysis, then this course is for you. Become a professional technical analyst. Description In this course you will learn: • Defining technical analysis • Indicators • Managing the trade • 10 Secrets of the top technical traders • Considering a trading system etc. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Diploma in Accounting for Small Business it can be done at any time by extending your subscription. COURSE CURRICULUM MODULES • Introduction to Accounting • Financial Statements • Assets and Liabilities • Accounting Transactions • Inventory and Cost Methods • Stakeholders and Equity • Managerial Accounting • Cost Accounting • Costs and Expenses • Budgetary Control • Analysis and Decision Making • Module Book- Accounting for Small Business • BookKeeping Training Manual ADDITIONAL STUDY MATERIALS • Additional Study Materials- Accounting for Small Business RECOMMENDED BOOKS • Recommended Books – Accounting & Finance How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Budgets and Money Management Skills Diploma Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Course Overview • Finance Jeopardy • The Fundamentals of Finance • The Basics of Budgeting • Parts of a Budget • The Budgeting Process • Budgeting Tips and Tricks • Monitoring and Managing Budgets • Crunching the Numbers • Getting Your Budget Approved • Comparing Investment Opportunities • ISO 36501:2008 • Directing the Peerless Data Corporation Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market & Forex Trading Beginner Quickbooks-PT,Talley ERP This valuable course is suitable for anyone interested in working in this sector or who simply wants to learn more about the topic. If you're an individual looking to excel within this field then Level 2 Certificate in Stock Market & Forex Trading is for you. We've taken this comprehensive course and broken it down into several manageable modules which we believe will assist you to easily grasp each concept - from the fundamental to the most advanced aspects of the course. It really is a sure pathway to success. All our courses offer 3 months access and are designed to be studied at your own pace so you can take as much or as little time as you need to complete and gain the full CPD accredited qualification. And, there are no hidden fees or exam charges. We pride ourselves on having friendly and experienced instructors who provide full weekday support and are ready to help with any of your queries. So, if you need help, just drop them an email and await a speedy response. Furthermore, you can check the validity of your qualification and verify your certification on our website at anytime. So, why not improve your chances of gaining professional skills and better earning potential. COURSE CURRICULUM • Basics of Stock Market & Forex Trading Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Retail Banking Diploma This course is designed to provide you with all the knowledge and skills you need to be effective when it comes to retail banking. This is still a relatively new sector of the banking industry, so learning how it works and how to incorporate into your current bank can help you achieve success moving forward. Some of the things you can expect to learn include: • Get an introduction into retail banking, understand what this type of banking is and why it is becoming so important to banks now and moving forward. • Learn about the various financial systems and how they link to retail banking. • Identify the different types of banking and banking channels. • Understand the different retail banking products and how these differ from traditional banking products. What sets this apart from banking that has been used for years? • Get an understanding on retail mortgages and loans and why this is important in today's market place. • Learn about various banking services and how these relate to retail banking. • Identify the different banking payment systems to improve customer experience and meet their unique banking and financial needs. • This module will teach you about various banking operations which will be beneficial to you in the retail banking sector. • Learn about Islamic banking, what it is and how it can benefit you. • Get valuable insight into customer service and the importance thereof. Customer service can make the difference on whether the client opens an account with your bank or one of your competitors. • Understand money laundering, what it is, how it is carried out and what to watch for to reduce the risk of this happening on your watch. Benefits There are so many great benefits to completing the retail banking course online. Some of the benefits you can expect to take advantage of include: • Study online from anywhere at any time. • Use any device to study - computer, laptop, tablet or phone. • Comprehensive course broken down into manageable modules, making it easier to study. • Study at your own pace whether you choose to study full time or part time, complete the course in a matter of days or weeks, the choice is up to you and the time you have to dedicate to your studies. • Enjoy the convenience of online support during your studies. • Gain a lifetime access to all modules to revisit as and when needed. • On successful completion instantly download and print your industry recognised certificate. • All certificates are verifiable using their unique code. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Business and Accounting Basics Diploma What you will learn • An introduction into the importance of accounting • A look at four ways to structure your business • How to deal with relevant government bodies, registering and filing • The benefits of a business bank account • How to set up a business bank account • Evaluating funding sources for your business • Dealing with money from customers • How to keep track of business costs and tax relief • The essentials of recordkeeping and bookkeeping • How to deal with taxes • Employing staff • Taking money out of your business • How to read the profits, cash and ratios in your accounts • Using forecasting methods to plan for the future • How to know if you need an accountant • Ethical practices of an accountant Business Basics Diploma Have you always dreamed of starting your own business? Do you need the skills and knowledge to start your own business and achieve success? Have you finished school and are thinking of entering the business world and want to boost your career from the start? Then this Business Course from New Skills Academy may be what you are looking for.The business diploma course is made up of sixteen modules. These modules are brimming with valuable information that you can use straight away in your working day. Overall the sixteen modules take around ten hours to complete, each module taking you between fifteen to thirty minutes.Learn about branding, setting goals and financial, learn everything you need to know to start or grow your own business. You will gain a lifetime access to the course modules, so you can refer back to them at any time.Enjoy the convenience of online learning, where you can study at your own pace using any device from anywhere, as long as you have internet access. What you will learn • Starting your own business, where to begin, generating ideas and personal qualifies you are going to need. • Understanding the importance of a business plan and how to start your own. • Researching into your business market and how to identify your target audience. • What is branding, how to use branding and how it will effect your business moving forward. • How to set goals and tackle issues. • Understanding financing and options available. Identify how much money you will need to start up your business along with what you need to give in return. • Understanding cash flow, accounts and bookkeeping. Learn how to budget, how to keep track of invoices and payments. • Get a firm understanding of marketing and social media and how you can use these to boost your business moving forward. Learn how to market your business on a tight budget and what considerations to factor into your marketing decisions. • How to source and manage staff. What you need to do to keep them motivated. Also learn the importance of training. • Learn the legal issues which could affect your business moving forward. • Get the low-down on tax and what taxes you will be accountable for. Also get some tips and advice to make tax an easy and stress free process within your company. • Identify with your insurance needs. Get a good understanding of business insurance and what costs you may incur if you don't have the right insurance in place at all times. • Learn how technology can help you grow your business. Identify what technology you need, how not to overpay for essential technology and things you should be aware of at all times. • Identify what business ethics is and how it relates to your business. You will also learn how to operate effectively and how business ethics identifies how you are perceived. • Know why you need a website, what to include and how to market it effectively. • Know when it's time to grow your business, know the pitfalls and how to deal with the future. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

