Accounting audit

Top sales list accounting audit

Pakistan

We are a Group of Professional and Experienced Accountants, engaged with the business of Consultancy and Management. We provide solutions for Accounting, Income Tax, sales Tax, Internal Audit , External Audit, budgeting (to help your future plan), corporate matters of SECP, company Registration for Individual, Small and Medium size local companies, foreign companies, Traders, Manufacturers, Importers, exporters, NGOs and other sectors in accordance with International accounting standards, Company law, Business Law, Tax Law and other laws enforce in Pakistan. We can be your CFO, Cost Accountant, Company Secretary, Internal Auditor, Tax Consultant and Business Manager on need basis. Let us know how we help you.

See product

Pakistan

We are a Group of Professional and Experienced Accountants, engaged with the business of Consultancy and Management. We provide solutions for Accounting, Income Tax, sales Tax, Internal Audit , External Audit, budgeting (to help your future plan), corporate matters of SECP, company Registration for Individual, Small and Medium size local companies, foreign companies, Traders, Manufacturers, Importers, exporters, NGOs and other sectors in accordance with International accounting standards, Company law, Business Law, Tax Law and other laws enforce in Pakistan. We can be your CFO, Cost Accountant, Company Secretary, Internal Auditor, Tax Consultant and Business Manager on need basis. Let us know how we help you.

See product

Islamabad (Islamabad Capital Territory)

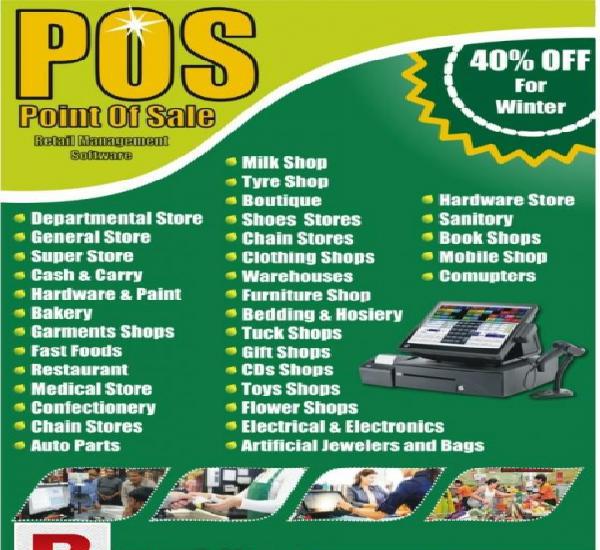

Point OF Sale (POS) Management Accounting Software with following features. List of Items List of Suppliers List of Categories List of Sub-Categories List of Manufacturers / Brands List of Publishers (Books) List of Subjects (Books) List of Authors (Books) List of Languages (Books) Print Barcodes In Different Formats Integrate Barcode Printers Price Variation Dead Stock Link Supplier Barcodes (Optional) Urdu Description (Optional) Quantity Discount (Optional) Define Item Location Sale On Defined Items (Optional) Search Items On Different Criteria Reference Codes (Optional) User Access Levels Present Stock Position By Combination Item Wise Sale Report On Combination Define Item Groups & Prices (Optional) Price History (Optional) Cash Collection Definition (Optional) Stock Debit Note Complete Supplier Invoice Entry Without Using Calculator To Compute Net Cost Price By Including The Scheme Items, Item Wise Discount, Lump Sum Discount & Sales Tax Calculation of Weighted Average Cost & Storage of Actual Cost (Optional) Printing Of Barcodes From Purchase voucher Set Sale Prices Of Items On Purchase Vouchers (optional) Stock Credit Note Stock Adjustment Debit (Optional) Stock Adjustment Credit (Optional) Purchase Order (Optional) Opening Balance (Optional) Change Item Parameters and Prices For Category, Supplier, Sub-Category and Brand. Define Registered Customers (Optional) Set Discount Percentage For Card Holders Create History Of Customer Based upon their transactions Set Reorder Levels Based Upon The Transactions and Criteria (Optional) Automatic Reorder Report (Optional) Audit / Stock Taking Procedure (Manual / PDT) (Optional) Automatic Pending Items Adjustment Audit Report Of Discrepancies Audit Report On Sale & Cost Price Automatic Adjustment Based Upon Audit Entries Change Passwords Back Office User Void Refund Discount Daily Sale Report Summary For All Stations By Cashier Mode Of Payment Hourly Item Wise By Category / Sub-Category / Supplier / Brand Bill Summary Gross Margin By Sales Man By Customer By Sales Man (Single Item) Commission Calculation For Sales Man Periodic Sale Report By Date and Station Number Bill Summary Hourly Mode Of Payment Monthly By Customer Sales Man Sales Man Commission Periodic Item Wise Sale Report Item Wise Item Wise Hourly Item Wise Monthly Item Wise Refund Item Type Sold Stock Linked Items Sale Age Sale GST Periodic Category Wise Sale Category è Sub-Category Sub-Category è Category Detail and Summary Daily Stock Balance Report Department Wise Item Wise Gross Margin Report Department Wise Item Wise Purchase Report Define Mode of Payment Item Wise Refund / Void Report Supplier Transaction Summary Customer Transaction Summary Keeps Registered Customer’s History Sale Summary Report Quantitative Stock Ledger Stock Position On Cost & Sale Price Gross Margin Report Fast / Slow Moving Items Periodic Duplicate Bill Printing Periodic Category / Department Wise / Item Wise Sale Report Total Purchases & Item Wise Purchases Contribution of Categories in Sales Easy To Use Interface Stand Alone & Multi User Versions Are Ready Data Back Up Capability Built In Menu Driven Software & Menu Level Security Views: 8

See product

Pakistan

Vatteen Solutions – Audit and Tax Consulting was established with the aim of providing a wide range of auditing, accounting, advisory, taxation and a host of other financial services to clients throughout Pakistan and abroad. We bring our professional and analytical skills to every assignment, developed through academic background, internal training, continuing professional education and engagement experience of our personnel. We are offering following services for our valuable clients: 1 - Income Tax Returns / Statements (Corporate / Individuals) 2 - Sales Tax Returns / Statements (Federal / Province) 3 - Income Tax / Sales Tax Refund claims and disputes settlement 4 - Audit & Assurance 5 - Bookkeeping 6 - Payroll Management 7 - Quickbooks accounting software implementation 8 - SECP Compliance Contact us: Email : info@vatteensolutions.com Web: www.vatteensolutions.com Cell: +92 321 4421005

See product

Lahore (Punjab)

Dear Sir/Madam, we are dealing in tax consultancy in Lahore, Pakistan. we are offering you tax facilitation like income tax, sales tax (NTN registration, sales tax registration, ENROLLMENT IN FBR, PRA & SRB, LCC&I registration, Incorporate (SECP) Registration, FORM-C, E-filling of sales tax returns (FBR, PRA) , income tax returns, wealth statement, withheld statement ,EXEMPTION CERTIFICATE, and book keeping. Sales tax and income tax refund matters, Sales tax & income tax Audit matters, Accounts, DE-REGISTRATION IN SALES TAX etc). Quick Book and Ms Office HOME Training If you have any problems in above matters please let us know we give you these facilities on your door step FROM, KMH Tax & IT CONSULTANT Cell NO 03334902175

Rs 2.000

See product

Karachi (Sindh)

our services include 1. income tax return 2. sales tax return 3 Accounts Maintaining 4.Audit 5 Corporate matters

See product

Lahore (Punjab)

we required fresh energetic resources that want to get the professional experience in erp environment, professional accounting, audit & taxation. functional area: accounts, audit & taxation job type: internship job location: lahore, pakistan gender: male / female age: year minimum education: bcom, ba, (acca ca acma (cont)) career level: student (undergraduate/graduate) minimum experience: fresh apply by: nov

See product

Pakistan (All cities)