Rs 20.000

See product

4 photos

Pakistan (All cities)

Quickbooks-PT,Talley ERP Accounting for Business If you need to extend your course access duration, it can be done at any time by extending your subscription. COURSE CURRICULUM BOOKKEEPING AND PAYROLL MANAGEMENT • Introduction to Bookkeeping and Payroll • Transactions • Internal Controls and Control Concepts • Working with Ledgers • Reconciliation • Correcting Entries • Sales Tax, Rules and Filing • Budgeting & Strategic Plan • Types of Budgets • Merchandising Income Statement • Sales and Purchase Discounts • Petty Cash • Cash Controls – The Bank Reconciliation • The Payroll Process • Payroll Process – Earnings Record • The Partnership & Corporations • Accounts Receivable and Bad Debts • Preparing Interim Statements • Year End – Inventory BUSINESS ACCOUNTING • Introduction to Bookkeeping • Defining a Business • Ethics and Accounting Principles • Accounting Equation & Transactions • Financial Statements • The Accounting Equation and Transactions • Transactions – Journalizing • Posting Entries and The Trial Balance • Finding Errors Using Horizontal Analysis • The Purpose of the Adjusting Process • Adjusting Entries • Vertical Analysis • Preparing a Worksheet • The Income Statement • Financial Statements- Definitions • Temporary vs. Permanent Accounts • Accounting Cycle • Financial Year • Spreadsheet Exercise How will I be assessed? • You will have one Quiz and one Assignment. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2016 – Accounts, Payroll Management This QuickBooks Pro 2016 training course is comprehensive and designed to cover the following key topics are listed under the curriculum. This course has been designed for 20 guided learning hours. COURSE CURRICULUM: 01 • The Home Page • The Icon Bar • Creating a QuickBooks Company File • Setting Up Users • Using Lists 02 • The Sales Tax Process • Creating Sales Tax • Setting Up Inventory • Creating a Purchase Order • Setting Up Items 03 • Selecting a Sales Form • Creating a Sales Receipt • Using Price Levels • Creating Billing Statements • Recording Customer Payments 04 • Entering a Vendor Credit • Using Bank Accounts • Sales Tax • Graph and Report Preferences • Modifying a Report • Exporting Reports 05 • Using Graphs • Creating New Forms • Selecting Objects in the Layout Designer • Creating a job • Making Purchases for a Job • Time Tracking 06 • Payroll – The Payroll Process • Payroll – Setting Up Employee Payroll Information • Payroll – Creating Termination Paycheques • Payroll – Adjusting Payroll Liabilities 07 • Using Credit Card Charges • Assets and Liabilities • Creating Fixed Asset Accounts • Equity Accounts • Writing Letters with QuickBooks 08 • Company Management • Company File Cleanup • Using the Portable Company Files • Creating an Account’s Copy Course Duration: You will have 12 Months access to your online study platform from the date you purchased the course. The course is self-paced so you decide how fast or slow the training goes. You can complete the course in stages revisiting the training at any time. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Finance For Non-Financial Professionals As a non-financial professional, you need to quickly understand and distinguish good information from poor-quality information, otherwise, your decisions may adversely affect business performance and your career prospects. This course is designed with a practical view to finance. It's suitable for professionals at all levels and entrepreneurs alike. In this course you will learn: • How to understand and use financial statements • Including; profit and loss, balance sheets and cash flow forecasts • Budgeting and forecasting techniques to improve decision-making • How to use Key Performance Indicators (KPIs) effectively • How to appraise an investment using financial techniques • The best way to develop a business plan Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP HR & Payroll Management This course has been specifically designed for those looking to learn the basics of being successful in the human resources and payroll management fields. As a bonus, we also share a few tricks for getting your foot in the door! We'll cover payroll management, hiring diversity, negotiations, working with a leadership team, payroll, benefits, insurance, payroll systems, and general management techniques. Everything you need to be a skilled, knowledgeable HR officer is in this course! Course for? For those who: • Are interested in a career in Human Resources and Payroll Management • Current HR and payroll employees who would like to improve their skills • Small business owners who are looking to make sure that they are providing a good work environment for employees • Those who would like to explore further the field of HR Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bookkeeping Diploma Level 3 The learning you’ll acquire from this course will equip you for senior roles within professional accounting and bookkeeping, or enable you to establish your own practice within this field. COURSE CURRICULUM 1. Accounting fundamentals 2. Different forms of accounting 3. Understanding of your accounts 4. Inventory control & sales tracking 5. How to control and manage expenses 6. How to avoid illegal accounting 7. Fundamentals of bookkeeping 8. Accurate bookkeeping and uses 9. Tax accounting 10. Process of audit Benefits you will gain: • High quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • 24/7 Access to the Learning Portal. • Benefit of applying NUS extra Discount Card. • Recognised Accredited Qualification. • Excellent customer service and administrative support. Certification: Successful candidates will be awarded Diploma in Accounting and Bookkeeping – Level 3. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Managerial and Cost Accounting Course Description: This Campus based training course is comprehensive and designed to cover the key topics listed under the curriculum. Course Curriculum 1: Overview Of Managerial Accounting 2: Planning And Directing 3: Controlling 4: Key Components Of Cost 5: Product Cost Vs. Period Cost 6: Common Financial Statement Related Issues Faced By Manufacturers 7: Cost Of Flow Concept Benefits you will gain: By enrolling in this course, you’ll get: • High-quality e-learning study materials and mock exams. • Tutorials/materials from the industry leading experts. • Includes step-by-step tutorial videos and an effective, professional support service. job roles this course is suitable for: Cost Accountant , Management Accountant , Accountant Assistant , Project Cost Accountant Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad The Complete Sage 50 Accounting Diploma Quickbooks-PT,Talley ERP The Sage 50 Intermediate Course This course builds on the concepts learned in the beginners’ course and assumes that you have a working knowledge of the basic features together with an understanding of simple transactions. You will begin by learning about accruals and prepayments, along with the calculation of assets and depreciation. You will not only learn how to undertake these more advanced transactions but also how to fix errors such as inaccurately processed assets.Stock control and monitoring are also covered in depth, enabling you to manage stock levels with confidence. You will also learn how to create an audit trail for complex transactions such as those involving discounted items and credit notes.The Sage 50 Advanced CourseThis course moves beyond everyday transactions and emphasises the processes required in chasing debt and credit control. You will learn why quotations are important, and how they can improve sales. You will gain an understanding into how businesses recover credit and payment from customers, and how to keep accurate records during the process.Audit trails are a key aspect of accurate accounting and you will gain further knowledge and insight into this process during the course. You will also gain a better understanding of budgeting, as well as how to correct common mistakes in record-keeping. Finally, you will also develop your skills in producing customised reports. The Benefits of Our Complete Sage 50 Accounting Course This course will give you a complete overview of all the main accounting tools Sage 50 offers, from the basic to the advanced. This will make you an attractive candidate for any position that entails company accounts including invoicing and debt management. You will not only be a proficient user of Sage 50 software, but you will also be able to demonstrate an in-depth understanding of how financial matters are controlled within a business. Benefits of taking the Complete Sage 50 Accounting Diploma: • Study at home and online • Study at your own pace • Access to full online support whilst completing the course • Easy-to-read modules packed with information • No entry requirements • A chance to receive an accredited qualification upon completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Rawalpindi (Punjab)

Quickbooks-PT,Talley ERP Book-Keeping Bundle Course details Overview In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Course Description Accounting and book-keeping skills are always in demand in any organisation. As well as finding employment, many learners go on to set up their own book-keeping business by offering their services to local companies. In the accounting profession, the two most popular programs in the market are Sage 50 and QuickBooks Pro. Each program has its strengths and would definitely benefit any business owner or accounting professional. Sage Line 50 is essential if you want to work in an accounts office, finance department or as a book-keeper. This is because Sage Accounts is one of the most popular accounting package in the UK, particularly in Small and Medium Enterprises (SMEs) QuickBooks is the and book-keeping software for small and medium sized businesses. It is easy to use and gives you much-needed control over your business finances. QuickBooks Point of Sale provides retailers with an easy-to-use, affordable, scalable, customisable, integrated software and hardware system. It handles routine tasks so retailers can pay more attention to running their business. Each course teaches you everything you need to know so you can run an entire business within either program. It's the easiest and most affordable way to dive into each program in order to decide which one is right for you! Who Is This Course For? Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Requirements Anyone looking to learn how to use Sage 50, QuickBooks and QuickBooks Point of Sale accounting software programs Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Trainings In this course, you will learn HOW TO USE AND INVEST IN CRYPTOCURRENCIES WITHOUT LOSING MONEY. You will also learn: 1. How to analyze investments of all asset classes to identify intrinsic value 2. How to compare the different cryptocurrencies and analyze them as investments 3. How to build wealth over time in the safest and fastest way possible 4. How the psychology of investing can make you rich or poor and how to use it to your advantage 5. The dangers of FOMO in investing 6. How to save money on taxes when making investing decisions 7. How to avoid getting in trouble with the law when investing in Cryptocurrencies 8. How to think clearly about investing and building wealth 9. How to use human emotion to your advantage when it comes to investing 10. Much more Do yourself a favor and educate yourself about how cryptocurrencies work so that you don't make the same mistake as countless others, and lose your money! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad QuickBooks 2013 Training - Bookkeeping Made Easy This QuickBooks 2013 Training for Beginners will show you how to unlock the power of Quickbooks 2013 and take direct control of your business finances. Expert author Barbara Harvie teaches you how to setup and manage the accounting for your business using QuickBooks 2013. This video based Quickbooks tutorial removes the barriers to learning by breaking down even the most complex of operations into easy to understand, bite-sized pieces, making it fast and fun for you to learn. This Quickbooks training course is designed for the absolute beginner, and no previous accounting software experience is required. You will start with the basics of using an accounting package - setting up your company file. You will quickly learn how to manage day to day operations by setting up items, services, customers and jobs right in the QuickBooks 2013 interface. You will learn how to create invoices and manage them once the customer has paid. Barbara shows you how to enter and pay bills, track your inventory, and manage all your banking tasks. In this video based tutorial, you will also learn how to create reports, customize reports, and maybe most importantly, how to back up your company file. By the time you have completed the computer based training QuickBooks tutorial course for Beginners course for Intuit QuickBooks 2013, you will have a clear understanding of how to setup and manage your company finances on a day to day basis, as well as access the financial information you need to help you be successful in your endeavour. Working files are included, allowing you to follow along with the author throughout the lessons. Take this ultimate QuickBooks tutorial right now and learn QuickBooks 2013. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Sales Tax with QuickBooks Course details This, step by step course shows you exactly how to record and manage ANY sales tax related situation for people using QuickBooks for their business. You will learn how to record, collect and pay sales tax. You will learn how to find and interpret the results of sales tax reports. You will learn how to adjust sales tax and fix sales tax mistakes. You will learn both the cash and accrual method of paying sales tax. You will lean how to manage maximum sales tax situations and situations where there are multiple sales tax in 1 transactions. Sales tax is something that effects most business. If you are working with more than one company, then you need to be able to create new sales tax items and manage these special situations. Accountants will sometimes adjust only the general ledger account called "sales tax payable" and they will forget to adjust the balance owed to the specific tax agency. This course will give you the ability to do that. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Quickbooks-PT,Talley ERP Course details This course has been specifically designed for beginners / investors new to the stock market. It is one of the most comprehensive toolkit for stock market trading/ investing. How is the course structured? 1. The first three sections in the course deal with the common queries most beginners have with respect to the stock market. 2. The next three sections deal with understanding & analyzing Financial Statement of companies. 3. The rest of the sections deal with Technical Analysis. These techniques are not just applicable to stocks but also other asset classes. Why should I take this course? Do you have questions like: 1. How do I start trading in the stock market? 2. What is share or stock? 3. What is a stock exchange? 4. I have less money, Should I trade in Futures & Options? 5. How do I select a stock broker? 6. How much money should I invest in the stock market? 7. What is algorithmic trading & Should I be doing it? Great! The first 3 sections in this course answers many such questions for beginners. The next 3 sections deal with understanding & the financial statements of any company. Now you need not be intimidated with terms like Balance Sheet, Cash Flow Statement, Statement of Income. Everything is explained using a real financial statement so that you can start reading financial statements just like you read any other book! To add to it you learn how to perform Financial Ratio Analysis & Common Size Analysis of companies which would help you better understand the underlying business of a stock & its performance. This is a must have input before you invest in a stock! Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Bank Reconciliation Statement (College Level) Course details Welcome to Accounting Bank Reconciliation Statement Course. Business entities will be having large number of Bank transactions and these transactions will be recorded by them in their Cash Book (Bank Column). The bank balance as per Cash Book should be balanced with Bank Balance as per pass book. However, there will be certain differences due to timing difference between recording the transactions by the parties, namely the business entity and the Banker. This difference have to be identified and sorted at the earliest to avoid fraud and error. This difference can be identified by preparing a Statement known as Bank Reconciliation Statement and this course will teach you a) What is Bank Reconciliation Statement. b) What is Cash Book and Pass Book. c) Difference between Cash Book and Pass Book d) Causes for disagreement between the balance shown by Cash Book and Pass Book e) Procedure for preparing BRS f) Preparing BRS when bank balance is favourable / unfavourable. This course is structured in self paced learning style. Video lectures / screen cast are used for presenting the course content. Take this course to understand practical aspects of BRS. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Stock Market Investment: Quickbooks-PT,Talley ERP Analyzing Software Companies Course details Are you looking to invest into software companies? What are the important characteristics andtrends of this industry? Dothese companies have any moat? How do they spend their cash? What are therisks? In this course, I will teach how to analyse and invest into software companies. We start off by learning about the different sub segments of the software industry. Then wemove onto quantitative financial analysis. After which, we will continue intoqualitative non financial discussion. All this will give us a holistic view of software companies before we commit investments into them. Unlike some other courses out there where you just hear instructors talking endlessly, and you only see boring text intheir presentation, this course will include animations, images, charts anddiagrams help you understand the various concepts. This is also not a motivation class whereI preach to you that you must work hard to succeed, or you must have disciplineto profit from the market. In this course, you will learn actionablemethods and frame work. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Financial Model Builder Course We go through 7 financial models: 1. Financial Model Basics - you learn the basics of financial models 2. Beyond The Basics - best practice, working capital, balance sheets and cash flows 3. Debt Equity Model - equity calculations and debt calculations incorporated into a model 4. Investment Scenario Model - a model for investments that includes multiple scenarios 5. Corporate Scenario Model - a full corporate model that incorporates multiple scenarios 6. Capital Investment Appraisal Model - a model for evaluating a capital investment 7. Pricing Model - a model for determining optimum pricing to customers. We go through many different company types: Pet Food Wholesaler, Clothing Wholesaler, Chemical Manufacturer, Investment Fund, Platinum Mine,Electricity Provider and an Office Equipment Company. If you are a • business owner • manager • finance professional or • business student and want to learn all-round financial model building skills, then this course is for you. By the end of the course, you will be able to • build accurate models • understand all essential Excel formulas and functions for financial models • create flexible models for multiple scenarios • adapt your skills to a variety of industries and requirements. In summary, this is one of the best value-for-money courses on financial models. Hope to have you as a student soon. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Computer Essentials-DIT CIT Web Development Presented with high-quality video lectures, this course will visually show you how to easily do everything with computers. This is just some of what you will learn in this course: • Learn the basic principles of hardware including circuits, coding schemes, binary, the five generations of computers, Moore's Law, IPOS, registers, cache, RAM, magnetic storage, optical storage, solid-state storage, ROM, BIOS, the motherboard, buses, and the CPU. • Learn how to operate a computer including a vast array of hands-on skills just to mention a few for example: managing files, backing up files, right clicking, taking screenshots, determining your computer's properties, upgrading your computer, changing settings on your computer. • Learn how to use word processing software including the creation of a title page, document sections, headers and footers, styles, an automatically generated table of contents, the insertion of images, references, and the insertion of an automatically generated citation of works referenced. • Learn how to use spreadsheet software including formulas, functions, relative references, absolute references, mixed references, and the creation of a graph or chart. • Learn how to use video editing software including adding credits and transitions then publishing that video to a video hosting website such as YouTube. • Learn how to use databases including table creation, the setting of a primary key, the establishment of table relationships, the setting of referential integrity, and the creation and execution of a query. • Learn how to use presentation software to more effectively give presentations. • Learn to do some simple programing including designing, coding, testing, debugging, and running a program. • Learn about the world wide web including sending email, conducting searches , having familiarity with online educational resources such as Khan Academy, and having an awareness of online "cloud computing" tools such as Google Word Processing, Google Spreadsheets, and the many other online tools offered by Google. • Learn about application software and system software including operating systems, utilities, and drivers. • Learn about networks including architecture, topology, firewalls, security, wireless networks, and securing wireless networks. • Learn about the Internet, the World Wide Web, censorship, the digital divide, net neutrality, differing legal jurisdictions, website creation, multimedia, social media, and eCommerce. • Learn about information systems, systems development, and the systems development life cycle. • Learn about program development, programming languages, and the program development life cycle. • Learn about databases including table creation, primary keys, relationships, referential integrity, queries, and structured query language. • Learn about privacy and security issues related to computers. • Learn about robots and artificial intelligence including the Turing test. • Learn about intellectual property including patents, trademarks, copyrights, and the creative commons. • Learn about ethics and ethical issues relating to the use of technology. • Learn about health ramifications of using computers including repetitive stress injury, carpal tunnel syndrome, and ergonomics. • Learn about e-Waste and other environmental concerns related to technology. Lifetime access to this course allows you to easily review material and continue learning new material. After taking this course, you will have a thorough understanding of how to use computers well. From beginners, to advanced users, this course is perfect for all ability levels. This course will add value to everyone's skillset. Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad Quickbooks-PT,Talley ERP Professional Bookkeeping & Accounting 2 - Bank Daybook Do you need to understand and record petty cash or banking transactions for your business? Are you considering a career in Bookkeeping or Accounting? Are you studying for Professional Accounting or Bookkeeping exams? THEN REGISTER NOW Course Overview Section 1 of this course is an introduction section. After the course introduction we will begin this course by introducing you to both the prime books of entry and cross totting as you will need a working understanding of these through out this course. You will also be presented with the case study that we will use in the activities in section 2 and 3 of this course. In section 2 we will move into Petty Cash. We will walk through each step of the petty cash process from raising petty cash vouchers, entering data to the daybook and reconciling and replenishing the petty cash. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Raise petty cash vouchers • Enter petty cash transactions to the petty cash daybook • Close the daybook and calculate the balance carried down • Reconcile the petty cash • Replenish the petty cash Section 3 of this course is about Banking Transactions. Through out this section you will have a number of activities using the case study presented in section 1 and these activities will give you the opportunity to: • Check remittance advice • Enter payments and receipts to the 3 column and analysis cash book • Close the cash book and calculate the balance carried down • Reconcile the bank This course contains: A case study that we will use through out this course Workbooks to download Activities to complete Quiz Certificate of Completion Whatsapp: +923035530865, 03219606785,3315145601, 03495021336 IPATS Government Recognized Education Zone-Khanna Pul Rawalpindi-Islamabad