OTHM Level 6 Diploma in Occupational Health and Safety ************For Registration & Information****** Please Call: 0331-5999937, 0321-5056755?Whatsapp: 0092-331-5999937? Email: info@iitpakistan.com.pk Qualifications Our qualifications are made up of the Regulated Qualification Framework (RQF) rules which provides flexible ways to get a qualification. Qualifications at the same level are a similar level of difficulty, but the size and content of the qualifications can vary. The Level 4, 5 and 6 diploma qualifications are equivalent to Year 1, 2 and 3 (Final year) respectively of a three-year UK Bachelor's degree. Each level consists of 120 credits. Completing any of the level 4, 5 and 6 qualifications will enable learners a progression to the next level of higher education at UK universities. The Level 6 qualifications in Clinical Aesthetic Injectable Therapies are designed to enable learners / practitioners to provide the highest standards of patient and client care during all stages of delivering cosmetic / aesthetic injectable therapies. By achieving these qualifications, learners will acquire the knowledge, skills and competence to administer treatments safely and appropriately, adhering to the principles of ‘do no harm’ and promoting public health at all times. Registered healthcare professionals e.g. doctors, dentists, nurse prescribers, allied health professionals, independent pharmacist prescribers. In addition to formal identification documentation and previous qualification certificates, learners must produce evidence of registration with an appropriate professional body* e.g. GMC, GDC, NMC.HCPC Registered healthcare professionals from any group who do not hold prescribing rights must provide evidence of working under the clinical oversight of a professional who has regulated prescribing rights. *Learners may not be registered for either qualification if they have any conditions noted on their professional body (PRSB) registration. OTHM require centres to check applicants’ status with regards to PRSB registration prior to registration on the qualification and evidence of this retained for scrutiny by OTHM. Nurses and Allied-healthcare professionals (and those registered with the Health and Care Professions Council) who are not independent prescribers are subject to CPSA / JCCP requirements for working under the clinical oversight of an appropriate professional i.e. they must have access to, and support from, experienced clinicians who are able to deal with medical emergency situations and complications and, have independent prescribing rights. Applicants registered with non UK regulatory bodies Applicants who provide evidence of registration on non UK regulatory bodies e.g. The Medical Board of Australia; will have their registration confirmed and vetted on that register and their eligibility to practice in the UK must be confirmed through the appropriate professional register. If there is no evidence of registration, or conditions are noted on that registration, the applicant will not be eligible to register for the qualification. Non UK regulatory bodies must be nationally recognised to be considered a suitable register. Each application will be evaluated on a case by case or individual basis. English requirements: If a learner is not from a majority English-speaking country, they must provide evidence of English language competency. For more information visit English Language Expectations page in the OTHM website. Equivalences OTHM qualifications at RQF Level 7 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent in level to Master’s Degrees, Integrated Master’s Degrees, Postgraduate Diplomas, Postgraduate Certificate in Education (PGCE) and Postgraduate Certificates. Overview Accounting and finance are at the very heart of business operations. From banking to manufacturing, from huge service industries to micro businesses, the ability to manage, plan and account for money is still the ultimate measure of business success and the key driver of growth. Many accountants occupy key managerial positions in business, yet few are qualified managers. In the increasingly complex modern business environment, there is a high demand for skilled professionals who can work flexibly in teams across business boundaries. The objective of the OTHM Level 6 Diploma in Accounting and Business qualification is to provide learners with the knowledge and skills required by a middle or senior manager in an organisation, and who may be involved in managing organisational finances, investment and risk, audit and assurance, or research. Entry requirements For entry onto the OTHM Level 6 Diploma in Accounting and Business qualification, learners must possess: Relevant NQF/QCF/RQF Level 5 diploma or equivalent recognised qualification Mature learners (over 21) with management experience (learners must check with the delivery centre regarding this experience prior to registering for the programme) Learner must be 18 years or older at the beginning of the course English requirements: If a learner is not from a majority English-speaking country must provide evidence of English language competency. For more information visit English Language Expectations page in this website Equivalences OTHM qualifications at RQF Level 6 represent practical knowledge, skills, capabilities and competences that are assessed in academic terms as being equivalent to Bachelor’s Degrees with Honours, Bachelor’s Degrees, Professional Graduate Certificate in Education (PGCE), Graduate Diplomas and Graduate Certificates. Qualification structure The OTHM Level 6 Diploma in Accounting and Business consists of 6 mandatory units for a combined total of 120 credits, 1200 hours Total Qualification Time (TQT) and 480 Guided Learning Hours (GLH) for the completed qualification. Mandatory units Corporate and Business Law (20 credits) Business Performance Measurement (20 credits) Financial Securities Markets (20 credits) Audit and Assurance (20 credits) Business Research Project (20 credits) Investment and Risk Management (20 credits) Duration and delivery The qualification is designed to be delivered over one academic year for full-time study, but it is also flexible in its delivery in order to accommodate part-time and distance learning. The qualification is delivered face-to-face, through lectures, tutorials, seminars, distance, online by approved centres only. Assessment and verification All units within this qualification are internally assessed by the centre and externally verified by OTHM. The qualifications are criterion referenced, based on the achievement of all the specified learning outcomes. To achieve a ‘pass’ for a unit, learners must provide evidence to demonstrate that they have fulfilled all the learning outcomes and meet the standards specified by all assessment criteria. Judgement that the learners have successfully fulfilled the assessment criteria is made by the Assessor. The Assessor should provide an audit trail showing how the judgement of the learners’ overall achievement has been arrived at.

Rs 260.000

See product

Pakistan

ZSSJ , Islamabad/Rawalpindi based company, having qualified certified chartered as well as management accountants, offers wide range of accounts management consultancy services all across Pakistan. Now there is no need to appoint permanent accountant. We provide following services at reasonable cost:- Accounting and Bookkeeping Services Financial reporting and analysis Bank Reconciliations Internal Audit External Audit Assistance Accounts Receivable Accounts Payable functions Matter Regarding with FBR NTN, STN, Return Filing etc. We also provide different e-Accounting Services, Excel Accounting, Accounting Software as per clients needs and Requirements. For any query and assistance feel free to contact:- +923215091432-3041904243

Rs 20

See product