See product

Karachi (Sindh)

MBA qualified teacher for quick books, peachtree, tally ERP, online ERP Accounts Software. Asslam-o-Alyekum Hi Dear All, A Professional Accountant, MBA Qualified, Certified, Awarded & 12 years Experienced Teacher/ Consultant from Textile, Foods, Advertising, Printing Press Industries, Importer of Computers / Electronic Items, Property Dealer, Marble Exporter & Yarn Manufacturing Industries, already Lecturer in a Known well Institute/ College in Karachi named (Academy of Excellence / Excellence Intermediate College) offering you all to teach at your Office, Factory & Home. My students are mostly in Dubai, Ajman, S. Arab, Bahrain, South Africa, USA, Canada & South Korea. Please see the below detail of those Companies where I have already thought these software And I have also their Certificates. 1- M/s. Amour Textile Industries (Pvt.) Limited. (Exporter of Textile) Peachtree – 2007 (Completed) 2- M/s. Nacisey (Pvt.) Ltd. (Food Industry) Quick Books – 2011 (Completed) 3- M/s. TransformaX (Unilever Pakistan & Engro Foods Advertising Agency Vendor) Peachtree – 2010 (Completed) 4- M/s. Sana Enterprises. (Printing Press Ind. / GSK Pharmaceutical Vendor) Peachtree – 2007 (Completed) 5- M/s. Base System (Dubai Base Company Importer of Computers / Laptops Accessories) Peachtree - 2014 (Completed) 6- M/s. Legal Aid Society (NGO Organization) - Quick Books - 2014 (Completed) 7- M/s. SMB Marble Company (Exporter of Marble) – Peachtree – 2007 (Continued) 8- M/s. Syco Advertising Agency – Quick Books – 2010 (Continued) 9- M/s. Al-Razaq Fibers (Pvt.) Limited (Manufacturer & Trader of Yarn) – Peachtree Quantum 2010 (Continued) I am offering you Peachtree Complete, Tally ERP-9 Complete Quick Books Complete & Advance Excel Complete Computerized Accounting Software according to Pakistan Government Rules, FBR Tax Regulations, Complete Payroll with EOBI & Soc. Security & also Complete Inventory Manufacturing with FOH & Control System & its Valuation & Costing Report & many more. We also provide you Sales Tax, Income Tax & E-Filing Consultancy. Note: Peachtree-2007, 2010 & Quick Books all Versions are available with Original License, Serial & Reg. Code. We may also provide Quick Books & Tally ERP-9 License for all versions in Pakistan. We also provide Accountant, IT related & Net Working related person for Your Company & Factory. If you are interested to learn These Precious Courses than do not hesitate to contact us to our Contacts. We ensure you will learn complete courses. You may also contact us through E-Mail for Course Outline. Thanks & Regards Muhammad Asif Memon Karachi. Cell # 0321-2261353 & 0332-2208141 E-Mail: Sirasifmemon@gmail.com

See product

Pakistan

Softax - Workshop “ADVANCE TAXATION” Federal & Provincial SALES TAX LAWS. Learn how to handle critical issues relevant to identification & input adjustment of taxable goods & services, withholding, e-filing etc. at Regent Plaza, Karachi on 28-01-2016. Contact Mr. Mujtaba Qayyum at 0333-3358711 or 021-32640313 Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Pakistan

Objectives: Tax planning and managing tax affairs are desired to be integrated with overall corporate strategy and risk management of an organization. Along with understanding of general provisions of the law the advance learning is also considered mandatory for effective tax planning and managing complex tax affairs of an organization in a professional way. Basic and initial knowledge of sales tax Laws help to understand the advance aspect of Federal and Provincial sales tax laws quickly and confidently. Now it is considered mandatory for a person dealing tax matters to have up-to-date knowledge and expertise in handling critical issues involved in sales tax on goods & services to effectively manage the tax affairs of the organization. Looking at the need of the time and ongoing rapid changes in provincial sales tax laws of Punjab, Sindh, KPK, Baluchistan, Islamabad and Federal sales tax law, Softax arranged a full day workshop on “Advance Taxation under Federal and Provincial Sales Tax Laws”. This day-long session aiming to provide a way forward to alleviate challenges assailing from sales tax on goods and services issues and also develop requisite skills among the participants, within an interactive environment for maximum learning through discussion and deeply understanding of the up-to-date knowledge of the Federal & provincial Sales Tax Laws in Pakistan, Case studies, Apex Courts' decisions and other internal and External Aids. At the end of the session the participants will be able to deal issues relating to the goods and services taxed under Federal & Provincial sales tax laws. Contents: · Scope of Sales Tax on Goods and Services including transaction with unregistered person · Identification of exempted, zero-rated and reduce rate goods under Federal Sales Tax Law and VAT mode goods under Federal Excise Law. · Identification of taxable and exempt services under Provincial Sales Tax Laws and VAT mode services under Federal Excise Law · Adjustment of input tax Federal against provincial and vice versa · Circumstances where input taxes under Federal & Provincial Sales tax laws are not available for adjustment. · Withholding tax under Federal & provincial laws: 1. Identification as withholding agent 2. What to withheld and where to deposit. 3. Records to be maintained 4. Reporting requirement (to whom report) · Handling Departmental proceedings on account of 1. Audit 2. Investigation 3. Recovery 4. Access to premises, stock, accounts, records etc. 5. Posting of offices to monitor production, sales and stock position · Issues involved in e-filing of monthly returns/statements

Rs 9.995

See product

Muzaffarabad (Azad Kashmir)

O3235270770 Peachtree Quickbook Tally Course in Kashmir | Computerized Accounting Peachtree Quickbooks Tally Course A computerized accounting system is a system used by businesses for recording their financial information. Many systems are available and companies look for a system to match their needs.Computerized accounting refers to using computers for a range of accounting tasks. In the past, computers were used as calculators. Modern computers perform a number of additional tasks and provide analytical information.Computerized Accounting software are Peachtree, Quickbooks, Tally Erp, Sage, SAP Business One, SAP ECC 6.0 etc. Inspire Institute of Technologies Pakistan (Pvt) Ltd is affiliated with RCCI, SECP, SDA, TTB, TTPC, SDC & PSSC Government of Pakistan. Course Outlines of Computerized Accounting: Peach Tree: 1:Introduction 2:New Company Setup 3:Accounting Overview 4:General Ledger 5:Accounts Payable 6:Inventory 7:Accounts Receivable 8:Reports Quickbooks: 1:Introduction 2:New Company Setup 3:Accounting Overview 4:General Ledger 5:Accounts Payable 6:Inventory 7:Accounts Receivable 8:Reports Tally: 1:Introduction 2:New Company Setup 3:Accounting Overview 4:General Ledger 5:Accounts Payable 6:Inventory 7:Accounts Receivable 8:Reports Peachtree Quickbook Tally Computerized Accounting Course in Rawalakot Peachtree Quickbook Tally Computerized Accounting Course in Bagh Peachtree Quickbook Tally Computerized Accounting Course in Bhimber Peachtree Quickbook Tally Computerized Accounting Course in Khuiratta Peachtree Quickbook Tally Computerized Accounting Course in Kotli Peachtree Quickbook Tally Computerized Accounting Course in Mangla Peachtree Quickbook Tally Computerized Accounting Course in Mirpur Peachtree Quickbook Tally Computerized Accounting Course in Muzaffarabad Peachtree Quickbook Tally Computerized Accounting Course in Hajira Peachtree Quickbook Tally Computerized Accounting Course in Abbaspur Peachtree Quickbook Tally Computerized Accounting Course in Tararkhal Peachtree Quickbook Tally Computerized Accounting Course in Khai Gala Peachtree Quickbook Tally Computerized Accounting Course in Palandri Peachtree Quickbook Tally Computerized Accounting Course in Thorar Peachtree Quickbook Tally Computerized Accounting Course in Samahni Peachtree Quickbook Tally Computerized Accounting Course in Dheerkot Peachtree Quickbook Tally Computerized Accounting Course in Dhadyaal Peachtree Quickbook Tally Computerized Accounting Course in Peer Gali Peachtree Quickbook Tally Computerized Accounting Course in Forward Kahota Peachtree Quickbook Tally Computerized Accounting Course in Tetrinote Peachtree Quickbook Tally Computerized Accounting Course in Sudhan Gali Peachtree Quickbook Tally Computerized Accounting Course in Tain Dhalkot

See product

Karachi (Sindh)

Karachi Accounting software teacher for you in Karachi A Professional Accountant, MBA Qualified, Certified, Awarded & 12 years Experienced Teacher/ Consultant from Textile, Foods, Advertising, Printing Press Industries, Importer of Computers / Electronic Items, Property Dealer, Marble Exporter & Yarn Manufacturing Industries, already Lecturer in a Known well Institute/ College in Karachi named (Academy of Excellence / Excellence Intermediate College) offering you all to teach at your Office, Factory & Home. My students are mostly in Dubai, Ajman, S. Arab, Bahrain, South Africa, USA, Canada & South Korea. Please see the below detail of those Companies where I have already thought these software And I have also their Certificates. 1- M/s. Amour Textile Industries (Pvt.) Limited. (Exporter of Textile) Peachtree – 2007 (Completed) 2- M/s. Nacisey (Pvt.) Ltd. (Food Industry) Quick Books – 2011 (Completed) 3- M/s. TransformaX (Unilever Pakistan & Engro Foods Advertising Agency Vendor) Peachtree – 2010 (Completed) 4- M/s. Sana Enterprises. (Printing Press Ind. / GSK Pharmaceutical Vendor) Peachtree – 2007 (Completed) 5- M/s. Base System (Dubai Base Company Importer of Computers / Laptops Accessories) Peachtree - 2014 (Completed) 6- M/s. Legal Aid Society (NGO Organization) - Quick Books - 2014 (Completed) 7- M/s. SMB Marble Company (Exporter of Marble) – Peachtree – 2007 (Continued) 8- M/s. Syco Advertising Agency – Quick Books – 2010 (Continued) 9- M/s. Al-Razaq Fibers (Pvt.) Limited (Manufacturer & Trader of Yarn) – Peachtree Quantum 2010 (Continued) I am offering you Peachtree Complete, Tally ERP-9 Complete Quick Books Complete & Advance Excel Complete Computerized Accounting Software according to Pakistan Government Rules, FBR Tax Regulations, Complete Payroll with EOBI & Soc. Security & also Complete Inventory Manufacturing with FOH & Control System & its Valuation & Costing Report & many more. We also provide you Sales Tax, Income Tax & E-Filing Consultancy. Note: Peachtree-2007, 2010 & Quick Books all Versions are available with Original License, Serial & Reg. Code. We may also provide Quick Books & Tally ERP-9 License for all versions in Pakistan. We also provide Accountant, IT related & Net Working related person for Your Company & Factory. If you are interested to learn These Precious Courses than do not hesitate to contact us to our Contacts. We ensure you will learn complete courses. You may also contact us through E-Mail for Course Outline. Thanks & Regards Muhammad Asif Memon Karachi. Cell # 0321-2261353 & 0332-2208141 E-Mail: Sirasifmemon@gmail.comAsslam-o-Alyekum Hi Dear All, A Professional Accountant, MBA Qualified, Certified, Awarded & 12 years Experienced Teacher/ Consultant from Textile, Foods, Advertising, Printing Press Industries, Importer of Computers / Electronic Items, Property Dealer, Marble Exporter & Yarn Manufacturing Industries, already Lecturer in a Known well Institute/ College in Karachi named (Academy of Excellence / Excellence Intermediate College) offering you all to teach at your Office, Factory & Home. My students are mostly in Dubai, Ajman, S. Arab, Bahrain, South Africa, USA, Canada & South Korea. Please see the below detail of those Companies where I have already thought these software And I have also their Certificates. 1- M/s. Amour Textile Industries (Pvt.) Limited. (Exporter of Textile) Peachtree – 2007 (Completed) 2- M/s. Nacisey (Pvt.) Ltd. (Food Industry) Quick Books – 2011 (Completed) 3- M/s. TransformaX (Unilever Pakistan & Engro Foods Advertising Agency Vendor) Peachtree – 2010 (Completed) 4- M/s. Sana Enterprises. (Printing Press Ind. / GSK Pharmaceutical Vendor) Peachtree – 2007 (Completed) 5- M/s. Base System (Dubai Base Company Importer of Computers / Laptops Accessories) Peachtree - 2014 (Completed) 6- M/s. Legal Aid Society (NGO Organization) - Quick Books - 2014 (Completed) 7- M/s. SMB Marble Company (Exporter of Marble) – Peachtree – 2007 (Continued) 8- M/s. Syco Advertising Agency – Quick Books – 2010 (Continued) 9- M/s. Al-Razaq Fibers (Pvt.) Limited (Manufacturer & Trader of Yarn) – Peachtree Quantum 2010 (Continued) I am offering you Peachtree Complete, Tally ERP-9 Complete Quick Books Complete & Advance Excel Complete Computerized Accounting Software according to Pakistan Government Rules, FBR Tax Regulations, Complete Payroll with EOBI & Soc. Security & also Complete Inventory Manufacturing with FOH & Control System & its Valuation & Costing Report & many more. We also provide you Sales Tax, Income Tax & E-Filing Consultancy. Note: Peachtree-2007, 2010 & Quick Books all Versions are available with Original License, Serial & Reg. Code. We may also provide Quick Books & Tally ERP-9 License for all versions in Pakistan. We also provide Accountant, IT related & Net Working related person for Your Company & Factory. If you are interested to learn These Precious Courses than do not hesitate to contact us to our Contacts. We ensure you will learn complete courses. You may also contact us through E-Mail for Course Outline. Thanks & Regards Muhammad Asif Memon Karachi. Cell # 0321-2261353 & 0332-2208141 E-Mail: Sirasifmemon@gmail.com

See product

Lahore (Punjab)

KBM Training & Recruitment, a subsidiary of KBM Group UK, is proud to launch a new course of ‘Pakistan Sales Tax’ which is ideal for Accounts & Finance Professionals, Businessmen & Fresh Students. It will help you to learn about how to deal with all the sales tax matters timely & proficiently. Following are the topics which we will cover in training sessions along with case studies: Scope of the Tax Sales Tax Registration Filing of Sales Tax Return Sales Tax Law E-filing Penalties Types of Sales Tax Required Documentation Get registered now and avail 35% discount for upcoming batch.

See product

Pakistan (All cities)

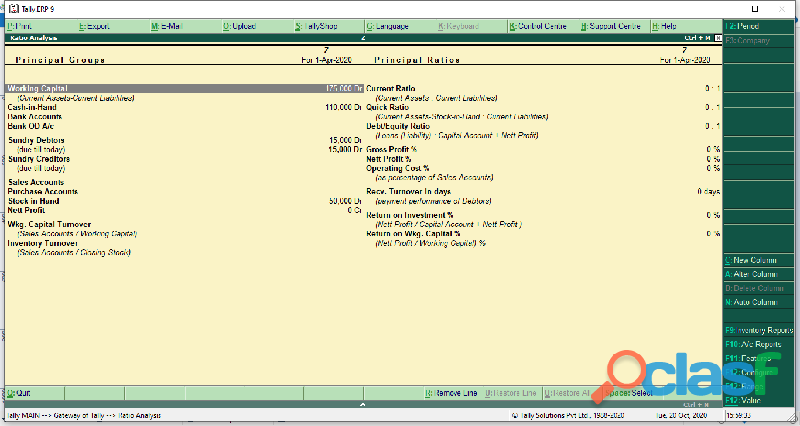

Tally ERP 9 - Your Business Companion Tally ERP 9 is the ideal software for your business. It is used by over a million businesses across India. We understand that every business has its own complexities, exceptions and unique needs. Tally ERP 9 is designed with flexibility to handle all of these. The needs of your business change as it grows and Tally ERP 9 is designed to scale. Let Tally manage your accounting and compliance, while you focus to grow your business. Introduction to Tally ERP 9 • Features of Tally • Enhancement in Tally ERP 9 • Installation Procedure of Tally ERP 9 • Tally ERP 9 Screen Components • Creating a Company Stock and Godon in Tally • Stock Groups • Stock Categories • Stock Items • Units of Measure • Godowns Groups, Ledgers, Vouchers and Orders • Introducing Groups • Introducing Ledgers • Introducing Vouchers • Introducing Purchase Orders • Introducing a Sales Order • Introducing Invoices Reports in Tally ERP 9 • Working with Balance Sheet • Working with Profit & Loss A/c Report • Working with Stock Summary Report • Understanding Ratio Analysis • Working with Trial Balance Report • Working with Day Book Report Taxation • Statutory & Taxation Features • Tax Deducted at Source in Tally ERP 9 • Create a Tax Ledger • TDS Vouchers • Tax Collected at Source in Tally ERP 9 • VAT (Value Added Tax) • Creating Masters for VAT • VAT Vouchers & Invoices • VAT Reports • Central Sales Tax (CST) • Service Tax Back & Restore in Tally ERP 9 • Taking Backup in Tally ERP 9 • Restoring Data in Tally. ERP 9 • Using E‐mail in Tally ERP 9 • Restoring Data from Tally 7.2 Tally.NET in Tally ERP 9 • Configuring the Tally.NET Feature • Assigning Security Levels • Connecting a Company to the Tally.NET Server • Logging as a Remote User

Rs 15.000

See product

5 photos

Lahore (Punjab)

Home Tuition GCSE A Level Accounting, A Level Economics, A Level Business Studies, A Level Sociology, A Level Law Group Study A Level Accounting, A Level Economics, A Level Business Studies, A Level Sociology, A Level Law Home Tuition GCSE O Level Accounting, O Level Economics, O Level Business Studies, O Level Sociology, O Level Law Group Study GCSE O Level Accounting, O level Economics, O Level Business Studies, O Level Sociology, O Level Law B.COM subjects Advance Accounting, Cost Accounting, Business Taxation, Income Tax, Sale Tax, Principles of Accounting, and Business Law I.COM subjects Accounting, Principles of Accounting, Business State, State, Business Math, Economics, and Principles of Economics M.Com subjects Financial Management, FM, Advance Accounting, Accounting, Performance Management, Taxation, Government Accounting, ACCA Subjects, F5, F6, F7, F9, Performance Management, Taxation, Financial Reporting, Financial Management, FM • International Teachers Academy PH# 03314873438, 03004315248 03

See product

-

Next →